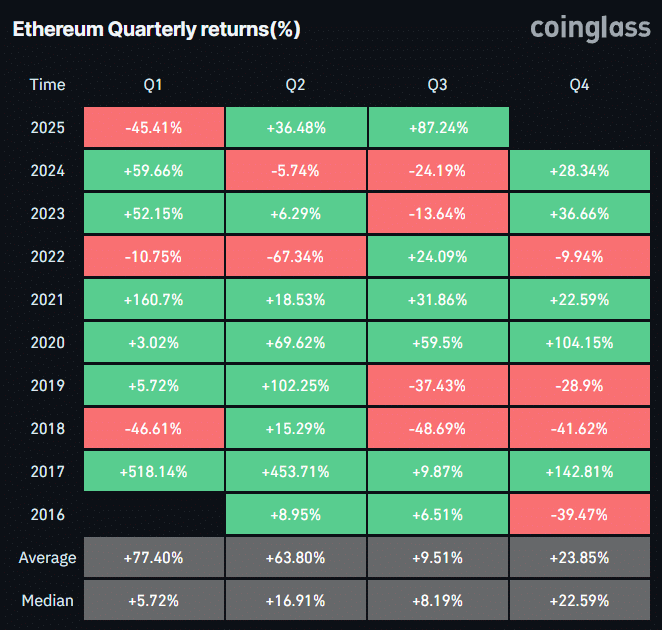

Despite experiencing strong volatility, Ethereum (ETH) recorded an impressive performance in Q3. Compared to other coins, ETH achieved a return on investment (ROI) of 86.41%, while Bitcoin (BTC) only achieved 7.87%. This is a nearly 12-fold superiority.

