U.S. stocks fell on Tuesday (November 4), pressured by a decline in artificial intelligence (AI)–related shares such as Palantir, as investors grew increasingly concerned about the valuations of the stocks that have led the market’s rally.

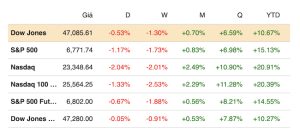

At the close of trading on November 4, the S&P 500 dropped 1.17% to 6,771.55 points, while the Nasdaq Composite lost 2.04% to 23,348.64 points. The Dow Jones Industrial Average slipped 251.44 points, or 0.53%, to 47,085.24 points.

Palantir shares tumbled 8%, even after the software company reported third-quarter 2025 earnings that beat Wall Street expectations and provided a strong outlook driven by growth in its AI business. The stock, which has surged more than 150% this year, is currently trading at over 200 times its projected earnings. This means that investors in this and other AI stocks are betting that these companies will continue to deliver robust revenue and profit growth to justify further buying.

Oracle shares, with a forward P/E ratio above 33, lost nearly 4%, trimming their year-to-date gains to about 50%. Chipmaker AMD, which has doubled in value this year, fell almost 4%. Other AI-related stocks such as Nvidia and Amazon also declined.

According to FactSet, the rally in AI stocks has pushed the S&P 500’s forward P/E ratio above 23 — near its highest level since 2000. As these stocks have propelled the broader market to new highs in recent months, analysts warn that without a corrective pullback, valuations are starting to look “truly stretched.”

Comments from executives at Goldman Sachs and Morgan Stanley further eroded investor confidence on Tuesday. Last night, Goldman CEO David Solomon said there is “a possibility that the stock market could decline by 10% to 20% over the next 12 to 24 months.” In addition, Morgan Stanley CEO Ted Pick remarked, “We should also welcome the possibility of corrections — declines of 10% to 15% — without being driven by any sort of macro cliff effect.”

Leave a Reply