A series of leading foreign organizations in the market such as Dragon Capital, VinaCapital, JP Morgan or Pyn Elite Fund… have made positive comments about Vietnamese stocks after the upgrade news, even making “shocking” predictions.

The Vietnamese stock market is in a booming phase with the boost to upgrade. With 4 consecutive sessions of increase since the official announcement of FTSE Russell, VN-Index has reached a new peak of over 1,765 points, VN30 even surpassed 2,000 points for the first time in history.

In that context, a series of leading foreign organizations in the market such as Dragon Capital, VinaCapital, JP Morgan or Pyn Elite Fund… have made comments on Vietnamese securities. Most of them assessed the upgrade as a historical turning point opening a new growth path with bigger goals.

“In the next 5 years, Vietnam’s stock market will develop equivalent to the previous 10-15 years combined”

At the recent Investor Day event, Mr. Le Anh Tuan, CEO of Dragon Capital, said that the official upgrade of the Vietnamese stock market is a worthy achievement after more than a decade of continuous efforts by management agencies. It is not only a technical step forward, but also a milestone demonstrating the maturity of the market in all aspects.

Mr. Tuan believes that short-term fluctuations in the market, whether up or down, are completely normal, like “potholes” on a long road. What is more important is that the long-term trend and internal strength are being firmly consolidated.

Being upgraded by FTSE Russell is an important step forward, the final destination that Vietnam is aiming for is to be recognized as an emerging market by MSCI. Mr. Tuan likened MSCI to “the biggest fish”, and affirmed that the journey towards this goal will not only help the market grow in depth but also expand strongly in scale and structure.

“I expect that in the next 5 years, the development of Vietnam’s stock market will be equivalent to the achievements of the previous 10-15 years combined, in terms of policy, infrastructure and depth,” Mr. Tuan commented. To achieve the goal of becoming an emerging market according to MSCI and FTSE Russell standards by 2030, Vietnam is pursuing a comprehensive reform roadmap in many aspects.

“When GDP grows in double digits, stock market growth is no longer calculated in percentages but in times. At the VN-Index mark of 1,700 points, P/E valuation is currently around 12.5-13 times, while 2026 profits are expected to increase by 18-20%. The Vietnamese stock market is facing a new opportunity, despite having increased relatively strongly in recent times,” Dragon Capital General Director emphasized.

Pyn Elite Fund believes Vietnam will be upgraded to emerging market status by MSCI in the coming years.

Also placing great faith in the market outlook, Mr. Petri Deryng – head of the billion-dollar foreign fund Pyn Elite Fund – said that FTSE Russell’s decision will attract more institutional investors to the Vietnamese stock market and may spark optimism among Vietnamese individual investors. Equity investment funds tracking the FTSE index will adapt to this change and increase the proportion of listed stocks in Vietnam in 2026.

“FTSE’s decision is very welcome for Vietnam, as the Government has taken many measures in recent years to upgrade its status. We believe that Vietnam will also be upgraded to emerging market status by MSCI, another rating agency, in the coming years. In addition, the IG rating of government bonds in the coming years will be very important for financing large public projects in Vietnam ,” Mr. Petri Deryng emphasized.

Pyn Elite Fund is known as one of the most optimistic organizations about the Vietnamese stock market in recent years. In mid-July when the VN-Index was around 1,500, the head of this foreign fund predicted that the index could reach 1,800 points this year. In the past, Mr. Petri Deryng predicted that the VN-Index could reach 2,500 points in the long term.

