U.S. Stocks Plunge on Thursday (Nov 6) as AI-Related Companies Face Pressure Over Sky-High Valuations

U.S. stocks tumbled on Thursday, November 6, as companies tied to artificial intelligence (AI) once again came under pressure due to their lofty valuations.

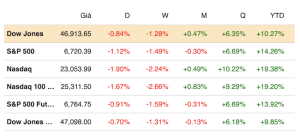

At the close of trading on November 6, the Dow Jones Industrial Average dropped 398.70 points (or 0.84%) to 46,912.30, the S&P 500 fell 1.12% to 6,720.32, and the Nasdaq Composite lost 1.9% to 23,053.99.

The Nasdaq 100 has declined more than 2% since the market closed on October 31 and is heading for its worst week since early April 2025. The biggest drags came from Nvidia, Microsoft, Palantir Technologies, Broadcom, and Advanced Micro Devices.

AI-related stocks have shown uneven performance since the start of November 2025, and that volatility continued on Thursday. Qualcomm shares fell nearly 4% after the chipmaker reported stronger-than-expected quarterly results but warned it may lose a future contract with Apple. AMD, which stood out in the previous session on November 5, slumped 7%, while Palantir and Oracle shares fell about 7% and 3%, respectively. Shares of Nvidia, a major AI powerhouse, and Meta Platforms, another member of the “Magnificent Seven,” also declined.

Analysts noted that many of these stocks are extremely overvalued, priced for perfection.

Thursday’s sell-off worsened amid concerns over the labor market, as October 2025 saw a massive wave of layoff announcements. According to Challenger, Gray & Christmas, total job cuts last month reached more than 153,000, nearly triple the figure from September 2025 and 175% higher than a year earlier. It was the highest October layoff total in 22 years, in what has become the worst year for job cuts since 2009.

These figures suddenly paint a bleak picture of the U.S. economy — especially amid the ongoing U.S. government shutdown, which has lasted more than a month, marking the longest in history and leaving few economic reports available.

Investors also turned their attention to Washington on Thursday, as the U.S. Supreme Court heard arguments for and against the Trump administration’s tariff policies. During the questioning session on November 5, the justices expressed skepticism about the legality of the trade tariffs, leading many investors to predict a ruling against the tariff policy.

Leave a Reply