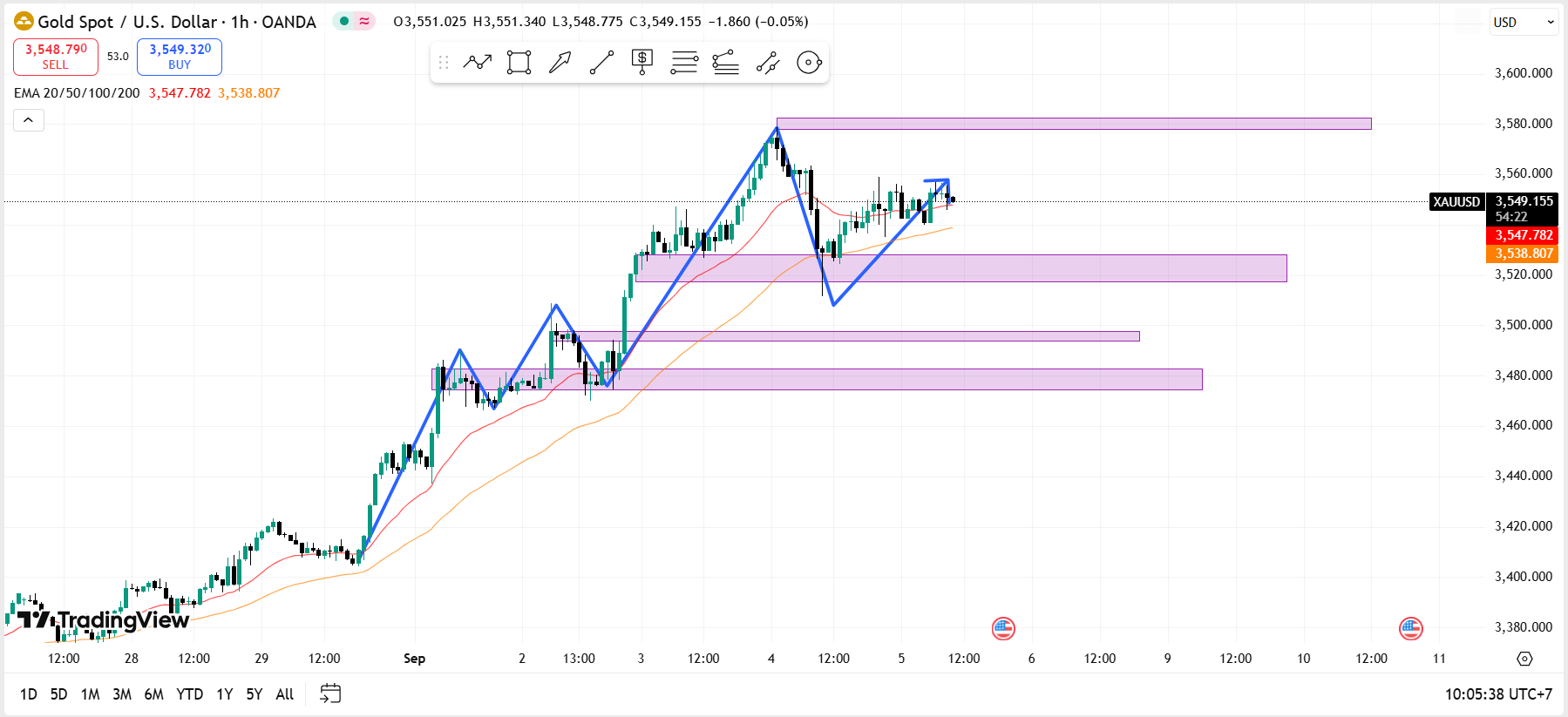

After hitting a new peak at $3,578/ounce yesterday morning, Gold saw a sharp correction down to $3,511 in the afternoon. Currently, it is in a recovery phase, trading around the $3,550/ounce level.

This could be the accumulation stage for Gold before a potential explosive breakout to set a new high.

The evidence shows that Gold is still maintaining its uptrend, with candles moving in a steadily accumulating upward pattern.

Today, the market is focusing on the NFP data that will be released tonight.

If the data shows that the labor market continued to weaken in August, this will serve as a strong catalyst pushing Gold higher before the Federal Reserve decides whether or not to cut interest rates.

On the other hand, if the data indicates a recovery in the labor market, Gold may establish a short-term sideways trend while awaiting the Fed’s decision on rate cuts.

Currently, the market expects with more than 96% probability that the Fed will cut interest rates in September. Therefore, the uptrend in Gold is almost confirmed, and at this time investors should NOT SELL Gold but only look for BUY opportunities.

Technical Analysis:

Gold is in an accumulation phase and showing signs of a strong breakout.

Today, Gold could surge from the 355x zone directly up to $3,617/ounce.

In case of a pullback, Gold may revisit the 3527–3530 zone once more before rallying strongly toward $3,617/ounce.

_Trí Hùng_

Leave a Reply