Bitcoin has been trading in a narrow range of 2.3% since Friday as investors await the Federal Reserve’s interest rate decision today (September 17). While the immediate impact of the rate cut on Bitcoin remains unclear, three independent factors are supporting BTC’s price increase.

Estimate: total Bitcoin held on exchange addresses | Source: Glassnode

The significant decline in the amount of BTC held on exchanges has become a key factor in short-term price formation. According to Glassnode estimates , 44,000 BTC were withdrawn in September alone, reversing the high deposit trend from July. The reduced number of available coins has created tighter liquidity, which could limit short-term selling pressure near the current price of $116,000.

BTC Supply Decreases and Spot Bitcoin ETF Demand Increases

Some argue that the remaining 2.96 million BTC on exchanges is enough to absorb the buying volume. However, this view ignores the fact that a large portion of these coins are not listed on the order books. Many customers hold Bitcoin on exchanges due to concerns about self-custody or to take advantage of benefits such as profit opportunities and reduced transaction fees.

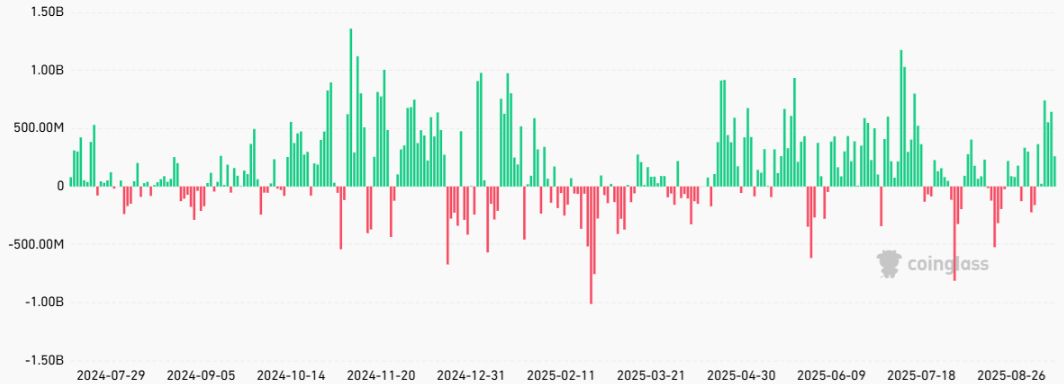

Daily Net Inflows of US-Listed Bitcoin ETFs | Source: CoinGlass

Additional support at $115,000 comes from continued accumulation in spot Bitcoin ETFs, a trend that has helped restore investor confidence after gold has outperformed by more than 11% since August. US-listed Bitcoin ETFs recorded $2.2 billion in net inflows between Wednesday and Monday, equivalent to daily buying pressure that is more than 10 times the amount of new Bitcoin mined each day.

Eric Trump’s Comments on Bitcoin

Eric Trump ’s interview on CNBC on Tuesday drew attention to Bitcoin’s unique characteristics. The son of US President Donald Trump has personally invested as a co-founder of Bitcoin mining and fund management company American Bitcoin (ABTC). Eric Trump has called Bitcoin “the greatest asset of our time,” describing it as a modern version of gold and an effective hedge against weakness in the real estate sector.

Bitcoin Reacts to Fed Rate Decision

The bond market is currently pricing in a 96% chance that the Fed will cut interest rates to 4.25% from the current 4.5%. This suggests that Bitcoin may react cautiously to Wednesday’s announcement. Fed Chairman Jerome Powell ‘s press conference remarks will be crucial in signaling future interest rate trends. If inflation remains a significant risk, Bitcoin’s trajectory to $120,000 may face resistance.

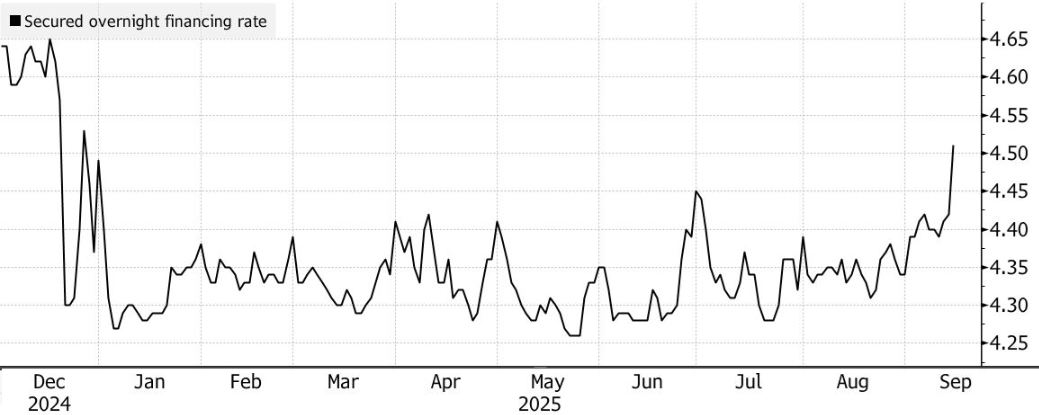

The Fed has guaranteed the overnight funding rate | Source: Bloomberg

However, a new financial signal emerged this week that could point to deeper market stress. On Monday, U.S. banks borrowed $1.5 billion from the Fed’s Standing Repo Facility, a move Reuters said reflected “tightness in meeting funding obligations.” The overnight lending rate also rose to 4.42% on Friday, marking a two-month high.

This uncertainty has led to a rally in gold prices, which hit a record high on Tuesday. Regardless of the Fed’s exact decision on interest rates, Bitcoin could surge past $120,000 as demand increases through spot ETFs, corporate reserve strategies and its role as an independent hedge — an advantage reinforced by Eric Trump’s comments.

Leave a Reply