Estonia FSA - Financial Supervision Authority, Estonia

- Website: http://www.fi.ee/

- Founded: 2001

- Operated by: Government

- License Type: AA

- Country: Estonia

- Hotline: +372 668 0500

- Email: info@fi.ee

Who is the FSA Estonia?

In Estonia, the official financial regulatory authority is Finantsinspektsioon, also known as the Estonian Financial Supervision Authority (EFSA).

Founded in 2001, EFSA is responsible for supervising and regulating financial markets in Estonia. It oversees the banking, insurance, and securities sectors with the aim of creating a stable financial environment and protecting consumers, clients, and investors.

EFSA is funded through supervision and procedural fees paid by supervised financial institutions. Since 2014, EFSA has also been part of the European Single Supervisory Mechanism.

How does EFSA regulate forex brokers?

1. Safety of Client Funds:

Investment firms must keep clients’ assets separate from the firm’s own assets and those of other clients, unless both parties have a written agreement. To hold a client’s securities in a nominee account, written consent from the client is also required.

2. Reporting Requirements for Forex Brokers:

- Transaction Reports

- Audit Reports

- Annual Financial Reports

- Anti-Money Laundering Reports

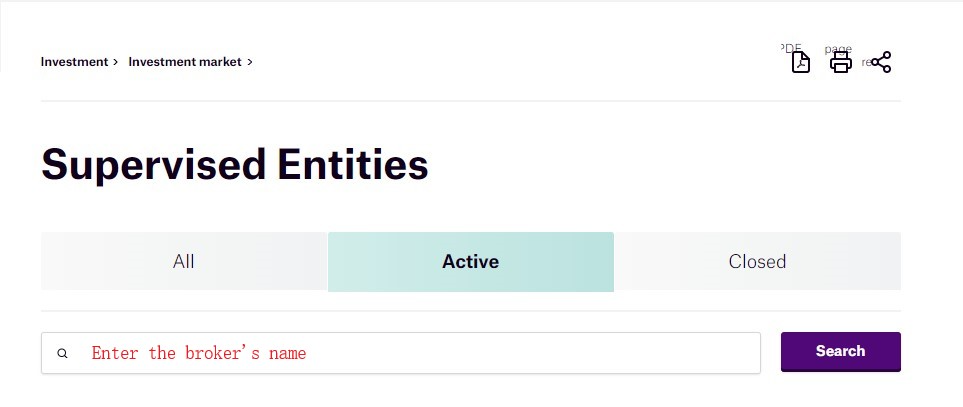

How to check if a broker is regulated by EFSA?

Information on EFSA-licensed investment firms can be found on the Investment Market page of EFSA’s website. Steps to verify include:

1. Find the broker’s official name from its website.

2. Enter the name in the search bar at:

https://www.fi.ee/en/investment-market/investment-firms-0/investment-market/investment-firms