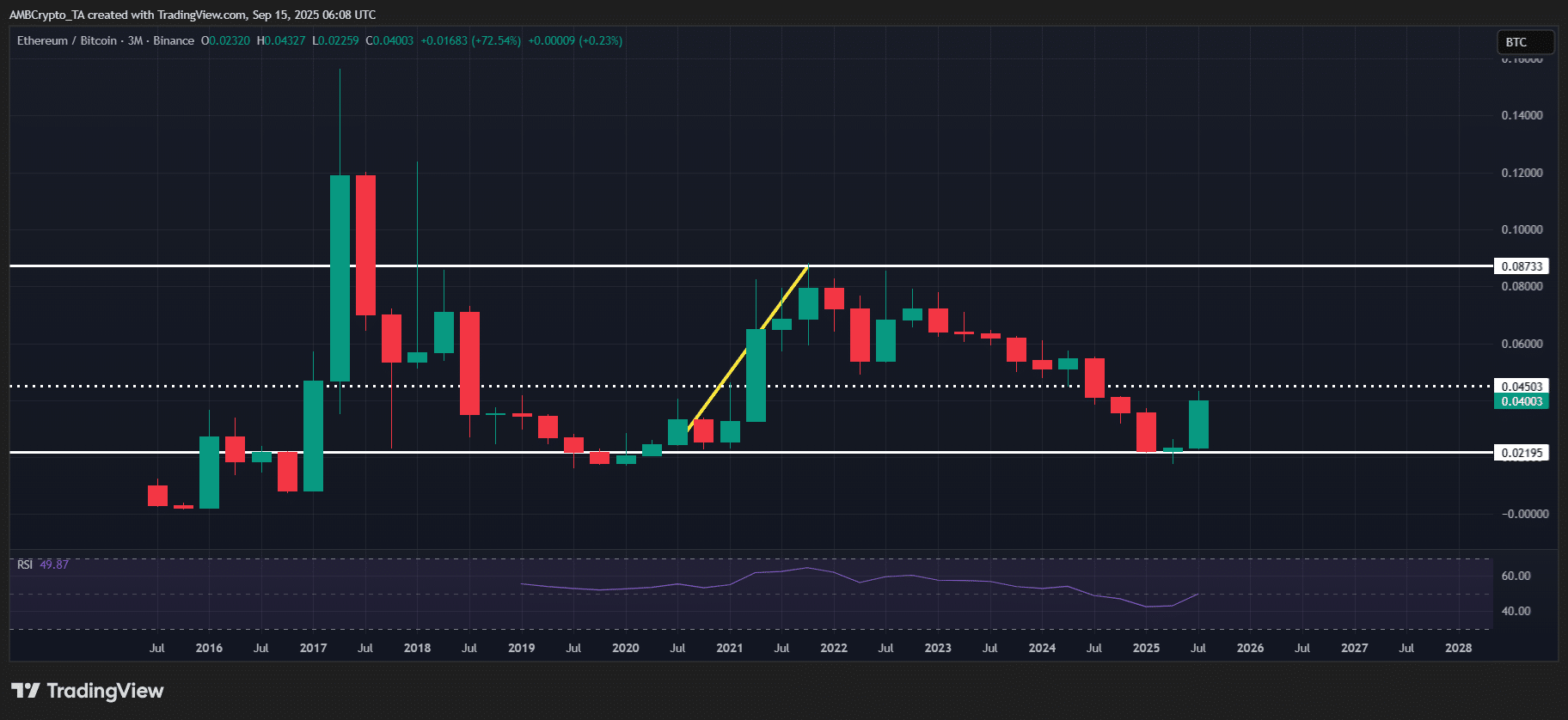

The ETH/BTC trading pair also confirmed this trend, with the ratio recording a 72% increase, marking the strongest quarterly growth since April 2021. Technically, about 84% of ETH’s gains come from circulating money.

In this context, the key question for Q4 is whether Ethereum can maintain this relative strength and continue to push higher, especially in a quarter that is typically led by Bitcoin.

Cash Flow Fuels Ethereum’s Record Quarter

Ethereum is on track for its strongest Q3 in history.

Source: CoinGlass

Notably, the last major rally occurred in 2020, when ETH gained 59.5% compared to BTC’s 17.97%. Furthermore, the ETH/BTC ratio increased by 35%, testing the 0.04 level for the first time in over a year, reinforcing the momentum from the circulating money.

Fast forward to today, and the ratio increased 72% in Q3, peaking at around 0.042, showing similar flow dynamics. In short, Ethereum’s outperformance was largely driven by flow in both cycles.

Source: TradingView

However, the real story lies in the consequences that follow.

After ETH outperformed in Q3 2020, ETH saw a 104% ROI in Q4. However, BTC posted a stronger gain of 168%. Meanwhile, the ETH/BTC ratio fell 23.7%, reflecting ETH’s relative performance.

Simply put, ETH’s outperformance in Q3 does not guarantee success in Q4. In conclusion, the money flowing back into BTC has left ETH with a cash flow deficit.

According to Bitcoin Magazine, this is an important factor to watch as we enter the next quarter.

Macro volatility prepares for Q4 showdown

Historically, BTC has typically delivered an 85% ROI in Q4, more than 3x the typical ETH gain. In fact, over the last two Q4 cycles (2023–2024), the average ETH/BTC ratio has posted a net loss of -13.05%, indicating money flowing back into BTC.

Bottom line: Q4 is typically Bitcoin-led, and Ethereum tends to have to catch up.

