ASIC - Australian Securities & Investment Commission

- Website: http://www.asic.gov.au/

- Founded: 1997

- Operated by: Chính phủ

- License Type: AA

- Country: Australia

- Hotline: + 61 3 5177 5407

Who is ASIC?

The Australian Securities and Investments Commission (ASIC) was established in July 1998 and now serves as the primary regulatory authority overseeing the securities and investment markets in Australia, under the Australian Securities and Investments Commission Act 2001.

ASIC’s core responsibility is to regulate financial institutions and companies, including banks, credit unions, financial brokers, and mortgage firms. It enforces financial laws to protect consumers, investors, and creditors, with the broader goal of fostering a transparent and equitable financial system.

To operate in Australia or provide financial services to Australian residents, brokers must hold a valid Australian Financial Services (AFS) license. Many leading international forex brokers choose ASIC as their regulator due to its strong global reputation and the legal protections it provides. Additionally, the Australian market itself offers lucrative opportunities.

ASIC has earned global recognition for its strict regulatory framework, which includes risk limitations, a ban on bonus incentives, and comprehensive consumer guidance.

However, in recent years, ASIC has also faced criticism from consumers, advocacy groups, and even government officials, who argue that it has been ineffective and slow to act in protecting the public from major financial scandals and abuses.

How does ASIC regulate forex brokers?

1. Ensuring client fund safety:

Segregated accounts at Tier 1 banks.

2. Initial capital requirement for forex brokers:

Minimum operating fund of USD 1 million.

3. Reporting requirements for forex brokers:

Annual audit report; Monthly income report; Monthly balance sheet; Consumer transaction data report (monthly and yearly).

4. Other regulations:

Having a visitable office in Australia; Risk restrictions; Bonus prohibition; Consumer awareness.

