Gold price today October 22, 2025 on the international market plummeted like never before in history. Domestic gold price fell from the historical peak of 160 million VND/tael.

In the world, as of 9:45 p.m. on October 21 (Vietnam time), the spot gold price today on the international market was at 4,088 USD/ounce. Gold for December 2025 delivery on the Comex New York floor was at 4,130 USD/ounce.

The world gold price on the night of October 21 was about 55.7% higher (equivalent to an increase of 1,463 USD/ounce) compared to the end of 2024. The world gold price converted to the bank USD price was 130.4 million VND/tael, including taxes and fees, about 22.1 million VND/tael lower than the domestic gold price as of the end of the afternoon session on October 21.

The spot gold price on the New York floor on the evening of October 21 (Vietnam time) suddenly plummeted, losing points like never before, dropping about 270 USD/ounce (equivalent to a decrease of 6.2%) just a few hours after the opening of the trading session. Gold broke the threshold of 4,100 USD.

Gold plunged in the context of the market receiving no unusual information except the USD’s strong increase. However, there is a risk factor that could contribute to pushing gold prices down very deeply.

Gold prices fell primarily due to a surge in profit-taking as the commodity’s price volatility formed a double top. This made investors doubt that gold could go any higher.

A stronger US dollar, with the DXY index rising from 98.6 points in the previous session to 98.9 points, contributed to the rapid increase in profit-taking activities.

Profit-taking activities took place after a series of days of continuous gold price increases and consecutive record highs, from more than 3,400 USD/ounce in early September to a peak of 4,380 USD/ounce in the previous session, equivalent to an increase of nearly 29%.

Gold price cools down from peak of 160 million VND/tael. Photo: CH

Strong profit-taking activities followed by a wave of short selling contributed to quickly sinking gold prices.

The price of gold dropped by $270 in a few hours is rare in the decades-long history of trading this precious metal, but it is also understandable when gold has increased by nearly $1,000 in the past month and a half.

In the past, gold has also witnessed many corrections of 5-15% after hot increases.

Domestic gold price today

The world gold price edged up slightly this morning after plunging last night. At 8:35 am today (October 22, Vietnam time), the world spot gold price was at 4,102 USD/ounce, up 14 USD/ounce compared to last night.

On the morning of October 22, the world gold price converted to USD bank price was at over 131.3 million VND/tael, including tax and fees, about 17.2 million VND/tael lower than the domestic gold price.

Domestically, gold prices have been adjusted down sharply by brands.

At the beginning of the trading session on October 22, the price of SJC gold bars was adjusted down by 5 million VND/tael for buying and 4 million VND/tael for selling compared to yesterday’s closing price, down to 146.5-148.5 million VND/tael (buying – selling).

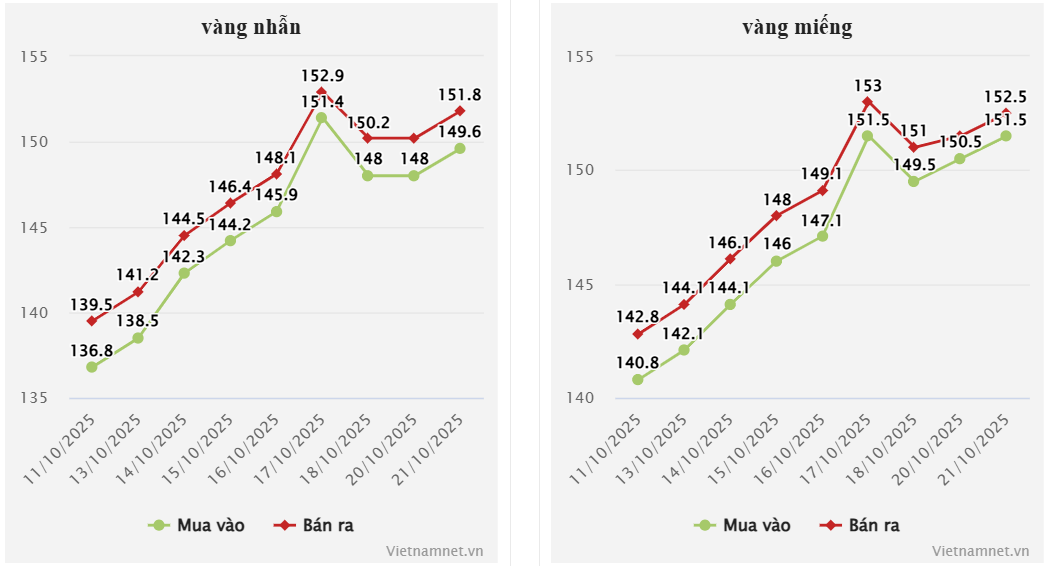

Similarly, the price of gold rings early this morning also decreased rapidly.

The price of SJC 1-5 chi gold rings at the beginning of today’s session was reduced to 145.5-148 million VND/tael (buy – sell), down 4.1 million VND/tael for buying and down 3.8 million VND/tael for selling compared to yesterday’s closing price.

The price of 9999 gold rings at Doji also decreased by 4.8 million VND/tael for buying and 4.8 million VND/tael for selling compared to the end of yesterday’s trading session, trading at 145-148 million VND/tael (buying – selling).

Domestic gold prices have continuously set new record highs. Specifically, by the end of the trading session on October 21, the price of 9999 gold bars at SJC was listed at 151.5-152.5 million VND/tael (buy-sell), an increase of 1 million VND compared to the previous session.

By the end of the afternoon of October 21, SJC announced the price of 1-5 ring gold at only 149.6-151.8 million VND/tael (buy – sell), an increase of 1.6 million VND/tael compared to the previous session. Doji announced the price of 1-5 ring gold at only 149.8-152.4 million VND/tael (buy – sell), an increase of 800,000 VND for buying and 1.1 million VND for selling. Bao Tin Minh Chau listed the selling price of ring gold at 159.5 million VND/tael.

Gold price forecast

It can be seen that the gold price has decreased very quickly in the trading session on October 21. The price of more than 6% caused a big shock to financial and commodity investors.

However, this is also what some organizations have predicted in advance. Accordingly, the gold price will undergo a 5-10% correction after increasing by 50-60% in 2025. In 2024, the gold price also increased by 27%.

In fact, most organizations predict that gold will continue to increase in price in the medium and long term due to the huge demand for this commodity, coming from central banks of countries, gold ETFs, financial institutions and individuals.

In a world of geopolitical uncertainty and trade and economic policies, gold remains the asset of choice. Countries are also diversifying their asset reserves and reducing their fiat currencies as they pump money into their economies.

However, any sharp rally is accompanied by corrections. A cooling Middle East, a short-term recovery in the US dollar, a possible reopening of the US government, or a easing of tensions between Russia and Ukraine could all cause a correction in gold prices.

Experts say such wild swings will become more common as gold and silver continue to hover in high price territory.

Notably, gold prices may be forming a short-term “double top” pattern, with key technical support levels at the 100-hour MA around $4,270 and the 200 MA currently near $4,163. However, buying pressure is still present at these support zones.

In addition, gold is also subject to an unprecedented risk of the negative impact of silver prices on this commodity. If in the past, the increase in gold prices often pulled silver prices up and vice versa, now the rapid decline of silver, losing the $50/ounce mark, can pull gold prices down as well.

Leave a Reply