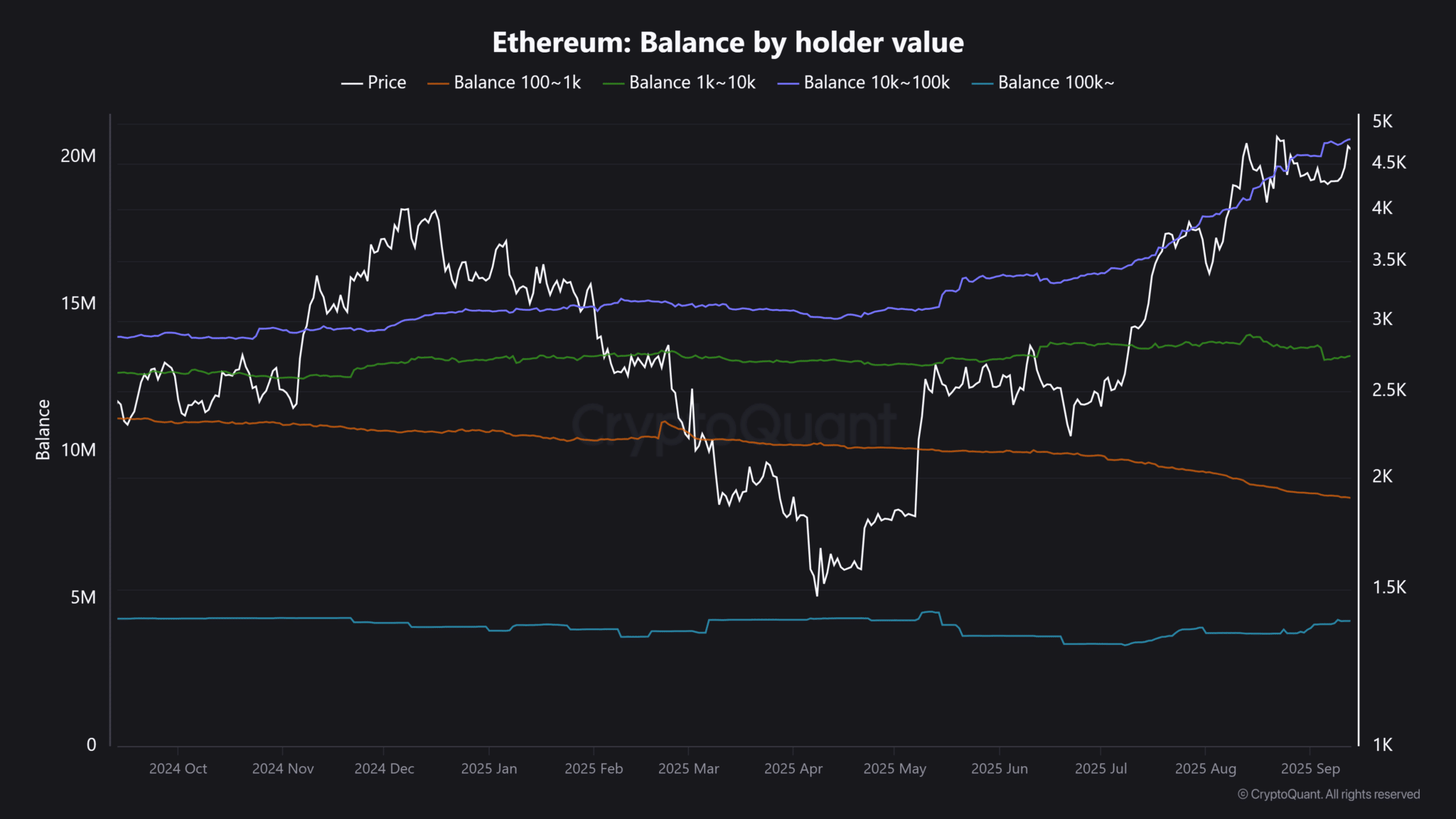

To change this scenario, ETH needs to break the traditional seasonal pattern. Interestingly, the smart money seems to be ready. The balance of the 10k to 100k ETH pool has reached 20 million ETH, an all-time high, according to information from CryptoQuant .

Source: CryptoQuant

Looking closely, the accumulation started in mid-Q2 after the Fud news on Liberation.

Why is this important?

Ethereum’s outperformance of Bitcoin in Q2 and Q3 was clearly strategic. Macro volatility pushed nearly 8 million ETH into this group as BTC.D fell nearly 12%, showing a clear rotation of capital.

Against this backdrop, the ETH/BTC ratio is currently targeting the 0.045 resistance, while macro volatility is still limiting inflows into Bitcoin.

Bottom line? ETH is likely to outperform BTC in Q4 for the first time in four years.

Leave a Reply