FCA - Financial Conduct Authority

- Website: https://www.fca.org.uk/

- Founded: 2012

- Operated by: Government

- License Type: AAA

- Country: United Kingdom

- Hotline: +44 207 066 1000

- Email: firm.queries@fca.org.uk

What is FCA?

The Financial Conduct Authority (FCA) in the United Kingdom is a key financial regulator overseeing forex brokers and other financial institutions.

Many traders prefer FCA-licensed brokers due to the regulator’s strict rules, customer fund protection, and compensation mechanisms in the event of insolvency.

Following Brexit, FCA licenses apply only to UK-based clients and no longer cover the European Union market. Brokers seeking access to EU clients must hold appropriate EU authorization.

How does the FCA regulate forex brokers?

1.Safety of client funds:

FCA requires investment firms (including forex brokers) to open segregated accounts for client funds; from this point, client funds are protected.

FCA Handbook details are as follows:

When receiving client money, a firm must promptly deposit it into one or more accounts opened at any of the following:

(1) a central bank;

(2) a CRD credit institution;

(3) an authorized bank in a third country;

(4) a qualifying money market fund.

2. Reporting requirements of Forex brokers:

Annual accounts and reports; Annual control reports; Client asset reports; Client money and asset reports; Market data reports; Product sales data reports; Remuneration data reports; Complaint reports; Transaction reports.

How to check whether a broker is licensed by the FCA?

In general, broker records regulated by the FCA can be found on the Financial Services Register on the FCA website. Try to search and check if it matches the information from the broker’s website.

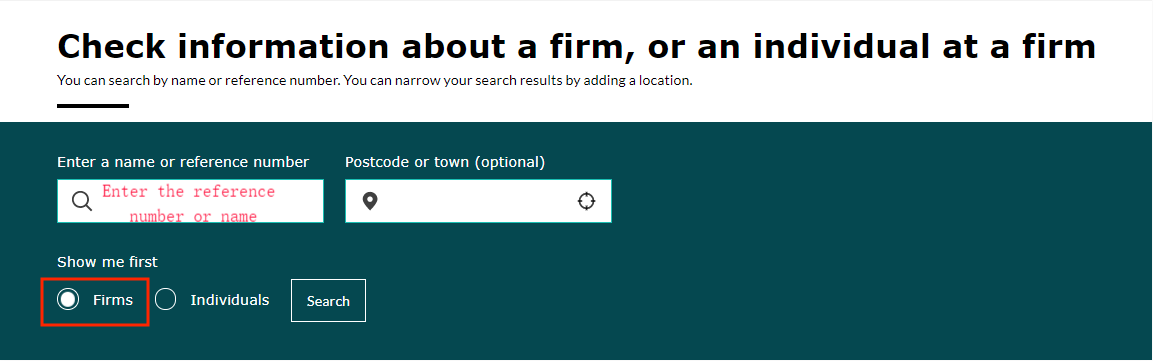

Detailed steps are as follows:

-

Find the license/reference number (preferred) or the name of the forex broker; you can obtain this information from the broker’s website;

-

Enter the reference number or name into the search bar on https://register.fca.org.uk/s/;

Note:

If you cannot find the broker’s record on the FCA website, it may be an unauthorized broker. Please stay away.