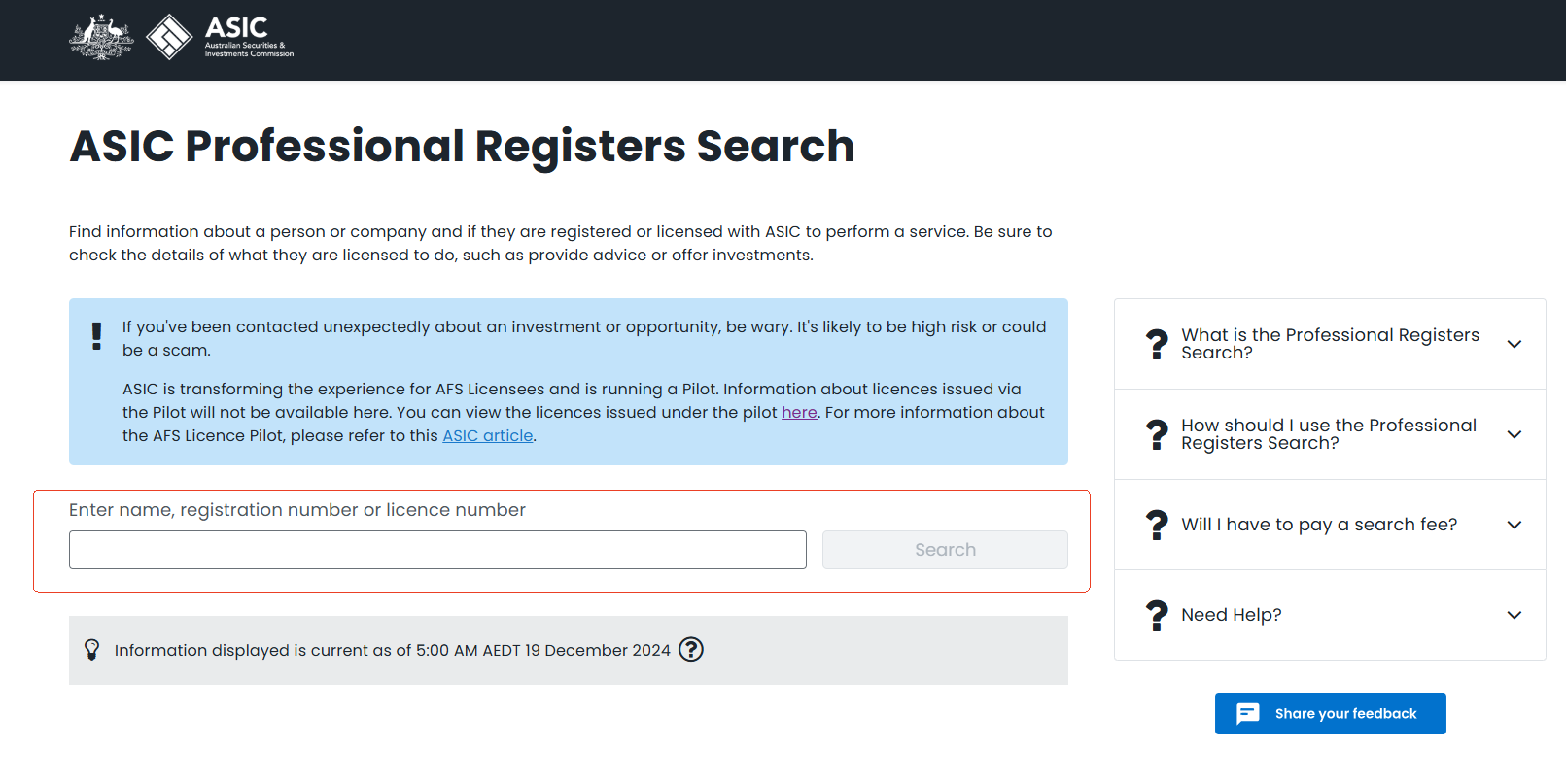

How to check whether a broker is licensed by ASIC?

In general, broker records regulated by ASIC can be found at: https://service.asic.gov.au/search/. Try to search and check whether the information matches that on the broker’s website.

Detailed steps are as follows:

1. Find the AFSL number (preferred) or the name of the forex broker, which you can obtain from the broker’s website.

2. Enter the AFSL number or name into the search bar at https://service.asic.gov.au/search/, then click the search button. You will see a list of companies appear below the search bar.

