North American stock markets have recently seen the share prices of many companies tumble due to their strategies of investing in bitcoin and other cryptocurrencies.

According to Bloomberg, this strategy was pioneered by Michael Saylor, who transformed the company he founded, Strategy Inc., from a software developer into a firm focused on digital asset investments. In the first half of 2025, more than 100 other U.S. public companies followed in Saylor’s footsteps, creating a new wave across North American equity markets. These companies’ stocks often surged whenever they announced a new crypto purchase.

However, the growth did not last long. As cryptocurrency prices stopped rising at the previous pace, the share prices of these companies began to decline.

One typical example is SharpLink Gaming Inc., whose stock once jumped more than 2,600% within days after the company announced it would shift from the gaming industry to buying the cryptocurrency Ethereum. Later, SharpLink’s shares fell 86% from their peak, causing the company’s market value to drop below the value of the crypto assets it owned. This situation has not been unique to SharpLink; other firms such as Greenlane Holdings have also experienced severe declines, with its stock plunging more than 99% this year despite holding a large amount of the BERA token.

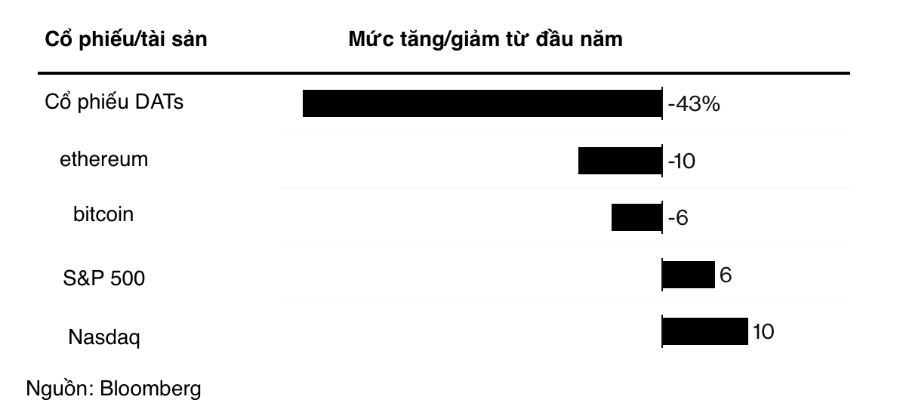

Data from Bloomberg shows that, on average, the share prices of U.S. and Canadian companies holding digital assets (DATs), such as Strategy Inc., have fallen 43% this year. Meanwhile, bitcoin itself has only dropped about 6% since the start of the year. This demonstrates that investing in the stocks of companies holding digital assets has not delivered the expected returns—especially for firms investing in smaller, more volatile tokens.

Part of the volatility in DAT stock prices stems from the fact that these companies have borrowed heavily to acquire digital tokens. For example, Strategy Inc. issued a series of convertible bonds and preferred shares to finance its bitcoin purchases, with the value of its bitcoin holdings at one point exceeding USD 70 billion. However, when crypto prices fall, these companies face pressure to pay interest and dividends on their debts while their digital assets generate no cash flow.

To stay afloat, Strategy Inc. has attempted to raise additional capital by selling perpetual preferred shares in Europe at a discount, after similar offerings in the U.S. failed to meet expectations. However, the euro-denominated preferred shares have since fallen below their offering price. Smaller companies without strong reputations are finding it even harder to raise capital as cryptocurrency prices fall and investor enthusiasm fades.

One solution Strategy Inc. is considering is selling part of its digital asset holdings to service its debt. Strategy CEO Phong Le has indicated the company may sell bitcoin if necessary to pay dividends. This statement sparked concern, as Saylor had previously insisted he would never sell bitcoin and would instead buy more during price declines.

If DATs are forced to sell their digital assets, cryptocurrency prices could fall even further, creating a downward spiral. If news breaks that Strategy Inc. has sold bitcoin—even a small amount—investors may begin to question the entire bitcoin investment strategy.

Although Strategy Inc. has set aside a USD 1.4 billion reserve fund to cover dividend payments in the short term, the company’s share price has still fallen 38% this year. The collapse of DAT stocks could spread across the market if traders used borrowed money to buy these shares. When prices plunge, those investors would have to sell other assets to meet margin calls. Currently, such concerns have discouraged companies from adopting similar strategies and have dampened the capital-market enthusiasm that this investment trend once generated.

However, there are signs that some larger DATs are beginning to acquire smaller DATs whose market values have dropped below their asset values. Strive Inc., co-founded by former Republican presidential candidate Vivek Ramaswamy, agreed in September to acquire Semler Scientific Inc. in an all-stock deal, merging two bitcoin-holding firms. Semler was one of the earliest DATs and has lost 65% of its market capitalization this year.

Ross Carmel, a partner at the law firm Sichenzia Ross Ference Carmel, predicts that M&A activity in the DAT sector will increase in early 2026, and that the main challenge will be determining which companies can survive long enough to participate.

Leave a Reply