The S&P 500 rose on Thursday (October 23), driven by technology stocks, as investors bought in following a series of upbeat corporate earnings reports.

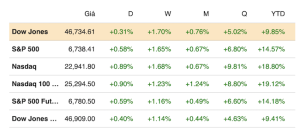

At the close of trading on October 23, the S&P 500 gained 0.58% to 6,738.44 points, while the Dow Jones Industrial Average climbed 144.20 points (or 0.31%) to 46,734.61 points. The Nasdaq Composite advanced 0.89% to 22,941.80 points, supported by gains in Nvidia, Broadcom, and Amazon. A nearly 3% rise in Oracle shares, another artificial intelligence-related company, also contributed to the market’s upbeat performance.

The indexes reached session highs after White House Press Secretary Karoline Leavitt announced during a press briefing that President Donald Trump would meet with Chinese President Xi Jinping on October 30 in South Korea. The news helped ease investor concerns over U.S.–China relations, which had pressured markets the previous day (October 22).

Thursday’s advance marked a full and stronger rebound from the prior session’s losses, when the S&P 500 fell 0.5%, the Dow Jones dropped 334 points (0.7%), and the Nasdaq Composite slipped 0.9% as investors moved away from risk assets.

Markets declined on October 22 after U.S. Treasury Secretary Scott Bessent confirmed that the White House was considering plans to restrict exports of American software products to China. The proposed measures stemmed from President Trump’s statement nearly two weeks earlier that the U.S. would impose export limits on “any and all critical software” before November 1.

Investors continue to monitor earnings reports from major U.S. companies, which many believe could determine the strength and sustainability of the market’s current rally. Honeywell, leading the Dow’s gains, surged nearly 7% on Thursday after reporting stronger-than-expected results and raising its full-year outlook. American Airlines shares rose 6% after posting a smaller-than-expected Q3 2025 loss and issuing an optimistic forecast.

The market managed to shake off intraday weakness. Tesla — the first of the “Magnificent Seven” to report — gained 2%, rebounding from earlier losses following a mixed Q3 earnings report. IBM also pared losses after reporting results that beat expectations, although software revenue came in line with estimates. Meanwhile, oil prices rose after the Trump administration imposed new sanctions on two of Russia’s largest oil companies, citing the country’s “lack of serious commitment to the peace process aimed at ending the war in Ukraine.”

According to FactSet, more than 80% of S&P 500 companies that have reported earnings so far have exceeded expectations.

Leave a Reply