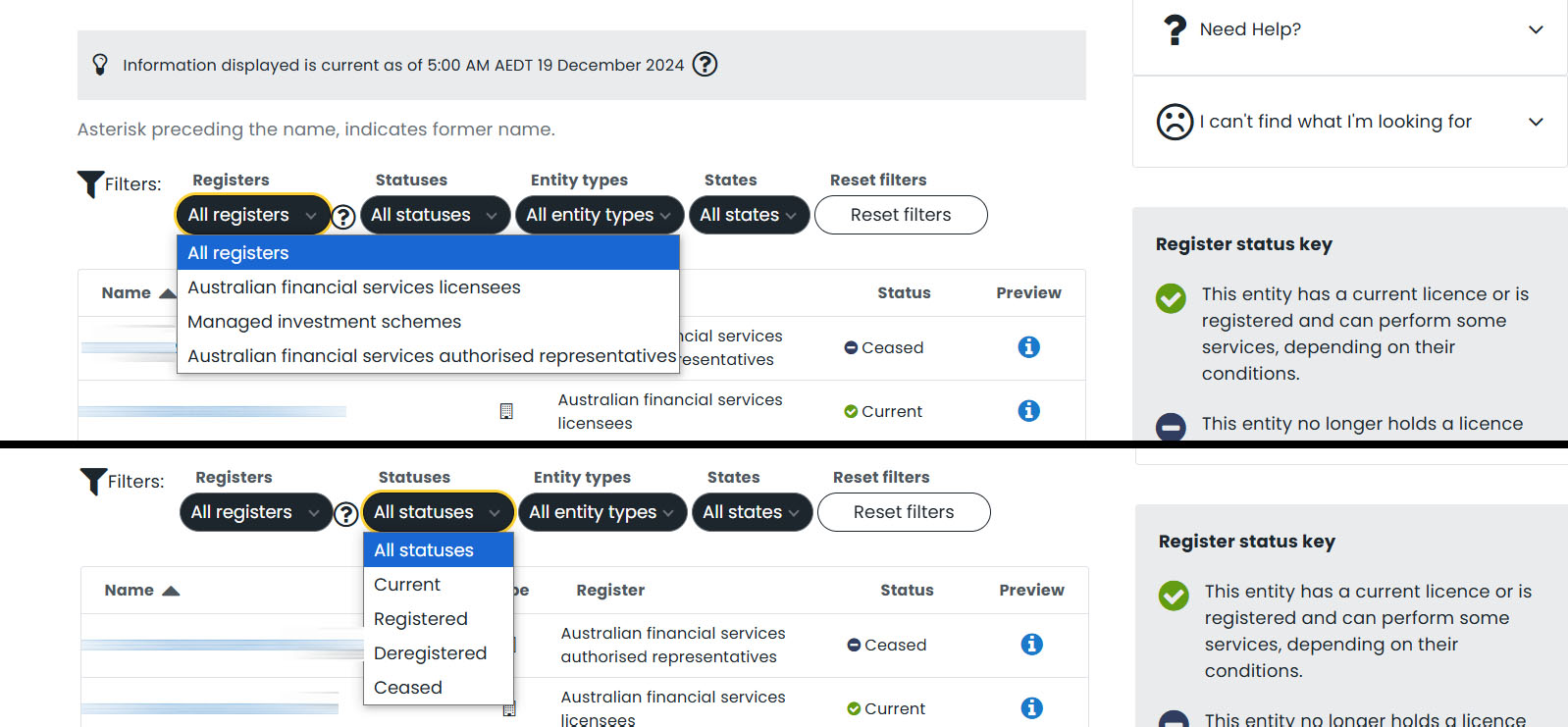

3. Use the filter to narrow down the information, making it easier to accurately identify the target company.

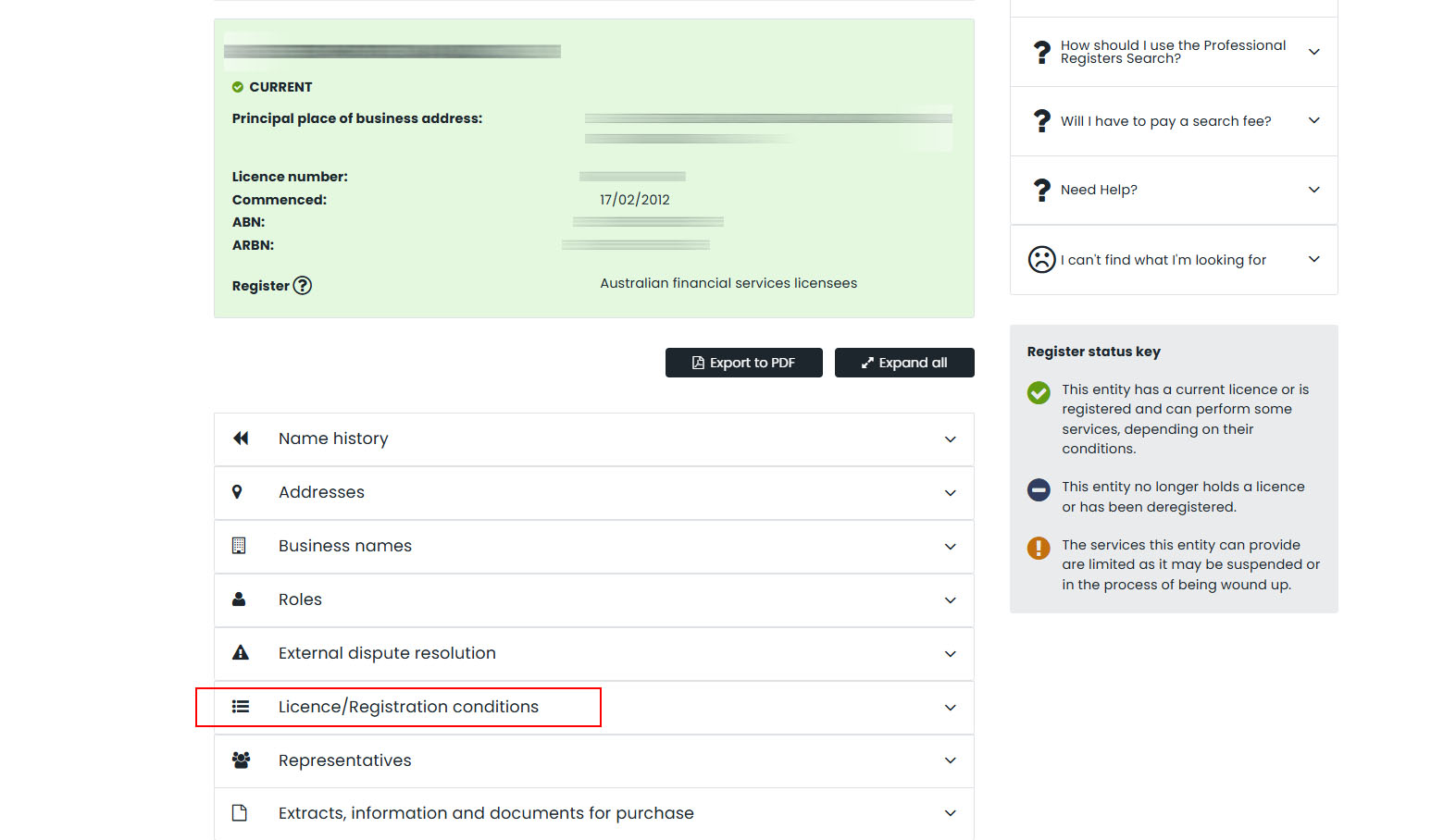

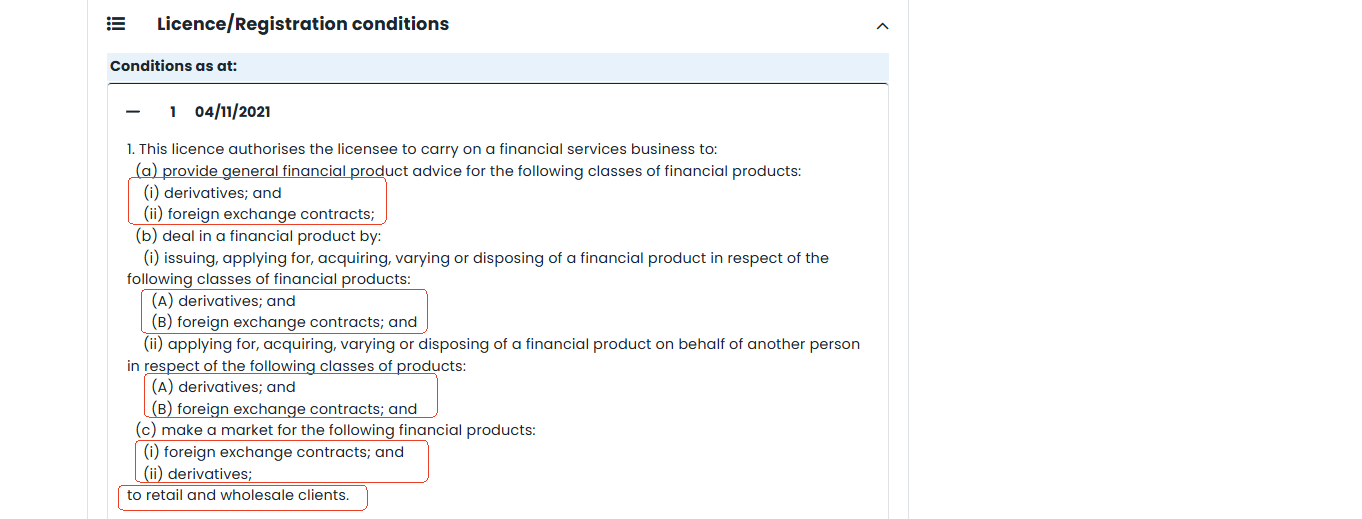

4. First, you can click the “!” button next to the company name to view basic company information. Second, you can click the company name to open a specific page with detailed information. Here, click “License/Registration Conditions” and check whether the broker is authorized to provide “foreign exchange contracts” or “derivatives” to retail clients. If not, the broker is not permitted to provide forex trading services, so please be cautious. If yes, proceed to the next step.

