JFSA - Financial Services Agency

- Website: https://www.fsa.go.jp/en/index.html

- Founded: 1997

- Operated by: Chính phủ

- License Type: AA

- Country: Japan

- Hotline: +81-(0)3-3506-6000

- Email: equestion@fsa.go.jp

Who is Japan FSA?

The Financial Services Agency (FSA) of Japan, established in 2000, is a government authority responsible for comprehensive financial oversight. It supervises banking, securities, exchanges, and insurance activities to ensure the stability and integrity of the country’s financial system. The agency is headed by a Commissioner and reports directly to the Minister for Financial Services. In addition, the FSA oversees the Securities and Exchange Surveillance Commission and the Certified Public Accountants and Auditing Oversight Board.

The official FSA website provides information on laws, regulations, supervisory measures, and a list of regulated institutions. It also publishes annual reports, notices, and a Frequently Asked Questions (FAQ) section to support stakeholders in the financial industry.

How does Japan FSA regulate forex brokers?

1. Ensuring the safety of client funds:

Segregating client assets from the assets of a company.

2. Reporting requirements for forex brokers:

• An annual business report for each fiscal year;

• Anti-money laundering report;

• Net asset value report.

How to check whether a broker is licensed by Japan FSA?

In general, broker records regulated by the Japan FSA can be found at:

https://www.fsa.go.jp/en/regulated/licensed/index.html#03.

You should check if the information on this website matches the information from the broker’s own website.

Detailed steps:

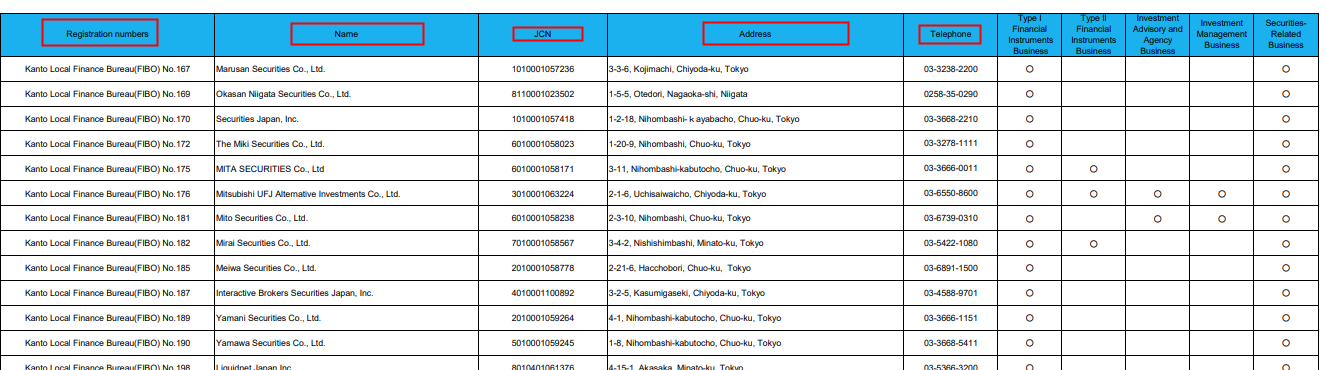

1. Find the license registration number (recommended) or the broker’s name, which you can obtain from the broker’s website;

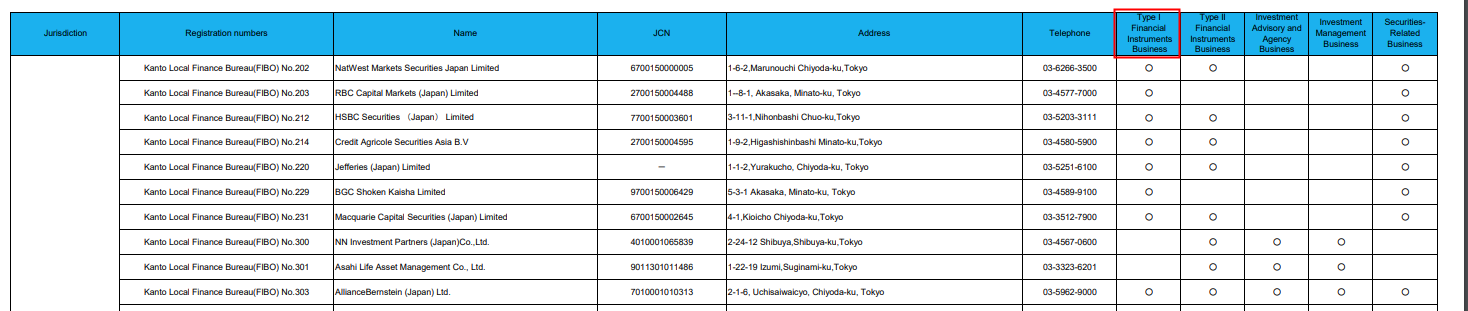

2. Download the Financial Instruments Business Operators list and search for the broker’s name inside it; https://www.fsa.go.jp/en/regulated/licensed/index.html#03;

3. If the broker’s name cannot be found, this indicates the broker may be unlicensed, so proceed with caution;

If found, check whether the broker is authorized to provide financial services under the category “Type I Financial Instruments Business.”

4. Finally, confirm that the company details published on the Japan FSA website match the broker’s own details, especially website address and email. If not, avoid the broker since it may be unauthorized, and your funds may be at risk.

How to resolve disputes with a broker regulated by Japan FSA?

When disputes arise with brokers regulated by Japan FSA, you can protect your rights and interests through the following steps:

Method 1: The best first step is to contact the broker directly and discuss with them to find a mutually beneficial solution.

Method 2: If you are not satisfied with the broker’s response, you can contact FINMAC in Japan, which helps resolve disputes between forex brokers and investors.

You can submit an online complaint/consultation form to FINMAC:

https://www.finmac.or.jp/contact/soudan/

Method 3: If neither of the above resolves the dispute, the final option is to bring the case to a court in Japan.