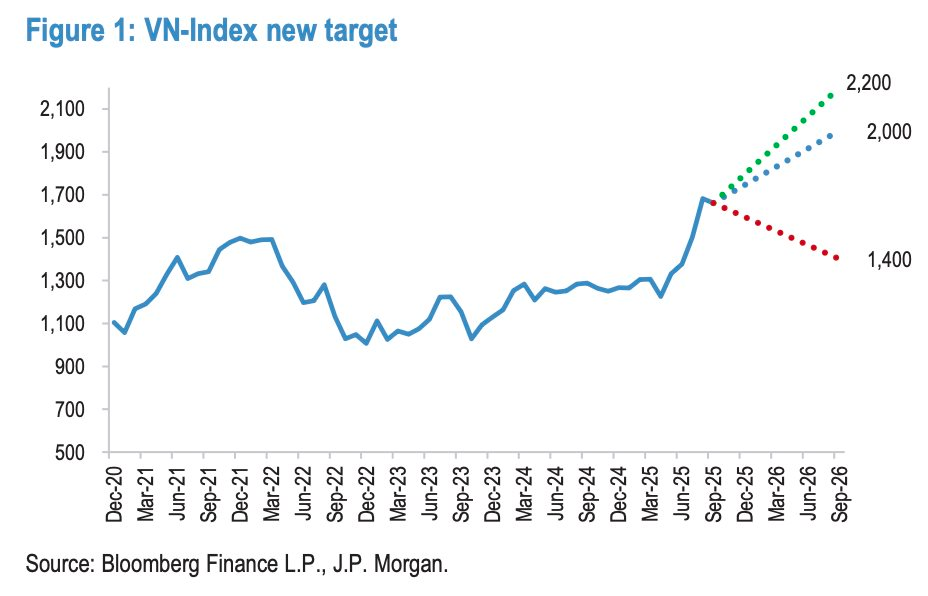

JP Morgan’s optimistic scenario predicts that VN-Index could reach 2,200 points in the next 12 months.

JP Morgan’s latest report said that the upgrade decision will open up a significant wave of passive capital flows into Vietnam. According to estimates, global index funds could pour about $1.3 billion into the Vietnamese stock market, equivalent to a 0.34% weighting in the FTSE Emerging Market All Cap Index. Based on the current capitalization, about 22 Vietnamese stocks could be added to this index portfolio.

On that basis, JP Morgan raised the VN-Index target for the next 12 months to 2,000 points for the base scenario and 2,200 points for the optimistic scenario, equivalent to an increase of 20-30% compared to the current level. A solid macro foundation and corporate profit growth are two key factors supporting the positive trend of the market.

According to JP Morgan, Vietnam’s GDP in the third quarter of 2025 increased by 8.2% over the same period, while the profits of listed enterprises are forecast to increase by an average of 20% per year in the period 2026 – 2027. In addition, if the upgrading process according to MSCI standards goes smoothly, the market can enjoy an additional 10% increase from the revaluation of the P/E ratio.

JP Morgan believes that the current valuation of the VN-Index is still in a reasonable range. The index is forecast to trade at a forward P/E of 15-16.5 times in the next 12 months, higher than the ASEAN average but still lower than the two historical peaks in 2018 and 2021. This reflects the long-term growth expectations of the economy and the increasingly improving profitability of Vietnamese enterprises.

VinaCapital: VN-Index’s valuation after upgrade may increase by 15-20%

VinaCapital is a bit more cautious, expecting the VN-Index valuation to increase by 15-20% over the next 12-18 months. This reflects Vietnam’s positive economic outlook, the Government’s supportive policies, expected corporate profit growth of about 15% over the next 1-2 years, along with the possibility of the VN-Index revaluing after being upgraded to emerging market status.

VinaCapital believes that this upgrade will be a turning point, opening up opportunities for the market to attract foreign capital flows from investment funds focusing on emerging markets. “This achievement is not the final goal, but a new beginning, posing urgent requirements and challenges for further development, with the strategic goal of expanding the size of Vietnam’s stock market to 120% of GDP by 2030, compared to the current level of 75% of GDP ,” VinaCapital’s analysis team commented.

After being upgraded, Vietnam will be included in the FTSE EM All Cap index (with a tracking size of about 100 billion USD). It is estimated that Vietnam can account for about 0.3% of this index (equivalent to about 300 million USD of passive capital flow for the FTSE EM All Cap index) with about 30 stocks included in the index.

Overall, when including other emerging market index funds, Vietnam is expected to receive about $5-6 billion in foreign capital inflows, including $1 billion in passive capital and $4-5 billion in active capital.

In addition, the Vietnamese stock market is still trading at a fairly reasonable valuation, around 13 times forward P/E. In the long term, the VinaCapital analysis team believes that economic growth is still the main determinant of stock market performance.

Leave a Reply