Last night, Gold continued to rise sharply, hitting a new peak at $3,791/ounce as weak PMI data weighed on the US Dollar, coupled with Donald Trump’s speech reversing his stance to support Ukraine in reclaiming territory from Russia. In addition, Trump also encouraged NATO to shoot down any Russian aircraft violating NATO airspace.

Although this morning Gold corrected more than 40 points back to the $3,75x zone, this may only be profit-taking from the BUY side and pressure from the SELL side as Gold surged too high.

So far, there are still no signals indicating that Gold will decline, so this can be seen purely as a profit-taking move.

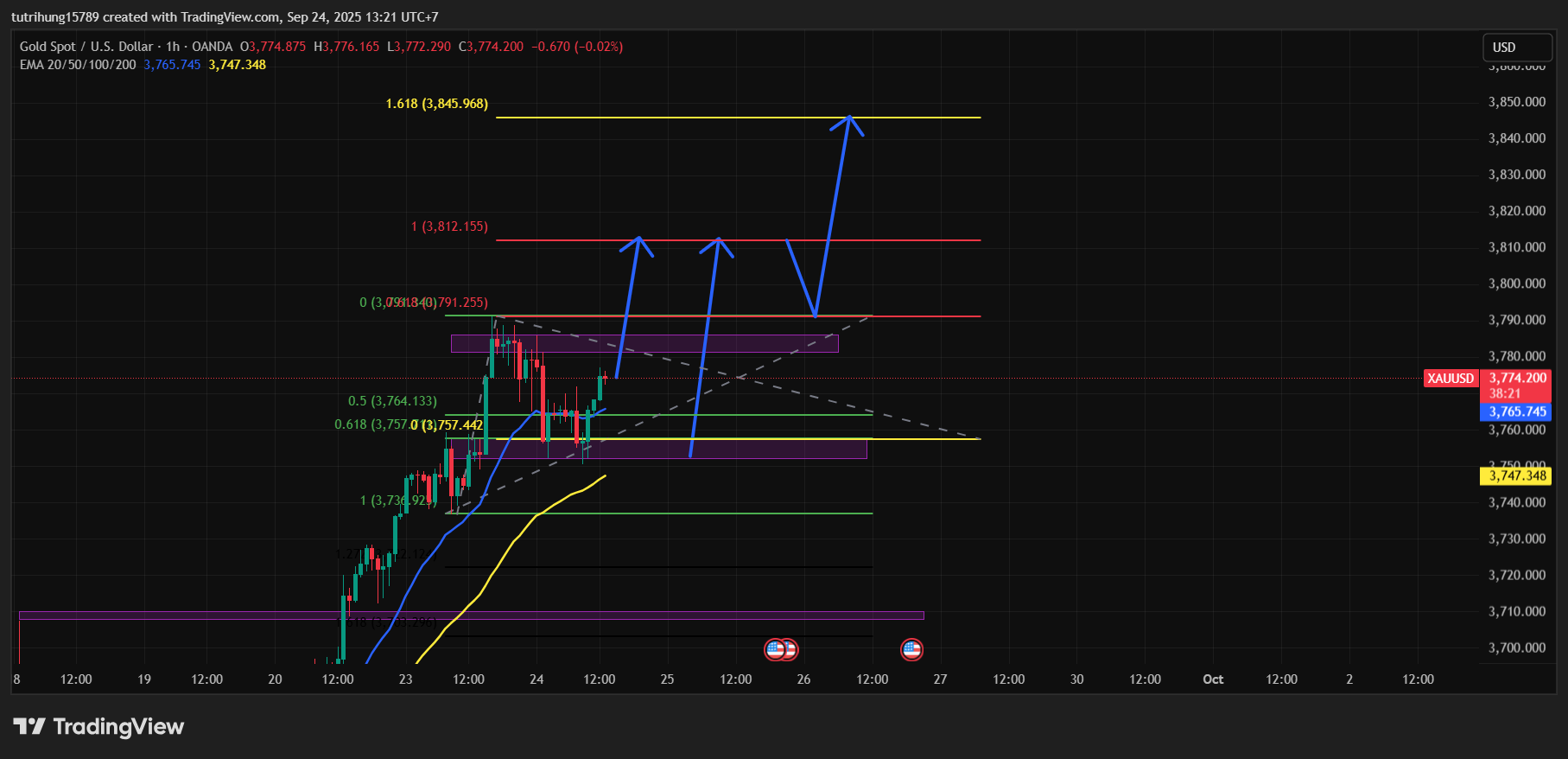

Therefore, in the short term, Gold may have a correction down to the $3,700 zone or deeper to $36xx, before continuing to rebound higher to the $38xx zone in the near future.

Technical analysis:

In the short term, Gold prices will continue to be supported by both technical and macro factors, pushing higher to break the $3,800/ounce level.

=> Potential BUY zones:

1: Buy immediately at the current zone of 377x

2: Wait for Gold to correct to the 375x support zone, then BUY up.

Target $3,800 – $3,812/ounce.

=> When Gold reaches $3,812/ounce, consider a short-term Sell back to 380x, then continue the BUY momentum up to 384x (Full Target for this week).

Trí Hùng

Leave a Reply