CBI - Central Bank of Ireland

- Website: http://www.centralbank.ie/

- Founded: 1943

- Operated by: Government

- License Type: A

- Country: Ireland

- Hotline: 353 (0)1 224 6000

Who is the CBI?

The Central Bank of Ireland (CBI) (Irish: Banc Ceannais na hÉireann) is the nation’s central bank and a member of the European System of Central Banks (ESCB). It also serves as the primary financial services regulator in Ireland, overseeing most categories of financial institutions, including forex brokers.

The CBI enforces strict regulations on forex brokers, particularly regarding negative balance protection and leverage limits, in line with the guidelines of the European Securities and Markets Authority (ESMA). However, it is important to note that many forex brokers operating in Ireland are not directly licensed by the CBI but instead hold authorizations from other EU regulators.

How CBI regulate a forex broker?

1. Safety of Client Funds:

Investment intermediaries should

(a) keep client assets separate from the investment firm’s own assets; and

(b) take all steps as may be necessary to ensure that any client asset is held by it in trust for the benefit of the client on behalf of whom such client asset is being held.

2. Requirement on Forex Brokers’ Reports:

Anti-money laundering Reports; Audit Reports; the Programme of Operations; Annual Financial Statements.

How to check a broker is CBI-regulated or not?

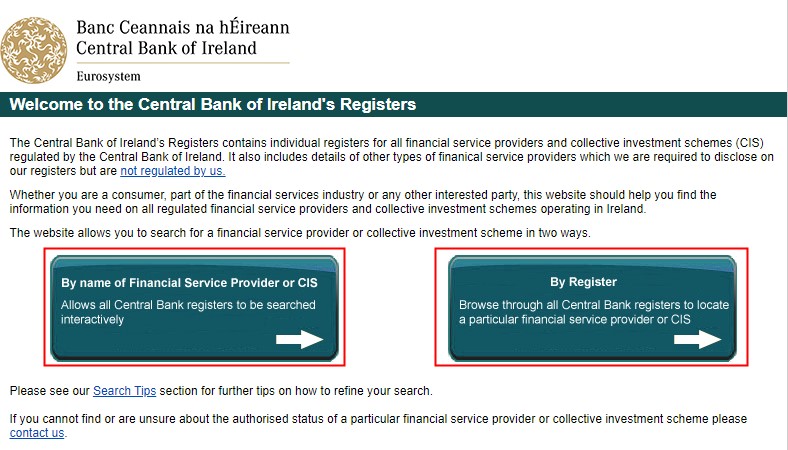

Generally speaking, CBI-regulated broker profile will be found at the Registers page on CBI website. Try to find it and check if it will match the info from the broker website.

The detailed steps are as below:

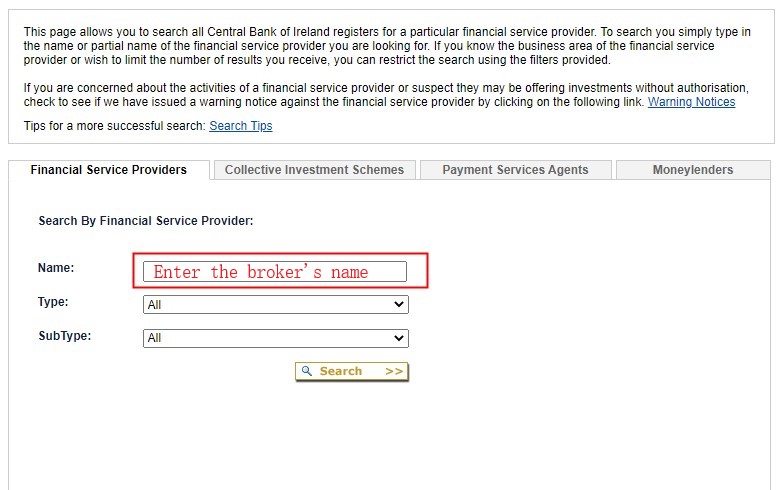

1. Find the name of the forex broker, which you can get from the broker’s website;

2. There are two ways to search for the broker on

http://registers.centralbank.ie/?utm_medium=website&utm_source=CBI-footer&utm_content=43731 ;

1) Enter the name into the search bar on http://registers.centralbank.ie/FirmSearchPage.aspx ;

