LBE - The Bank of Lithuania

- Website: https://www.lb.lt/

- Founded: 1922

- Operated by: Government

- License Type: B

- Country: Lithuania

- Hotline: +370 5 251 2763

- Email: frpt@lb.lt

Who is the LBE?

The Bank of Lithuania (LBE) is the central bank of the Republic of Lithuania, established in 1922.

Currently, LBE supervises more than 650 financial institutions, including banks, credit companies, insurance firms, payment institutions, fund management companies, consumer credit providers, and issuers.

As Lithuania is an EU member state, all financial regulations and supervisory activities of LBE comply with the EU MiFID framework.

How does the LBE regulate a forex broker?

Brokerage firms regulated by the LBE are required to protect clients’ funds by keeping them in segregated accounts. At the same time, they must ensure transparency by regularly submitting reports as required, including capital adequacy reports, interim financial statements, annual reports, and other documents specified by the LBE.

How to check a broker is LBE-regulated or not?

Generally speaking, LBE-regulated broker profile will be found at the Financial market participants page on LBE website. Try to find it and check if it will match the info from the broker website.

The detailed steps are as below:

1. Find the name of the forex broker, which you can get from the broker’s website;

2. Enter the name into the search bar on https://www.lb.lt/en/sfi-financial-market-participants ;

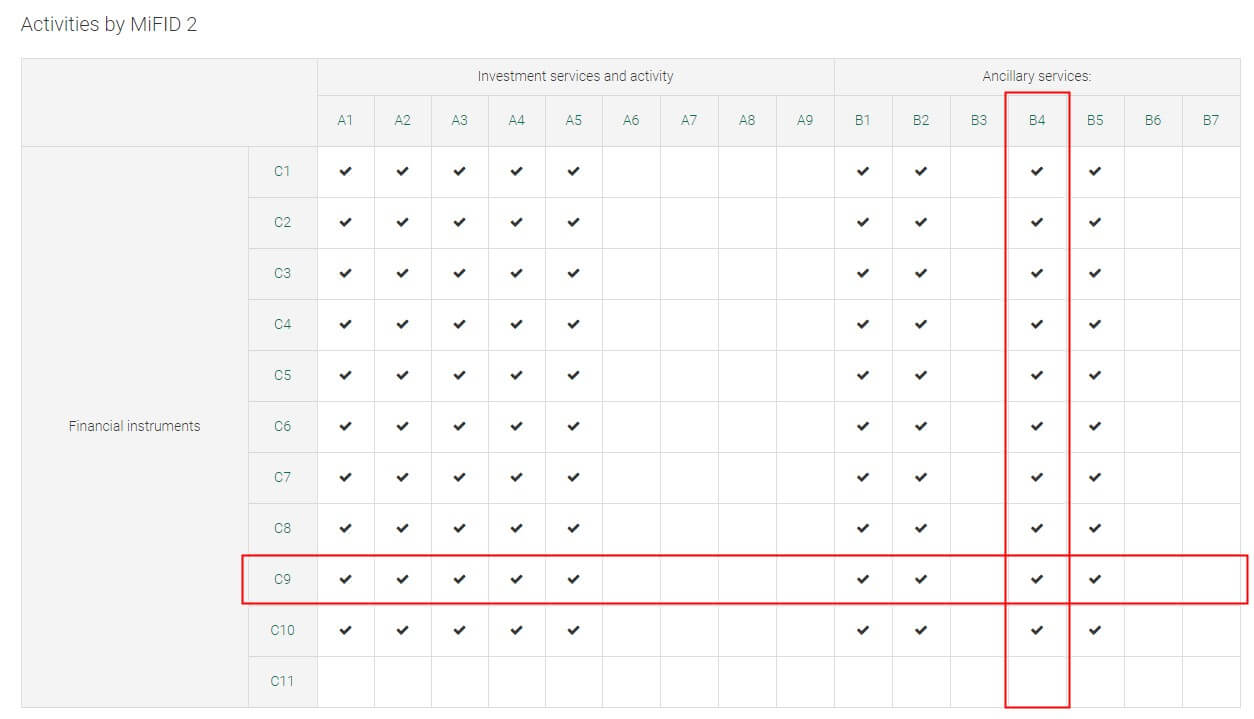

3. And you’ll get the broker’s contents on LBE website. At this time you need to check if the broker has the authorization to provide ‘C9 – Financial contracts for differences‘ or ‘B4 – Foreign exchange services where these are connected to the provision of investment services‘;

