Gold reached a new peak at 3893$/ounce yesterday morning before moving sideways within the 385x – 386x range until today.

Although last night’s ADP-Nonfarm data showed that the labor market is being severely affected – with no new jobs created and even a considerable number of jobs lost – gold did not show much volatility. This movement indicates that gold’s upward momentum is stalling and may soon face a major wave of profit-taking, as recent buying pressure has been overly strong.

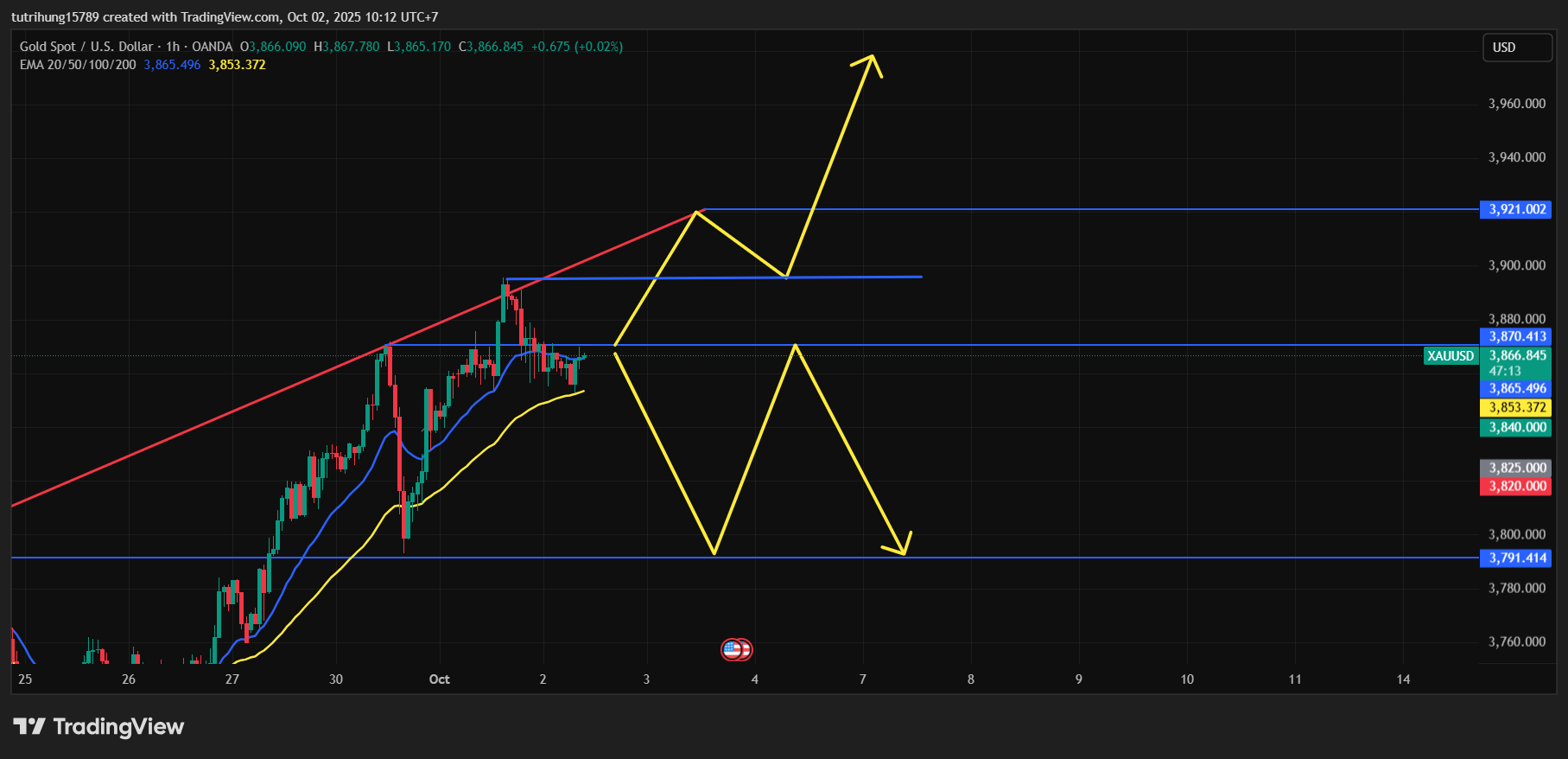

Therefore, the 3900$/ounce resistance zone is likely to be the key breakout point. If breached, it could trigger a powerful rally pushing gold toward 4000$/ounce as early as October. On the other hand, if gold continues trading below 3900$, it may be preparing for heavy profit-taking and a potential sharp correction back below 3800$/ounce.

Technical Analysis:

Gold is currently trading around the Key Level of 3870. This will be the critical zone that determines gold’s next short-term direction.

If gold breaks above 3870, another bullish wave may push prices back to the 389x peak or even further to 3919$/ounce.

Conversely, if it fails to break this level, gold is expected to continue moving sideways within the broader 3800 – 387x range until a breakout occurs.

Trí Hùng

Leave a Reply