U.S. stocks rose on Wednesday (December 3) as the latest employment data from ADP strengthened investor confidence that the Federal Reserve (Fed) will cut interest rates next week.

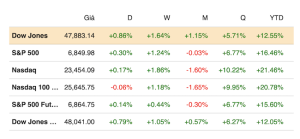

At the close of trading on December 3, the Dow Jones Industrial Average gained 408.44 points (or 0.86%) to 47,882.90. The S&P 500 advanced 0.30% to 6,849.72, while the Nasdaq Composite inched up 0.17% to 23,454.09.

ADP reported that the U.S. private sector unexpectedly shed 32,000 jobs in November 2025, in stark contrast to Dow Jones’ forecast of a 40,000-job increase. Despite the weak data, investors appear to be betting that the decline in private-sector employment will prompt the Fed to cut interest rates at its final meeting of the year on December 10.

According to the CME FedWatch Tool, markets are pricing in an 89% probability that the Fed will lower rates on December 10, significantly higher than the probability projected in mid-November 2025. Investors expect that a lower-rate environment will stimulate credit growth and provide a boost to the U.S. economy, pushing key financial stocks such as Wells Fargo and American Express higher on Wednesday.

Wednesday’s session also showed some signs of economic stability, as the latest U.S. services data came in slightly better than expected.

Meanwhile, Microsoft shares became a drag on the market, falling 2.5% after The Information reported that the company was reducing sales quotas for software related to artificial intelligence (AI). Microsoft’s stock later recovered from its intraday lows after the company denied cutting sales targets for its sales staff.

Other AI-linked stocks, including chipmakers Nvidia and Broadcom, also fell alongside Microsoft. Micron Technology faced similar pressure, losing more than 2%.

In contrast, Bitcoin continued its upward momentum, trading above $93,000 after the leading cryptocurrency logged its worst session since March 2025 on December 1. Shares of Marvell Technology jumped nearly 8% as Wall Street reacted to the company’s outlook for data-center growth.

Leave a Reply