The decline in gold prices last week, along with the widening gap between buying and selling, has caused heavy losses for domestic investors after a week. World oil prices are forecast to trend downwards in the context of OPEC+ agreeing to increase production. Domestic gasoline prices are likely to be adjusted down in this week’s management period.

Domestic gold bar price today (November 3)

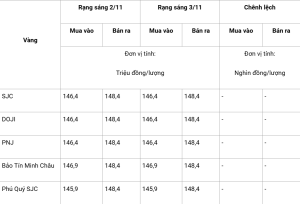

Gold bar prices today remained stable compared to yesterday morning’s trading session.

The brands SJC, DOJI, and PNJ simultaneously listed gold bar prices at 146.4 – 148.4 million VND/tael (buy – sell), unchanged in both directions.

Bao Tin Minh Chau traded gold bars at 146.9 – 148.4 million VND/tael (buy – sell), stable in both directions.

Phu Quy also kept the price of gold bars unchanged in both directions, currently trading at 145.9 – 148.4 million VND/tael (buy – sell).

Domestic gold bar prices updated at 5:00 a.m. November 3 as follows:

Domestic gold ring price today ( November 3 )

Following the trend with gold bars, brands did not adjust the price of gold rings compared to early this morning.

SJC listed gold rings at 143.6 – 146.1 million VND/tael (buy – sell), keeping the price unchanged in both directions.

DOJI and PNJ brand gold rings traded at 145.3 – 148.3 million VND/tael (buy – sell), unchanged in both directions.

Bao Tin Minh Chau gold rings also moved sideways in both directions, currently trading at 146.2 – 149.2 million VND/tael (buy – sell).

Phu Quy brand gold rings are stable in both directions, currently listed at 145.4 – 148.4 million VND/tael (buy – sell).

World gold price today

The world gold price today started a new week of “uncertainty” after the market just ended its second consecutive negative week, the price is still around 4,000 USD/ounce, a sharp decrease compared to the peak of last week. Experts are in a rare neutral and balanced state when forecasting the gold price this week.

The world gold price today increased by 18.4 USD/ounce compared to the closing session last weekend, currently trading around 4,003 USD/ounce (equivalent to about 127.2 million VND/tael converted according to Vietcombank exchange rate, excluding taxes and fees).

Thus, the domestic gold bar price is 21.2 million VND/tael higher than the world gold price.

Experts are neutral and balanced when forecasting world gold prices this week.

Experts are neutral and balanced when forecasting world gold prices this week.

Gold prices continued to fall last week, but even the prospect of a threatened rate-cutting cycle and conciliatory US-China trade talks could not keep the precious metal from falling below $3,900 an ounce. The price of gold ended the week firmly holding the $4,000 an ounce mark.

This week’s gold price forecast, according to Kitco News’ latest weekly survey, shows that industry experts are in a rare state of neutrality and balance. Of the Wall Street analysts participating in the survey, 21% predict gold prices will increase, 21% predict a decrease, and the remaining 57% believe that gold will continue to fluctuate sideways within a narrow range.

World oil prices

According to Reuters, eight countries in the OPEC+ alliance agreed on Sunday (November 2) to increase oil production in December by 137,000 barrels/day and then pause the production increase in the first quarter of 2026.

World oil prices are likely to fall this week as OPEC+ agrees to increase production in December

Downward pressure remained after latest data showed China’s manufacturing activity continued to shrink in October, marking a seventh straight month of decline, raising concerns about oil demand in the world’s second-largest economy.

In another development, oil prices were also affected by the US’s strong sanctions on two Russian energy groups, Rosneft and Lukoil, which hindered the flow of crude oil and refined fuels to Asia, raising concerns that supply disruptions would also cause crude oil prices to increase.

Separately, data from the US Energy Information Administration (EIA) showed gasoline, oil and distillate inventories fell by nearly 7 million barrels, far exceeding the expected decrease of just 211,000 barrels.

OPEC+ agrees to increase oil production in December by 137,000 barrels/day

In addition, the US dollar’s three-month high has made crude more expensive for buyers using other currencies, which analysts say is limiting the recovery in oil prices in the short term.

Last week, the US Federal Reserve (Fed) decided to cut its benchmark interest rate by another 0.25 percentage points. Low interest rates help reduce consumer borrowing costs, thereby stimulating growth and energy demand.

Overall, world oil prices continue to be affected by the intertwined effects of economic recovery expectations, US monetary easing and oversupply risks as OPEC+ adjusts production. However, analysts still maintain a positive forecast for the medium-term outlook. Accordingly, Brent oil prices could average $67.99/barrel in 2025, while WTI oil prices remain around $64.83/barrel.

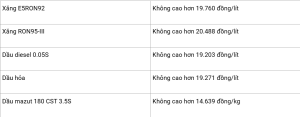

Domestic gasoline prices

Domestic retail prices of gasoline on November 3 are as follows:

Leave a Reply