FINMA - Swiss Financial Market Supervisory Authority

- Website: https://www.finma.ch/en

- Founded: 2008

- Operated by: Government

- License Type: AAA

- Country: Switzerland

- Hotline: +41 31 327 91 00

- Email: info@finma.ch

What is FINMA?

The Swiss Financial Market Supervisory Authority (FINMA) is recognized as one of the most reputable regulatory bodies in Europe, earning strong confidence from global investors and forex traders.

Authorized by the Swiss government, FINMA acts as the sole supervisory authority for a wide range of financial institutions, including stock exchanges, securities and forex brokers, banks, insurance companies, securities dealers, fund management firms, and other entities operating in the financial market. Its regulatory framework is designed so that only well-established and reputable forex brokers can obtain a FINMA license.

Under Swiss law, forex brokers regulated by FINMA must be registered as banks, which requires maintaining higher capital reserves and adhering to stricter operational standards. These brokers are also expected to follow best practices in brokerage services, ensuring fairness and transparency while avoiding any form of fraud or market manipulation.

How does FINMA regulate forex brokers?

1. Safety of Client Funds:

FINMA requires that clients’ margin assets, including forex deposits, must be completely segregated. Client funds held by FINMA-regulated brokers are fully protected.

2. Initial Capital Requirement for Forex Brokers:

All forex applicants under FINMA must meet the capital requirement: a minimum fully paid-up capital of CHF 10 million.

3. Reporting Requirement for Forex Brokers:

Forex brokers supervised by FINMA are required to provide audit reports and anti-money laundering reports to FINMA.

How to check if a broker is licensed by FINMA?

Generally, the broker’s records under FINMA can be found in the FINMA Authorised Institutions and Individuals page. Check whether the broker’s information published on FINMA matches the details from the broker’s official website.

Detailed steps:

1. Find the name of the forex broker, which you can obtain from the broker’s website.

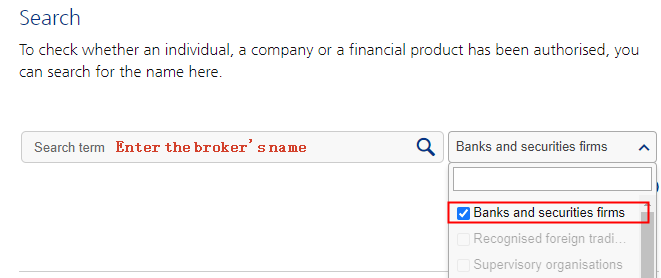

2. Enter the name into the search bar and select “Category” as “Banks and securities firms” at:

https://www.finma.ch/en/finma-public/authorised-institutions-individuals-and-products/

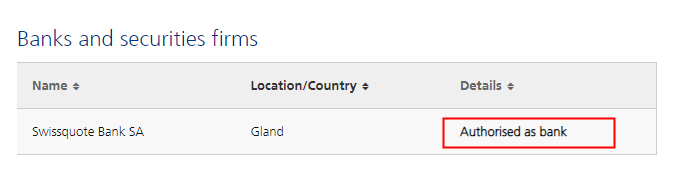

3. You will then receive the broker’s information on FINMA’s website. At this stage, check whether the broker is authorized as a bank. If not, please avoid that broker as they are not permitted to offer forex trading services.

How to resolve disputes with a FINMA-regulated broker?

When you have a dispute with a broker (bank) regulated by FINMA, you can proceed as follows:

• First option: The recommended way is to contact the broker (bank) directly and discuss with them to find a solution.

• Second option: If the response is unsatisfactory, you have the following choices:

● Contact the Swiss Banking Ombudsman.

You can file a complaint by post:

Schweizerischer Bankenombudsman, Bahnhofplatz 9, P.O. Box, 8021 Zurich, Switzerland

Or submit an online complaint form:

• Complaint by post: https://bankingombudsman.ch/en/written-enquiries/

• Online complaint form: https://bankingombudsman.ch/en/written-enquiries/

• Power of attorney form: https://bankingombudsman.ch/wp-content/uploads/2021/02/Eingabeformular2021_EN.pdf

● You can also contact FINMA. Clearly state the issue and what has happened so far. If the broker has given a response, please attach their reply along with your complaint to FINMA.

• Email: info@finma.ch

• Online complaint form: https://www.finma.ch/en/finma-public/reporting-information/

• Third option: If the above two options do not resolve the dispute, the last option is to bring the case to court in Switzerland.