As of the morning of September 23, Bitcoin (BTC) price was recorded at around $112,352, down 2.08% in the past 24 hours.

Market capitalization is around $2,240 billion and 24-hour trading volume is over $60 billion. During the day, BTC fluctuated between $111,900 and $115,700, showing strong volatility with many important technical signals.

As of the morning of September 23, Bitcoin was trading around $112,352, down 2.08% in the past 24 hours – Photo: Binance

Strong fluctuations

On the 1-day chart, Bitcoin entered a correction phase after reaching a short-term peak near $117,968. A bearish engulfing candle appeared with high trading volume, reflecting increased selling pressure and pulling the price to the support zone of $112,000 – $113,000.

BTC daily price chart as of September 21 – Photo: Bitstamp

On the 4-hour chart, the price dropped sharply from $117,968 to the $111,800 area, then recovered slightly. The strong volume during the decline suggests a possible “capitulation”. However, recent candles show that the selling pressure has weakened. On the 1-hour chart, the small downtrend is still in place, with the price fluctuating between $112,500 and $113,000.

Bitcoin is currently facing two main scenarios. In the positive scenario, if the price holds the $112,000-$113,000 range and breaks above $113,500, the uptrend could resume with a target of $117,500 or higher.

Conversely, in a bearish scenario, if the price falls below $112,000, especially if it loses the $111,500 mark, the market is likely to continue entering a deeper correction.

Strong cash flow into crypto funds, Bitcoin and Ethereum (ETH) lead the way

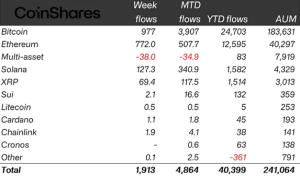

The cryptocurrency market continued to attract strong capital last week as crypto funds and exchange-traded products (ETPs) recorded a net inflow of $1.9 billion, according to the latest data from CoinShares. This is the second consecutive week of billion-dollar inflows into crypto funds, following last week’s $3.3 billion increase.

ETP is a general concept, referring to investment products listed and traded on the stock exchange, which may include ETF (Exchange Traded Fund), ETN (Exchange-Traded Note) or ETC (Exchange-Traded Commodity).

Among crypto ETPs, Bitcoin and Ethereum accounted for the majority of inflows, with $977 million and $772 million, respectively. Altcoins such as Solana and XRP also attracted $127 million and $69 million, respectively. As a result, the total assets under management (AUM) in global crypto ETPs has risen to a record high of $40.4 billion since the beginning of the year, according to James Butterfill, director of research at CoinShares.

Dòng vốn vào các sản phẩm ETP tiền mã hóa theo từng tài sản tính đến 19.0 (đơn vị: triệu USD) – Ảnh: CoinShares

Bitcoin ETFs continue to maintain a strong growth streak. In the last 4 weeks alone, Bitcoin ETFs have attracted a net of 3.9 billion USD, showing the confidence of institutional investors in this digital currency.

Meanwhile, “short Bitcoin ETP” products – betting on falling prices – have struggled, with capital withdrawals of up to $3.5 billion, bringing total AUM to a multi-year low of just $83 million.

Ether exchange-traded funds (ETPs) have also seen strong interest. Last week’s inflows brought the total AUM of Ether ETPs year-to-date to a record $12.6 billion.

This development coincided with the US Federal Reserve (Fed) cutting its base interest rate by 0.25 percentage points on September 17, a move seen as a strong catalyst for risky assets such as stocks and cryptocurrencies.

Market Psychology: Fear

Based on data from Binance, the “fear” and “greed” index (Fear & Greed Index) for the cryptocurrency market (based mainly on Bitcoin and large-cap cryptocurrencies) is currently at 40 which is classified as fear.

Chỉ số sợ hãi và tham lam của thị trường tiền mã hóa hôm nay 23.9 – Ảnh: Binance

A reading of 40 suggests that market sentiment is cautious and somewhat bearish. Investors are more worried than excited. However, this is not the level of “extreme fear” (below 25 – often associated with sharp sell-offs), but it is also not high enough to reflect optimism or greed, which usually appear when the index exceeds 75.

When the index falls into the fear zone, the market may be near an attractive price zone, creating an opportunity for long-term investors who want to accumulate gradually. If fear persists for a long time or falls further (below 30), the risk of the market entering a new sharp decline will increase significantly.

US – UK accelerate supervision and development of digital asset market

The US and UK have just announced the establishment of a Transatlantic Task Force to strengthen cooperation on capital markets and digital assets.

The initiative was announced by British Finance Minister Rachel Reeves and US Treasury Secretary Scott Bessent on September 22. The task force will bring together representatives from the two countries’ finance ministries and market regulators, with a focus on building a framework for monitoring digital assets and exploring opportunities in large-scale digital markets.

British Finance Minister Rachel Reeves – Photo: Getty

The group plans to report within 180 days through the US-UK Financial Regulatory Working Group, while consulting widely with the private sector.

“London and New York remain the two pillars of global finance, and close ties are essential as technology reshapes the marketplace,” said Ms. Reeves. Mr. Bessent also stressed that the initiative demonstrates a commitment to ensuring financial innovation is not limited by borders.

While the scope of work includes traditional capital markets, digital assets are expected to be a key focus. The task force will consider short-term measures such as facilitating cross-border transactions amid regulatory uncertainty, while also developing a long-term strategy for developing digital market infrastructure.

Leave a Reply