DFSA - DuBai Financial Services Authority

- Website: http://www.dfsa.ae

- Founded: 2003

- Operated by: Government

- License Type: AA

- Country: Dubai

- Hotline: +971 (0)4 362 0801

Who is the DFSA?

Dubai – the capital of the Emirate of Dubai – is the leading financial hub of the Middle East. In 2004, the city established the Dubai International Financial Centre (DIFC), along with the Dubai Financial Services Authority (DFSA) to oversee financial activities within the region.

Key point to note: DFSA’s jurisdiction is limited to the DIFC, and it enforces a regulatory framework aligned with international standards.

Functions and Authority of DFSA

DFSA regulates a wide range of sectors:

+ Asset management, banking, and credit.

+ Securities, collective investment funds, custody and trust services.

+ Futures commodities trading, Islamic finance, and insurance.

+ International stock and derivatives exchanges.

Additionally, DFSA supervises and enforces Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations within the DIFC.

In the UAE, only brokers licensed by DFSA are permitted to provide services within the DIFC. However, many brokerage firms still set up offices in Dubai without DFSA oversight, which exposes investors to risks such as fraud and scams. By contrast, DFSA-licensed brokers are strictly regulated, making fraudulent activities almost impossible.

How does the DFSA regulate a forex broker?

1. Client fund protection: Firms must maintain segregated client accounts.

2. Mandatory reporting: Including trade reports, audits, client asset statements, and AML compliance.

How to check a broker is DFSA-regulated or not?

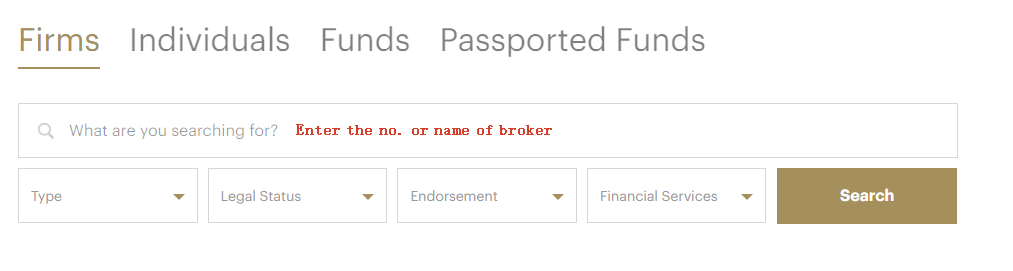

The detailed steps are as follow:

1. Obtain the broker’s official name from its website.

2. Visit DFSA’s Public Register: https://www.dfsa.ae/public-register/firms.

3. Enter the name or registration number to find the firm’s record.

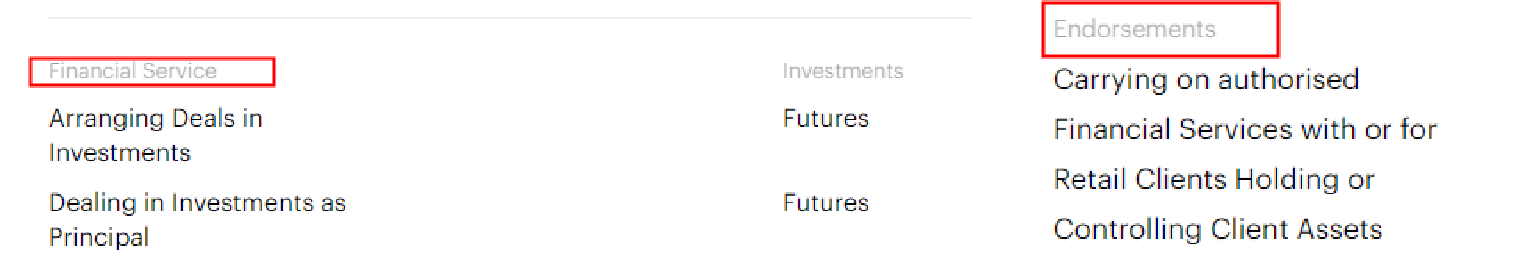

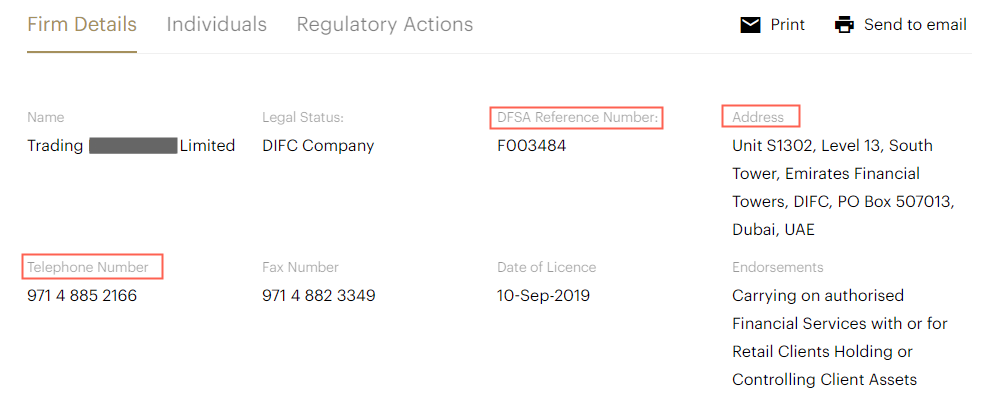

4. Verify the authorization for activities such as: Arranging Deals in Investments (Futures), Dealing in Investments as Principal, Providing Financial Services for Retail Clients.

5. Cross-check the DFSA listing (company name, website, email, etc.) with the broker you plan to trade with. If they do not match, avoid them to protect your funds.

How to solve disputes with a DFSA-regulated broker?

Option 1: Contact the broker directly to negotiate.

Option 2: If unresolved, contact DFSA:

+ Submit an online complaint: https://www.dfsa.ae/make-enquiry#complaints

+ Send by mail: DFSA, Level 13, The Gate, PO Box 75850, Dubai, UAE

+ Fax: +971 (0)4 362 0801

(Note: DFSA only accepts written complaints)

Option 3: If both options fail, the final step is to take the case to the Dubai courts.