The information shared by the investor community is divided into two extremes. One seems overly optimistic, but the majority is hesitant to wait for official information and macro variables.

Many stocks fell sharply last month even though the general index was flat. Illustration: L.Vu

Information noise upgrade

In the end, the rumors surrounding the “voting” for an upgrade by some organizations last week were fake news, according to the analysis team of Vietcap Securities Company. FTSE Russell held two official meetings in September, but the identities of the experts are confidential.

As part of the process, the FTSE Market Classification Advisory Committee formally considers countries on the Watch List (including Vietnam) for upgrade or downgrade. FTSE Russell’s recommendations are submitted to the FTSE Russell Policy Advisory Board. FTSE Russell then submits its recommendations for endorsement by the FTSE Russell Policy Advisory Board, which are then shared with the FTSE Russell Index Board for final approval. The FTSE Russell Index Board meeting takes place this week.

So, the question of whether or not to upgrade is still unanswered, although most analysts are optimistic about the October review. Instead, analysts have two scenarios: one is an upgrade on the announcement date of October 8 (local time); the other is an upgrade in March next year.

The market has previously talked a lot about the Government’s efforts in setting up rules and meeting the conditions for upgrading. Most of the criteria have been met, except for 2 issues related to the payment story.

Accordingly, the two barriers mentioned are the “Payment Cycle” criterion, which is currently rated as “limited”. This criterion is related to the pre-transaction margin requirement for institutional foreign investors. The second barrier is the “Payment” criterion, which is related to failed transactions. This criterion will be upgraded from “unrated” to “limited” in March 2025. Both criteria need to be at the “satisfactory” level.

The Ministry of Finance issued Circular 68 in November last year, which removed this requirement and introduced a new no-pre-trade margin (NPF) process. Over the past 11 months, FTSE Russell has been evaluating the effectiveness of the NPF process and taking feedback from market participants. Vietnam recorded its first and only failed transaction in December 2024. This failed transaction also served as a test case for FTSE Russell to confirm the practicality of the failed transaction handling process. Therefore, according to Vietcap, these two criteria can be “achieved”.

After a strong increase since the beginning of June, the index has started to move sideways and differentiate more clearly since mid-August until now.

The current concern of observers is that the assessors may still need a period of market monitoring before changes in settlement. For example, the two above settlement criteria need to be monitored for 6-9 months, while the settlement cycle of the KRX system (T+1.5) is expected to need 6-9 months to monitor, according to a report by HSC Securities Company.

In a related recent development, the State Bank issued Circular 03 and Circular 25, aiming to shorten the account opening process, which is considered a major administrative burden for foreign investors.

At the extraordinary general meeting of shareholders last week, Mr. Nguyen Duy Hung , Chairman of the Board of Directors of SSI Securities Company , expressed confidence when giving a probability of 90-95%, because it still had to be approved by the opinions and votes of investors. However, he also added that the upgrade story is not a “miracle” for the market.

The market is entering a “sensitive” phase.

During the period of waiting for the upgrade information, September was a month of decline for Vietnamese stocks. “Expectations about the upgrade have created high anxiety among both institutional and individual investors,” VietCap’s analysis team assessed.

Last week, the index was almost flat despite increasing 0.13% on a weekly basis, equivalent to an increase of more than 2 points. Trading liquidity also decreased by 18%, averaging only VND25,300 billion, the lowest level in the past two months.

As of October 1, the VN-Index decreased by 0.97% compared to the previous month, but still increased by 21% quarterly and more than 31% since the beginning of the year. Average monthly liquidity reached VND21,317 billion, down 37.5% compared to the previous month. Meanwhile, foreign investors still sold a net of more than VND27,257 billion last month.