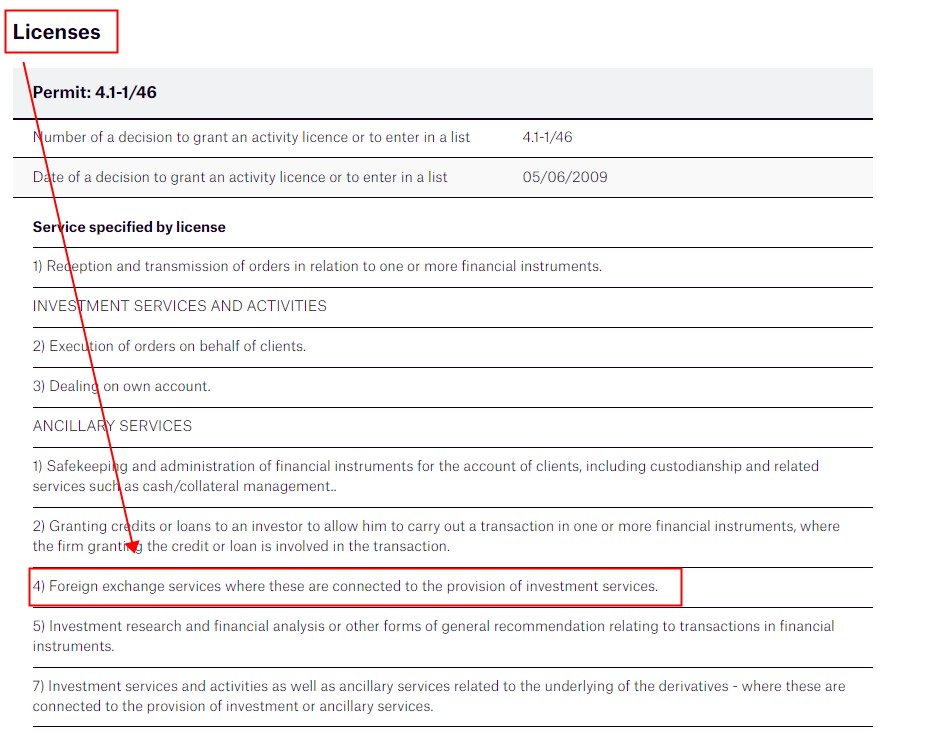

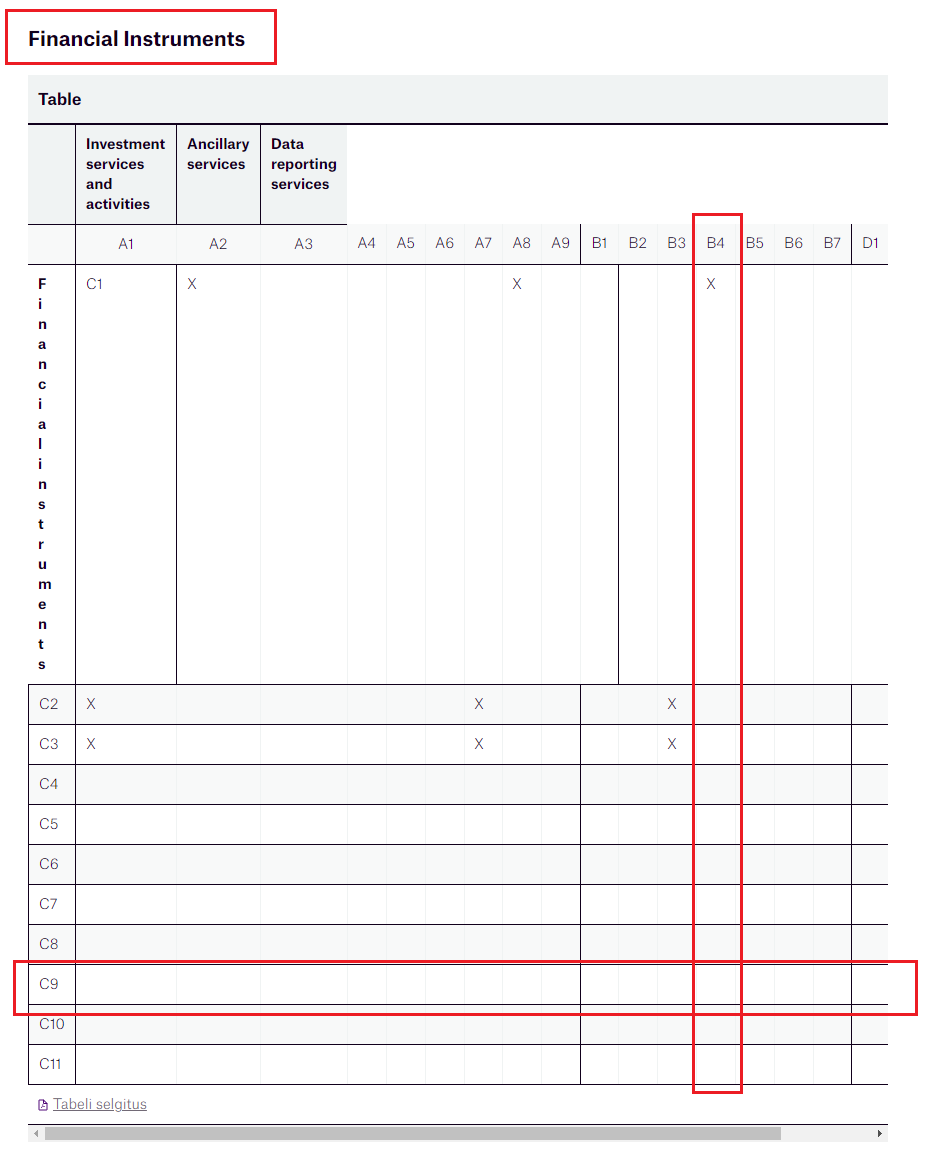

3. Review the results: check Licenses or Financial Instruments to confirm if the broker is authorized to provide: C9: Contracts for Difference (CFDs), or B4: Foreign exchange services related to investment services.

If the broker is an EEA-authorized firm, verify additional details with its home state regulator.

4. Compare the EFSA-listed information with the broker’s own website (especially domain, email, and contact details). If they don’t match, the broker is likely unauthorized and your funds may be at risk.

How to resolve disputes with an EFSA-regulated forex broker?

Contact the broker directly to discuss and find a solution.

1. Contact EFSA if the broker’s response is unsatisfactory.

2. EFSA can help mediate disputes. You can submit an online complaint form here:

https://www.fi.ee/en/consumer/when-should-i-contact-finantsinspektsioon/making-complaint

2. File a lawsuit in Estonia if the first two steps fail.