The strong capital attraction trend of Bitcoin ETFs takes place in the context of Bitcoin price actively recovering, approaching the historical peak.

![]()

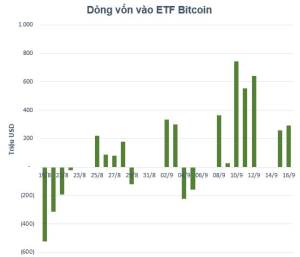

Bitcoin ETFs are continuing their positive net inflow trend. Statistics over the past 7 days show that Bitcoin ETFs globally have net inflowed a total of $2.88 billion. Of which, the iShares Bitcoin Trust (IBIT) – the largest in the group – has inflowed about $1.5 billion. Following is Fidelity Wise Origin Bitcoin Fund (FBTC) with a net inflow of nearly $959 million.

Currently, the total assets managed by Bitcoin ETFs globally are 144.5 billion USD. Of which, the largest scale is the iShares Bitcoin Trust (IBIT) fund reaching more than 86 billion USD, followed by a scale of more than 21 billion USD.

The strong capital attraction trend of Bitcoin ETFs takes place in the context of Bitcoin price actively recovering, approaching the historical peak. Currently, Bitcoin price has increased to over 117,000 USD, thereby raising the total market capitalization of this digital currency to 2,325 billion USD .

The recovery of the cryptocurrency market comes ahead of expectations that the Fed may cut interest rates at its upcoming meeting. According to analysts, a Fed rate cut usually leads to cheaper money and more liquidity in the economy, thereby encouraging investors to seek higher yields in asset markets such as stocks, cryptocurrencies and gold. In that context, Bitcoin is considered one of the assets that directly benefits.

Globally, it is understandable that large institutional capital is flocking to Bitcoin ETFs instead of buying Bitcoin directly. Bitcoin ETFs allow investors to gain exposure to Bitcoin prices without having to deal with the technical complexities of storing and securing digital currencies. On the other hand, these ETFs are traded on major stock exchanges, providing high liquidity and ease of purchase and sale.

However, spot Bitcoin ETFs still face challenges as Bitcoin’s volatile price makes their performance difficult to predict. Direct exposure to a highly speculative asset means increased risk, especially during periods of sudden market reversals.

In addition, the legal framework for cryptocurrencies is still in the process of being completed in many countries. Changes in regulatory policies can affect the operations of ETFs, from product structure to approval and monitoring processes.

Leave a Reply