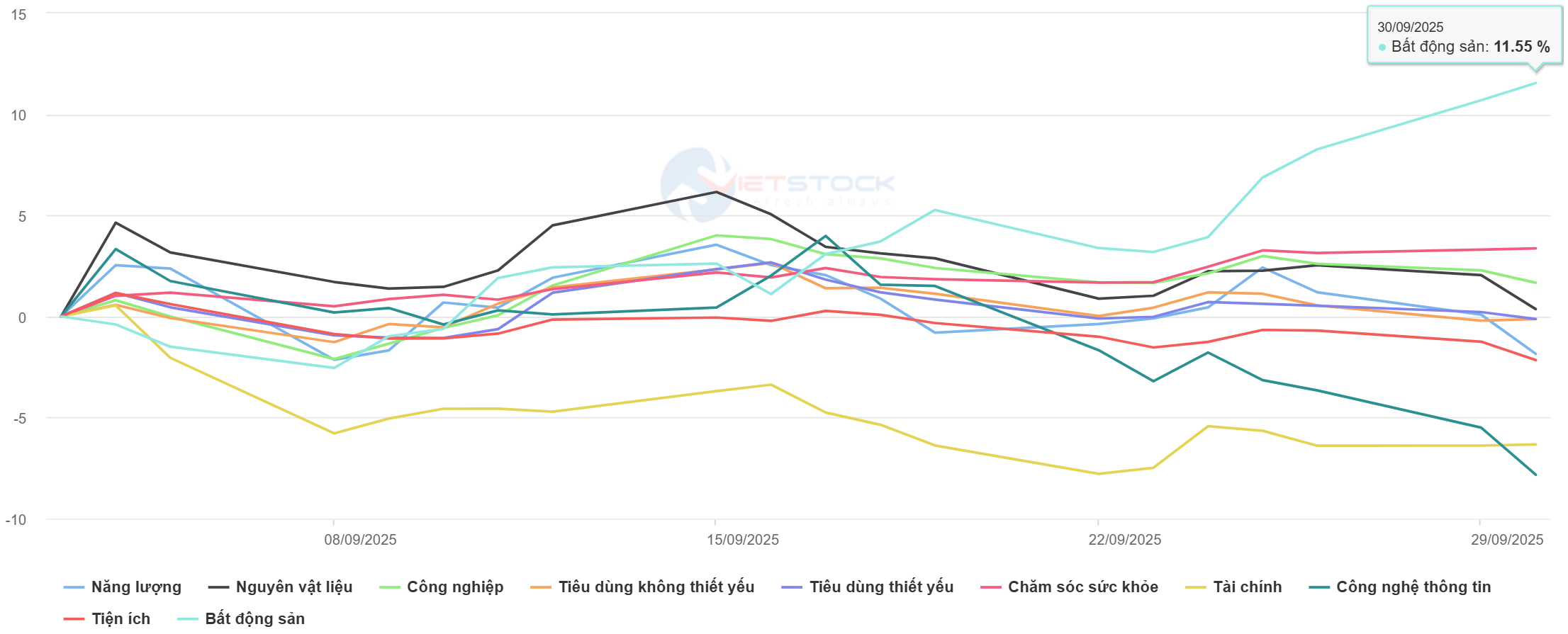

Last month, only the real estate industry performed positively, while most other industries declined, with the financial group experiencing the deepest decline. Source: Vietstock.

But many investors also believe that the market is entering a “sensitive” period because many other important news, including business results reports, are gradually “leaking” under the general name of “rumors”.

The most obvious is the securities group, an industry that is considered to benefit greatly from this upgrade and is also waiting for positive business news as liquidity recorded many new records in the past quarter.

According to the analysis team of MBS Securities Company , the high growth industries include securities (73%), residential real estate (70%), and the banking industry is forecast to increase by 21.5%, more positive than the first half of the year.

However, there are also some industries with estimated profit growth lower than the market such as industrial real estate and telecommunications technology. The forecast for the whole market this quarter recorded a profit growth of 25% in the third quarter compared to the same period last year.

In addition to information on upgrade prospects and business operations, there will be a series of macroeconomic data in the third quarter. These events are expected to decide the market at the end of the year.

In a related development, S&P Global has just announced that Vietnam’s manufacturing PMI index continued to remain above the 50-point mark for the third consecutive month, but remained unchanged from the previous month.

According to the analysis team of Maybank Securities Company, this figure is considered positive, even though export activities also show signs of stability, which is expected to boost growth. However, the factor that needs to be closely monitored next month is inflation. “The rate of increase in input costs and selling prices has continuously increased. If this trend continues, price pressure may negatively impact consumer demand,” the team assessed.

According to MBS , to achieve GDP growth of 8% or more, the growth rate of the last quarter must be at least 8.4%. In a positive scenario (i.e. information about growth and upgrading goes as expected), the market can break out of the accumulation zone of the past month. On the contrary, domestic speculative capital will push the VN-Index deep below the 1,600 point mark.

Leave a Reply