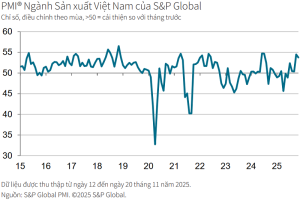

Vietnam’s Manufacturing PMI reached 53.8 in November 2025, indicating that the sector continues to maintain positive “health” and marking the fifth consecutive month of improving business conditions, despite significant supply-chain disruptions caused by storms and heavy rainfall.

Businesses expect new orders to continue rising.

On the morning of December 1, 2025, S&P Global released the November Manufacturing Purchasing Managers’ Index (PMI) for Vietnam, highlighting three key points: a sharp rise in output driven by increased new orders; severe storm impacts leading to supply-chain delays and slower completion of production work; and a second consecutive month of workforce expansion.

FIFTH STRAIGHT MONTH OF GROWTH MOMENTUM

According to S&P Global, although November’s PMI slipped slightly from October’s 54.5, the reading of 53.8 still signals strong improvement in the manufacturing sector. Production conditions have now strengthened for five consecutive months.

The main growth driver was the rise in new orders, marking the third monthly increase in a row. Notably, export markets showed encouraging signs, with new export orders rising at the fastest rate in 15 months. Surveyed firms emphasized improved demand from major markets such as mainland China and India.

Buoyed by strong order volumes, output expanded for the seventh straight month, although growth slowed slightly due to adverse weather conditions.

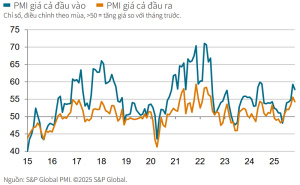

One of the most notable findings in this report was the negative impact of major storms on operations. Severe weather caused supplier delivery times to lengthen significantly, reaching the highest level since May 2022.

As a result, backlogs of work increased for the second consecutive month and at the fastest pace since March 2022. Many manufacturers had to draw down their inventories of finished goods to fulfill urgent orders, leading to a sharper drop in stock levels than in the previous month.

Additionally, storm-related supply disruptions pushed input costs higher. The rate of input-price inflation in November was the second fastest since July 2024. To compensate, firms continued to raise selling prices, passing part of the cost burden on to customers.

STRONGER RECRUITMENT TO KEEP UP WITH WORKLOAD

Facing pressure to complete a growing volume of work, manufacturers accelerated hiring activity. Employment rose for the second consecutive month in November, marking the strongest increase in almost a year and a half. Survey respondents indicated that most of the new hires were for full-time positions to ensure production needs were met.

Purchasing activity also increased for the fifth consecutive month and at the fastest rate in four months, in preparation for year-end production plans.

S&P Global noted that business sentiment among Vietnamese manufacturers remains highly positive. Nearly half of surveyed firms expect output to rise over the next year, pushing optimism to its highest level in 17 months. Companies anticipate continued growth in new orders and hope for more favorable weather conditions to support production.

Commenting on the survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, said that the strong momentum seen in October was largely sustained in November as Vietnam’s manufacturing sector experiences a positive end to the year. While the pace of output and new-order growth eased slightly, firms hired additional staff at a faster rate to handle the increasing workload.

Growth persisted despite supply-chain and production-line disruptions caused by recent storms. As companies catch up on delayed projects, expansion is expected to continue in the months ahead.

Leave a Reply