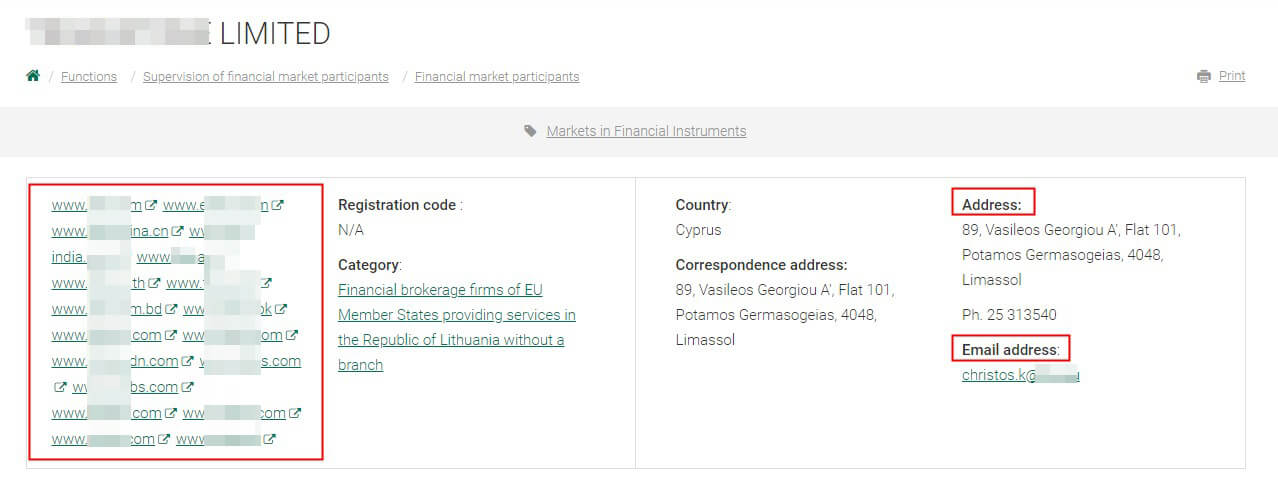

4. If all the steps above have been done, don’t forget to check the most important information: check if the firm details published on LBE website matches the ones you’ll go to trade with, especially the website and email etc.

If no, please keep away the broker because it’s probably an unauthorized firm and your money will fall in danger.

If the broker is an EEA authorised firm, you need to check further information in its home state regulator.

How to solve disputes with a LBE-regulated broker?

How to solve disputes with a LBE-regulated broker?

When you have disputes with a LBE-regulated broker, you can proceed the following ways:

1st way: The recommended way is to contact the broker directly and discuss with them to find a solution.

2nd way: If you’re not satisfied with the broker’s solution, try to contact LBE in Lithuania, which helps to solve the disputes between the forex broker and the investor.

Complaints can be submitted in three ways:

● Via the electronic dispute settlement facility E-Government Gateway.

● By completing a Consumer Application Form and sending it to the Financial Market Supervision Service of the Bank of Lithuania, Žalgirio g. 90, LT-09303, Vilnius, email: frpt@lb.lt.

Consumer Application Form: https://www.lb.lt/en/dbc-settle-a-dispute-with-a-financial-service-provider

● By filing out a free-form application and sending it to the Financial Market Supervision Service, Žalgirio g. 90, LT-09303, Vilnius, email: frpt@lb.lt.

3rd way: If the first 2 ways above can’t solve the dispute, the last way is to issue a case to the court in Lithuania.