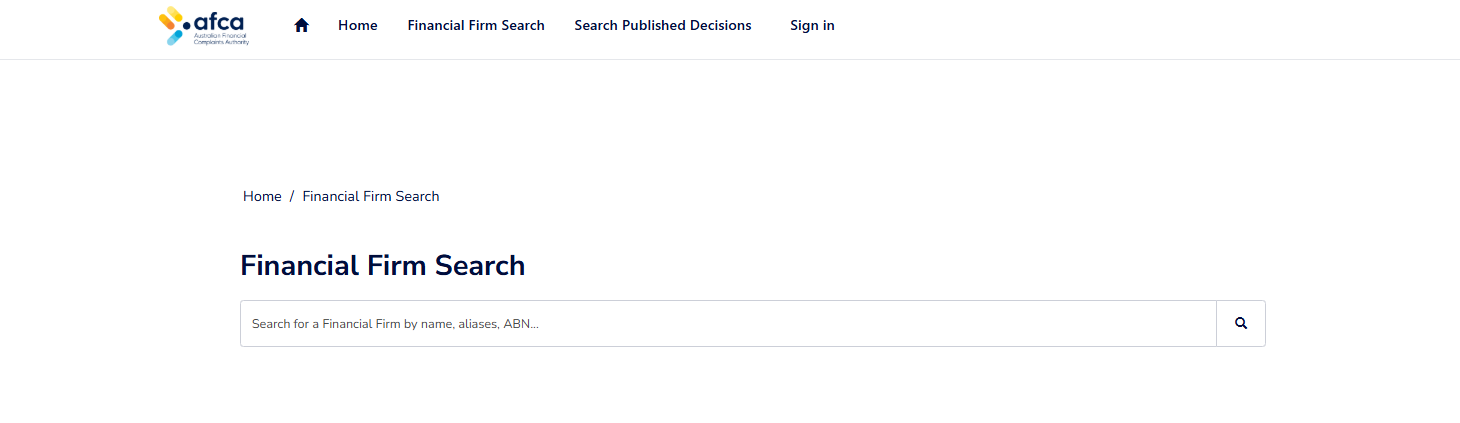

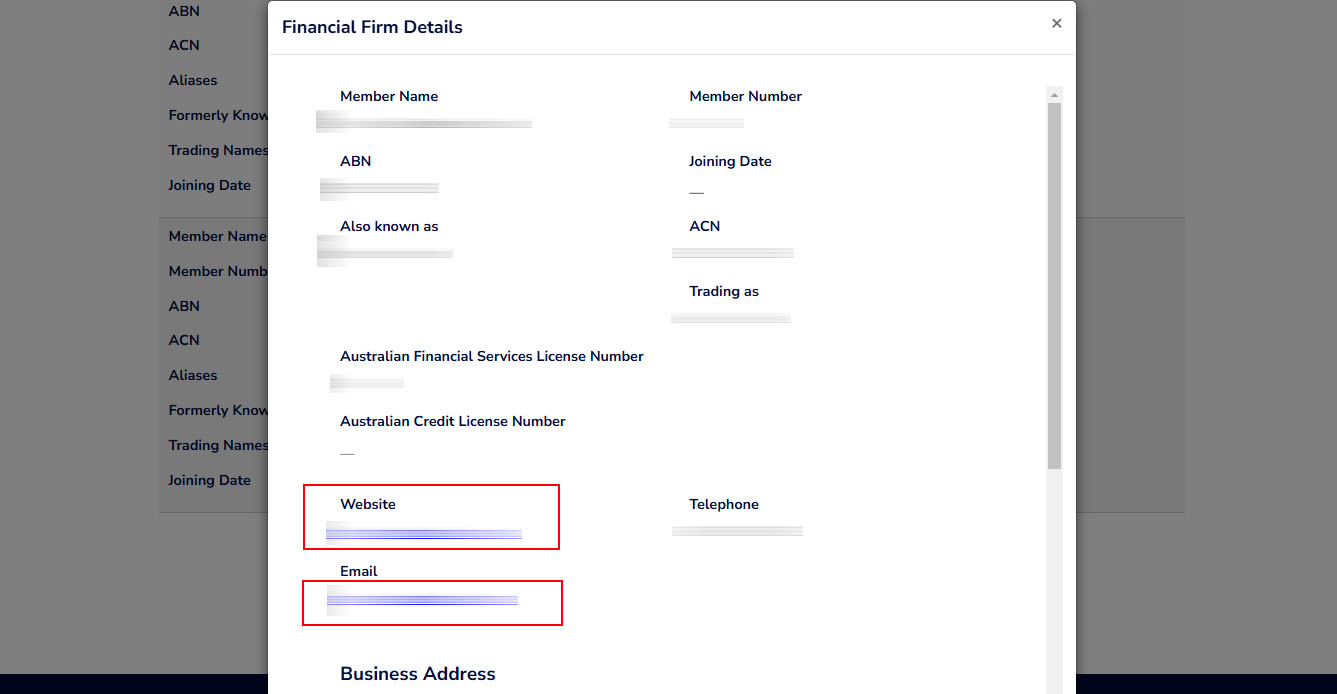

5. Obtain the “Membership Number” from the “External Dispute Resolution” section on the same page and go to https://my.afca.org.au/ff-search/. Enter the broker’s AFCA member number or name into the search bar to view the broker’s record. After completing the above steps, check whether the company details on the ASIC and AFCA websites match those of the broker you intend to trade with, especially the website and email. If they do not match, avoid the broker as it may be unauthorized and your funds may be at risk.

How to resolve disputes with a broker regulated by ASIC?

When you have a dispute with a broker regulated by ASIC, you can protect your rights and interests by following these steps:

Method 1: First of all, we suggest you contact the broker directly to find a mutually beneficial solution.

Method 2: If you are not satisfied with the broker’s solution, try contacting AFCA in Australia, which helps resolve disputes between forex brokers and investors.

• Online Complaint Procedure Guide: https://www.afca.org.au/make-a-complaint

• Online Complaint Form: https://ocf.afca.org.au

Method 3: If the above two methods cannot resolve the dispute, the final step is to take the case to court in Australia.

Thành viên tổ chức

ThinkMarkets

Regulatory Body: CySEC FCA ASIC Seychelles FSA FSCA

easyMarkets

Regulatory Body: ASIC CySEC FSCA BVI FSC Seychelles FSA