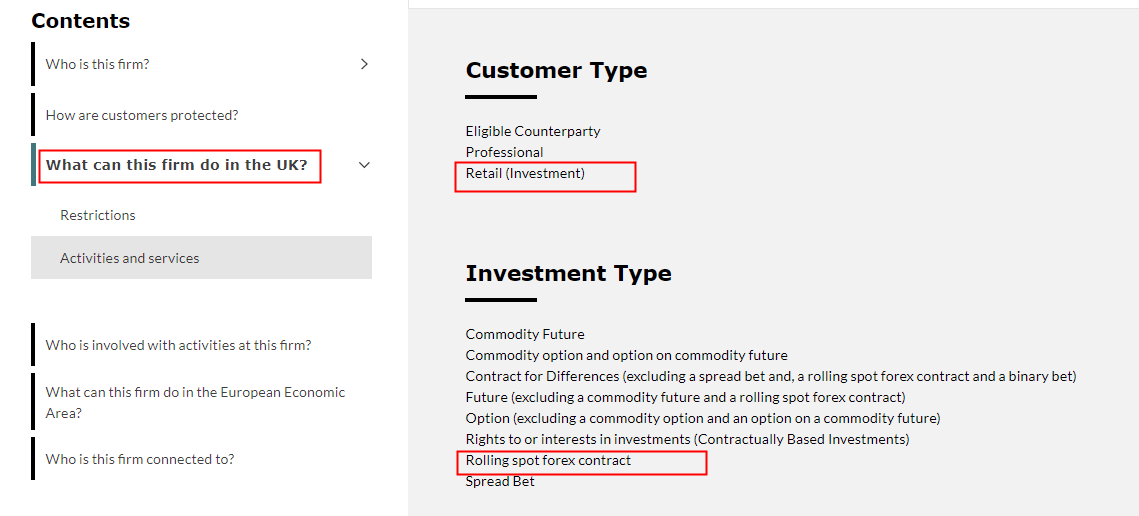

3. And you will get the broker’s details on the FCA website. At this time, click on “What can this firm do in the UK?” and check whether the broker is authorized to provide “Spot FX Contracts” to “Retail” clients;

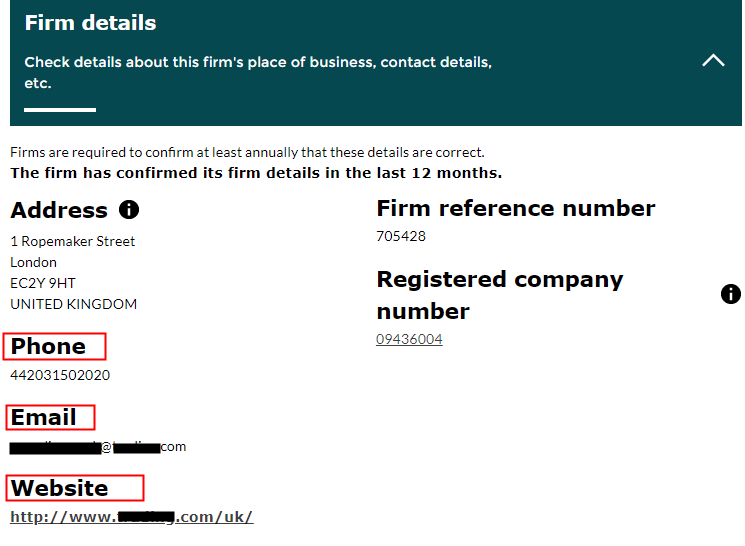

4. If you have done all the above steps, don’t forget to check the most important information: verify whether the company information published on the FCA website matches the one you are dealing with, especially the website, email, etc.

If not, please stay away from that broker because it may be an unlicensed company and your money will be at risk.

How can I resolve a dispute with a broker regulated by the FCA?

When you have a dispute with a broker regulated by the FCA, you can proceed in the following ways:

Method 1:

The recommended way is to contact the broker directly and discuss with them to find a solution.

Method 2:

If you are not satisfied with the broker’s solution, try contacting the Financial Ombudsman Service (FOS) in the United Kingdom, which is intended to resolve disputes between forex brokers and investors.

You can file a complaint via email at: complaint.info@financial-ombudsman.org.uk

or fill out and submit the online complaint form.

-

Complaint form via email: https://www.financial-ombudsman.org.uk/contact-us/forms

-

Online complaint form: https://help.financial-ombudsman.org.uk/help

Method 3:

If the two methods above do not resolve the dispute, the final option is to bring the case to court in the UK.