Strategy announced a $22 million purchase of Bitcoin yesterday, reflecting growing concerns about the potential dilution of shareholder holdings. The company has refused to reinstate safeguards that could prevent this.

Strategy is facing two bearish scenarios

Strategy is currently caught between two unfavorable scenarios. If the company stops buying BTC, this could undermine market confidence. Conversely, if the company decides to dilute shareholders’ holdings to finance these transactions, the company’s performance will continue to be unsatisfactory relative to the assets it holds.

Strategy’s Share Dilution Crisis

While Strategy has had some success with its Bitcoin accumulation plan, some problems have begun to emerge in recent weeks. The company’s purchases have slowed down, with President Michael Saylor announcing a $22 million BTC purchase yesterday. This amount is modest compared to some of its previous transactions. Furthermore, recent reports point to a pressing situation for Strategy: the company is increasingly relying on share dilution to fund these transactions.

If this situation continues, it could lead to a serious crisis, reducing shareholder confidence.

Warning signs of danger

Although Michael Saylor said in July that Strategy would not reduce its shareholders’ Bitcoin holdings, he made policy changes last month. Specifically, he announced that the company could sell shares for reasons other than buying BTC and removed investor protections.

Since taking these measures, Strategy has diluted common shareholders’ holdings by 3,278,660 shares to fund over $1.1 billion in new BTC transactions. This represents 1.2% of total shareholder holdings and has directly funded approximately 94% of the company’s BTC transactions over the past month.

Strategy’s dilution of shares is a serious problem for many reasons, one of which is that it weakens the incentive to invest in MSTR instead of buying BTC. Although the company has purchased about 10,000 BTC since August, its performance has lagged far behind that token.

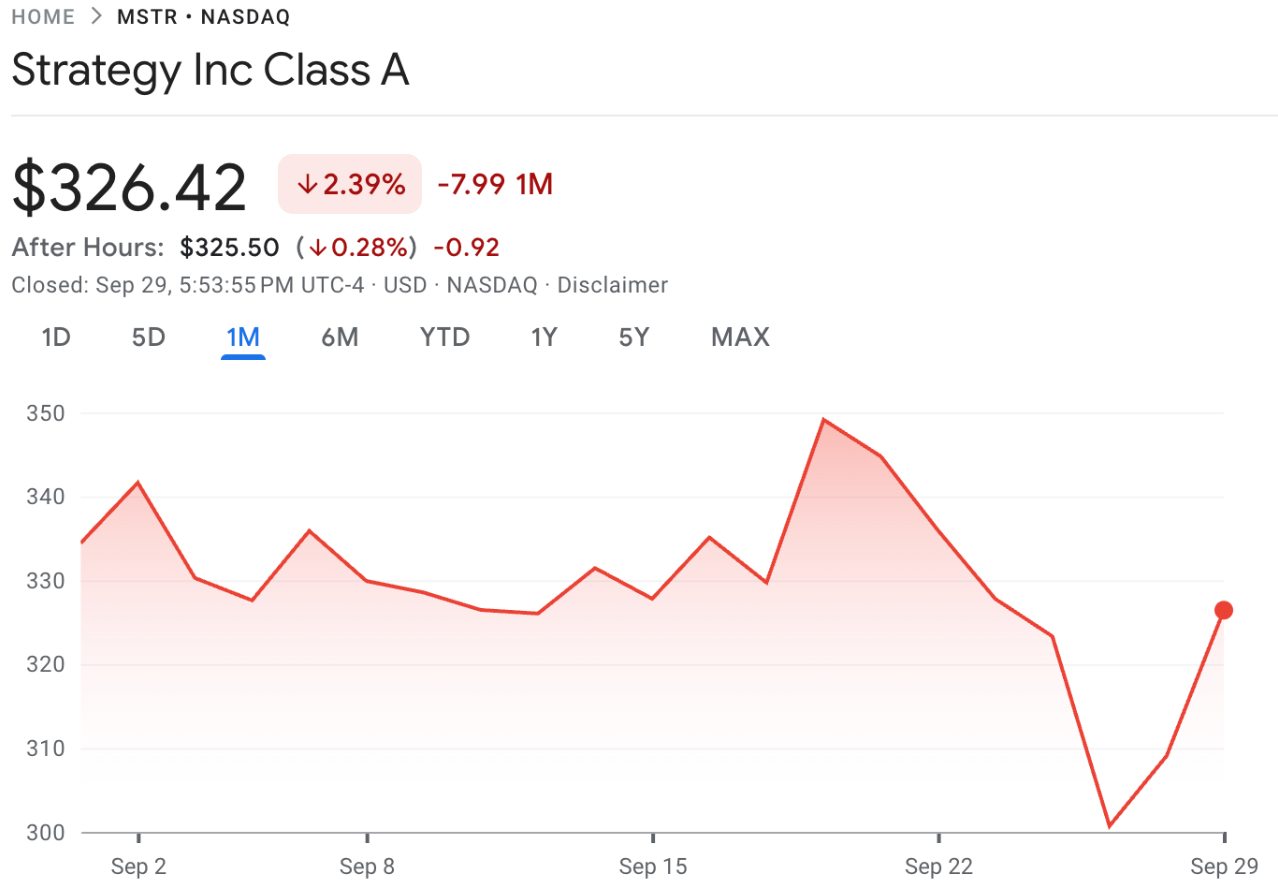

MSTR Price Performance | Source: Google Finance

There is no easy way out

While the company recently avoided a class-action lawsuit, this is still a major red flag. Strategy’s volatile revenue has cost the company several key titles, and dilution could have more serious consequences.

The company has a fiduciary responsibility to maximize shareholder value, which may conflict with its acquisition goals. Like the Red Queen in Alice in Wonderland, a BTC digital asset fund must constantly strive to maintain its position. Strategy is a pillar of corporate confidence in Bitcoin; if the company stops buying, the token price may fall, despite the dilution.

There is no easy way out of this crisis right now. Michael Saylor needs to not only continue to generate profits; he needs to outperform Bitcoin. Diluting his holdings may be the only way to keep Strategy in the lead for now, but it could also lead to a bigger crash down the road.

Leave a Reply