The US Federal Reserve (Fed) has just officially entered a monetary policy easing cycle, a move that is expected to last until 2026 and have a ripple effect on central banks around the world. In this context, experts recommend that real estate investors be cautious, consider monetary policy as only a temporary factor, and focus on carefully researching each specific market and asset.

A crane appears between residential buildings in Sydney, Australia, March 12, 2025. Photo: Reuters

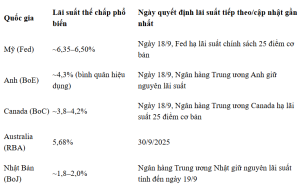

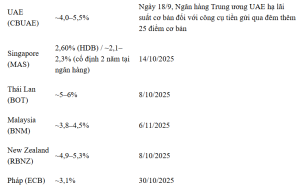

Last week, the Fed lowered its target interest rate by 25 basis points to 4-4.25%, marking the sixth adjustment by the Federal Open Market Committee (FOMC). With the US dollar still the key currency in global trade, this decision is expected to have a domino effect on many other central banks.

“Investors need to clearly define their goals: finding a stable cash flow, capital growth, or simply a safe haven,” said Liam Bailey, global research director at Knight Frank. He emphasized that every decision must be based on in-depth research, calculating the impact of exchange rates, input/output taxes, financial costs, operating costs and liquidity.

International investors: Risks come with opportunities

According to Mr. Kashif Ansari – Co-founder and CEO of international real estate brokerage group Juwai IQI, the factors that need special attention are exchange rate risks and legal and tax differences between countries. Investors with abundant cash resources, like many mainland Chinese investors, are at an advantage because they do not need international loans and can easily convince sellers.

Each international real estate market today exhibits outstanding advantages but also contains many potential risks that investors need to carefully consider.

In the US, foreign capital flows increased sharply by 33% in the 12 months to March 2025, reaching $56 billion, with Chinese investors leading the way. The market’s major advantages lie in its strong, transparent legal system and the presence of highly liquid “gateway cities”. However, the challenge comes from a complex legal landscape with different regulations between states, along with increasingly strict anti-money laundering supervision, especially for cash transactions.

In the UK, especially London, the attraction comes from the market’s “safe haven” status. High transparency and favorable resale potential make real estate here highly appreciated by investors. However, the burden of multi-layered stamp duty, with additional charges for non-residents, is a significant barrier. In addition, the Bank of England, after cutting interest rates in August, temporarily suspended adjustments in September, leaving the market waiting for a clearer signal at the November meeting.

For Canada, cities like Toronto, Vancouver and Montreal have top quality of life and a promising rental market. However, the policy of restricting foreign home purchases – still in place – has significantly reduced the attractiveness of international capital flows. However, the Bank of Canada’s interest rate cut to 2.5% on September 17 also opened up some hope for new investment activities.

In Australia, inflation rose 3% year-on-year in August 2025, exceeding forecasts and complicating plans for an expected rate cut in November. However, the real estate market in major centres such as Sydney, Melbourne and Brisbane remains attractive thanks to population growth and stable housing demand. For foreign investors, the main challenge is the mandatory approval process and many additional fees and taxes.

Japan is again standing out in the global picture thanks to a weak yen, which is a boon for international capital flows, and high rental yields in major cities. This is seen as a favorable time to invest…

In Malaysia, the wave of foreign buyers is increasing, mainly thanks to the open business environment, quality education system and comfortable lifestyle. Many investors come to this market to own resort real estate, rental houses or as a place to settle down and retire. This is a segment that is considered to have a lot of potential, especially in areas with strong demand but limited supply.

Singapore remains a “safe haven” in the region thanks to its transparency, limited land supply and stable local currency. These factors help maintain capital values in the luxury segment. However, the additional tax levied on foreign buyers is very high, becoming a major barrier to international capital flows.

Meanwhile, Dubai (UAE) continues to demonstrate its strong appeal with hot growth and explosive demand. This is an accessible market for foreign investors, meeting both lifestyle needs and providing access to global trade activities. Notably, if the October forecast becomes a reality, Dubai will set a record of 57 consecutive months of rising house prices – a rare growth streak in the world.

In the context of the Fed and many central banks loosening, global real estate opportunities are wide open but come with many challenges. Investors are advised not to just chase interest rates, but need to patiently research each market, set clear goals and prepare carefully in terms of legal, tax and cash flow.

Leave a Reply