CNMV - Comisión Nacional del Mercado de Valores

- Website: http://www.cnmv.es

- Founded: 1987

- Operated by: Government

- License Type: AA

- Country: Spanish

- Hotline: 900 535 015

- Email: international@cnmv.es

Who is the CNMV?

The National Securities Market Commission of Spain (Comisión Nacional del Mercado de Valores, abbreviated as CNMV) is an independent government body under the Spanish Ministry of Economy, responsible for overseeing the securities markets in Spain.

The CNMV supervises and regulates the capital markets within Spain’s financial services sector. Its website contains information on markets, listed companies, and investment firms, though much of the content is primarily available in Spanish with limited English translations.

As Spain is an EU member state, CNMV’s rules and operations comply with the Markets in Financial Instruments Directive (MiFID), a European Union law designed to regulate investment services across the European Economic Area (EEA).

How does the CNMV regulate a forex broker?

1. Client Fund Protection: Customer funds must be held in segregated accounts.

2. Reporting Requirements: Investment firms and credit institutions must report all transactions in financial instruments to the CNMV no later than the close of the next business day. They must also submit annual audit reports and anti-money laundering reports.

How to check a broker is CNMV-regulated or not?

In general, brokers supervised by the CNMV can be found in its online Registration Database. You should compare the information provided there with details on the broker’s own website.

The detailed steps are as follow:

1. Obtain the broker’s official name from its website.

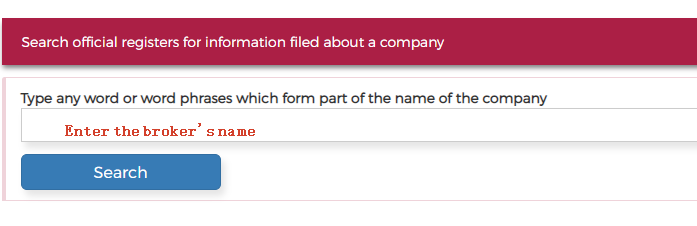

2. Enter the name in the search bar at CNMV’s entity search page.

3. A company may appear under different categories — select the correct one to view the broker’s details.

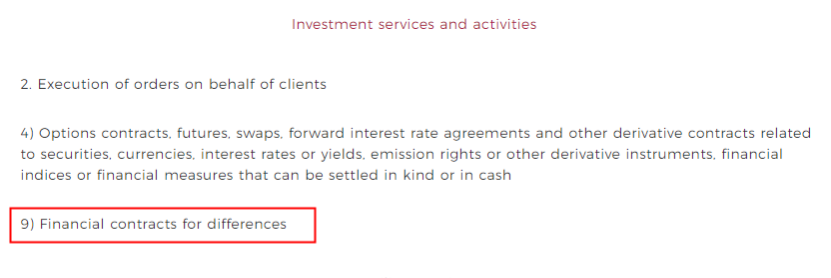

4.Click on Programa de actividades and check whether the broker is authorized to provide: Financial contracts for differences under Investment services and activities, or Foreign exchange services connected to investment services under Ancillary services and activities, with permission to serve retail clients.

If the broker is an EEA-authorized firm, you must also verify its license with its home-country regulator.

How to solve disputes with a CNMV-regulated broker?

If you encounter a dispute with a CNMV-supervised broker, you may protect your rights in the following ways:

1. Contact the broker directly to seek resolution.

2. Escalate to the CNMV if unsatisfied:

+ Submit an online complaint after registering: Complaint form.

+ Send the complaint form by post to CNMV’s Complaints Service: Edison, 4, 28006 Madrid – Passeig de Gràcia, 19, 08007 Barcelona.

+ Complaint form link: Download PDF

3. Take the case to court in Spain if the dispute remains unresolved.