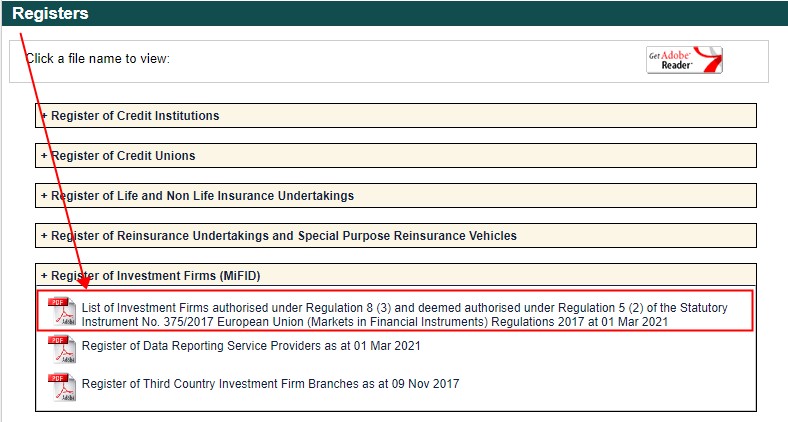

2) Search the name in the list of Investment Firms on http://registers.centralbank.ie/DownloadsPage.aspx ;

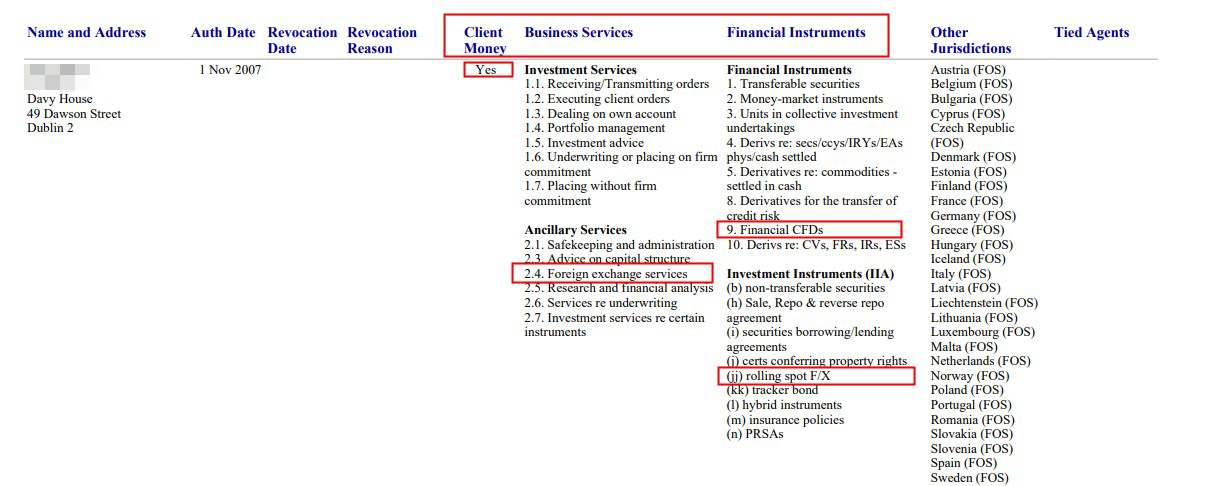

3. And you’ll get the broker’s contents on CBI website. You need to check the ‘Client Money’, ‘Business Services’ and ‘Financial Instruments’: check if the broker has the authorization to hold ‘Client Money’ and provide ‘9. Financial CFDs’ , ‘(jj) rolling spot F/X’ and ‘2.4. Foreign exchange services’;

How to solve disputes with a CBI-regulated broker?

When you have disputes with a CBI-regulated broker, you can proceed the following ways:

1st way: The recommended way is to contact the broker directly and discuss with them to find a solution.

2nd way: If you’re not satisfied with the broker’s solution, try to contact Financial Services and Pensions Ombudsman (FSPO) in Ireland, which aims at solving the disputes between the forex broker and the investor.

You can either send the complaint to the email: info@fspo.ie or make an online complaint form and submit it.

Emailed Complaint Form: https://www.fspo.ie/documents/complaint-form-english.pdf?v=7

Online Complaint Form: https://www.fspo.ie/complaint-form.aspx

3rd way: If the 2 ways above can’t solve the dispute, the last way is to issue a case to the court in Ireland.