U.S. stocks declined on Monday (December 1) as persistent market volatility carried over into December 2025.

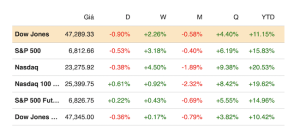

At the close of trading on December 1, the S&P 500 slipped 0.53% to 6,812.63 points, while the Nasdaq Composite fell 0.38% to 23,275.92 points. The Dow Jones Industrial Average dropped 427.09 points (0.9%) to 47,289.33. All three major indexes ended their five-day winning streak.

Bitcoin, the leading cryptocurrency, tumbled 6% to below the $86,000 mark, adding downward pressure to the stock market. This marked Bitcoin’s worst session since March 2025. Late last month, the digital currency fell below $90,000 for the first time since April 2025 and has since struggled to remain above that level. Crypto-related stocks, including Coinbase and Strategy, also slumped sharply on Monday.

Shares of Broadcom and Super Micro Computer fell more than 4% and 1%, respectively, indicating increased profit-taking in certain artificial intelligence (AI)-related stocks. However, Synopsys shares rose after Nvidia announced an investment in the company. Meanwhile, Nvidia — the “darling” of the AI sector and a favorite of both Wall Street and Main Street — gained more than 1%.

Outside the tech sector, retail stocks such as Ulta and Walmart advanced as the holiday shopping season kicked off. The State Street SPDR S&P Retail ETF bucked Monday’s market downturn, extending its five-session gain to more than 6%.

The market experienced turbulence and struggled throughout November 2025. The S&P 500 and Dow Jones were largely flat last month, while the Nasdaq Composite fell 1.5%, ending its seven-month winning streak. At one point in November, the Nasdaq was nearly 8% below its October 2025 closing level, amid concerns about AI stock valuations.

Seasonality is, however, working in Wall Street’s favor as December trading begins. According to the Stock Trader’s Almanac, the S&P 500 has risen an average of more than 1% in December, making it the third-best month of the year for the index since 1950.

Leave a Reply