-

Last Friday evening, when the Non-Farm Payrolls data was released, it showed that the U.S. labor market faced the sharpest decline since the Covid era in 2021.

-

Immediately, the market reacted strongly – U.S. stocks plunged – the U.S. dollar weakened – Gold was strongly supported and surged to set a new record high at $3,600/ounce.

-

The weakening Non-Farm data sent a clearer signal and strengthened expectations that the Fed will have to cut interest rates as early as September. This signal will act as a powerful lever driving Gold to continue its strong upward momentum during the remainder of 2025.

-

In addition, the Fed is also under pressure from the White House as Donald Trump keeps pushing to remove Governor Lisa Cook from the Fed’s board and replace her with someone he “can trust.”

-

If Trump succeeds, the Fed may lose its independence, and a new playing field will be established where monetary policy could be used as a political tool. In that case, Gold will become the top safe-haven asset, even surpassing the U.S. dollar, and be fiercely sought after by investors. A rise to $4,000 by the end of 2025 or even $4,500 in 2026 could become reality.

-

Therefore, Gold reaching $3,600 is just the beginning of a major storm waiting ahead.

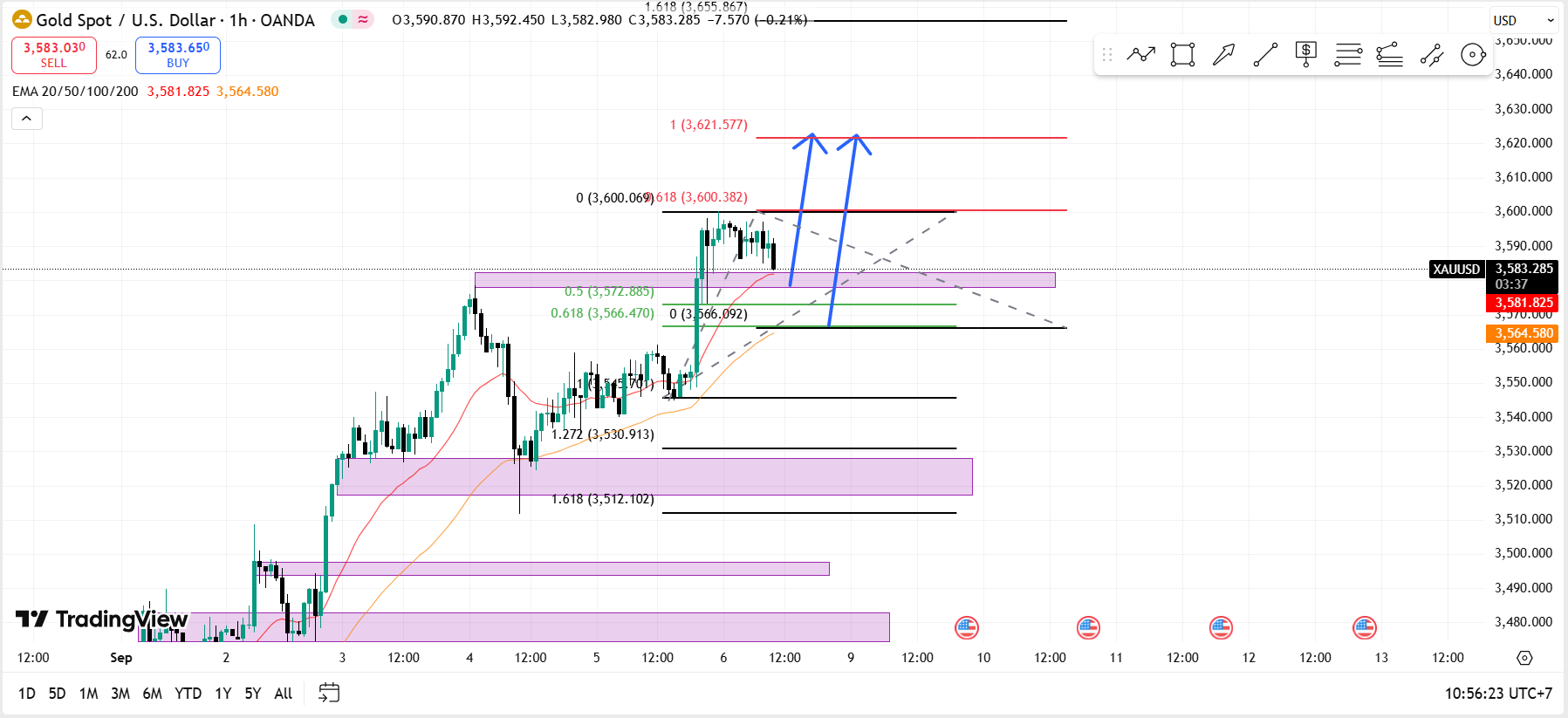

Technical Analysis

Gold is currently in a corrective wave from the $3,600 peak. In the short term, Gold may correct down to the $3,578 level or deeper to $3,566 at the 0.618 Fibonacci retracement before rebounding back to $3,600/ounce. If Gold gathers enough momentum to break above $3,600, it could then reach $3,621/ounce.

Leave a Reply