Stablecoin net inflows increased by 76%, from $10.8 billion in Q2 to $45.6 billion in Q3, led by USDT, USDC, and the rise of USDe from Ethena…

Illustration photo

In total, stablecoins have recorded more than $46 billion in net inflows over the past 90 days, reflecting growing demand for this crypto asset class.

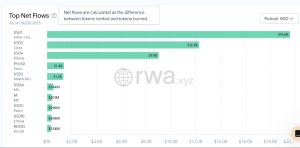

According to data from RWA.xyz, Tether’s USDT led the quarter with $19.6 billion in net inflow, followed by Circle’s USDC with $12.3 billion.

Stablecoin USDe (by Ethena) also recorded outstanding results in the quarter with $9 billion.

Source: RWA.xyz.

Other stablecoins made smaller but still notable contributions. PYUSD recorded $1.4 billion in inflows, while USDS recorded $1.3 billion.

Over the past six months, stablecoin inflows totaled $56.5 billion, of which just $10.8 billion was recorded in Q2. Q3 accounted for the majority, showing a rapid acceleration in demand, driven not only by USDT and USDC but also by the expansion of algorithmic stablecoins like USDe.

In terms of popularity, USDT accounted for the majority of flows in both Q2 and Q3, reaching $19.6 billion in Q3 and $9.2 billion in the previous quarter. USDC also saw a significant change, increasing from just $500 million in the previous quarter to $12.3 billion in Q3. Ethena’s USDe saw major expansion in the previous quarter, with flows of $9 billion compared to $200 million in Q2.

According to RWA.xyz, Ethereum continues to be the dominant network for stablecoins, hosting a supply of $171 billion, while Tron is second with $76 billion. Other networks such as Solana, Arbitrum, and BNB Chain collectively host $29.7 billion.

In terms of market share, USDT still dominates with nearly 59% of the market, according to DefiLlama, while Circle’s USDC is the closest competitor with about 25%, and USDe accounts for nearly 5% of the stablecoin market.

Data from RWA.xyz and DefiLlama shows that the total stablecoin market capitalization has increased to around $290 billion in the past 30 days.

However, despite the increase in capitalization and net cash flow, other monthly metrics declined. Monthly active addresses fell to 26 million, down 22.6% from the previous month, while transaction volume fell 11% to $3.17 trillion.

Leave a Reply