Mauritius FSC - Mauritius Financial Services Commission

- Website: https://www.fscmauritius.org/en

- Founded: 2000

- Operated by: Government

- License Type: B

- Country: Mauritius

- Hotline: 468-6473

- Email: ombudspersonfs@myt.mu

What is Mauritius FSC?

Established in 2001, the Financial Services Commission (FSC) of Mauritius is the integrated regulator for the non-bank financial services sector in Mauritius.

FSC is often chosen by many forex brokers because:

- The license is more competitive compared to European licenses.

- It allows higher leverage, which benefits clients with smaller capital.

However, it should be noted that FSC does not guarantee segregated accounts, meaning the level of client fund protection is not high. Therefore, investors should carefully assess before trading with brokers regulated by FSC.

How does FSC regulate forex brokers?

Capital safety: FSC does not mandate segregated accounts, so clients face certain risks.

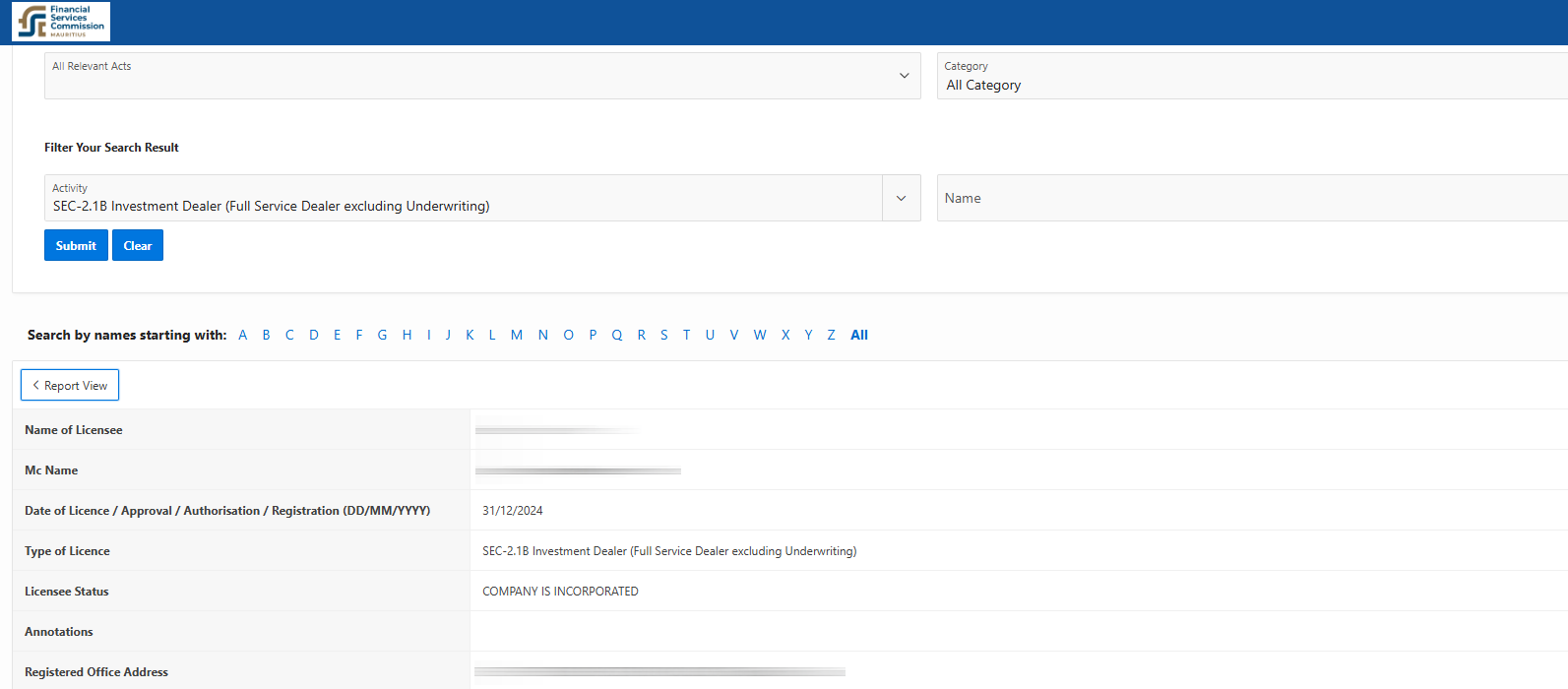

Licenses: Investors should verify whether a broker holds one of the following official licenses:

- Investment Dealer (Full Service Including Underwriting).

- Investment Dealer (Broker).

- Investment Dealer (Full Service Excluding Underwriting).

Otherwise, the broker’s operations may be questionable.

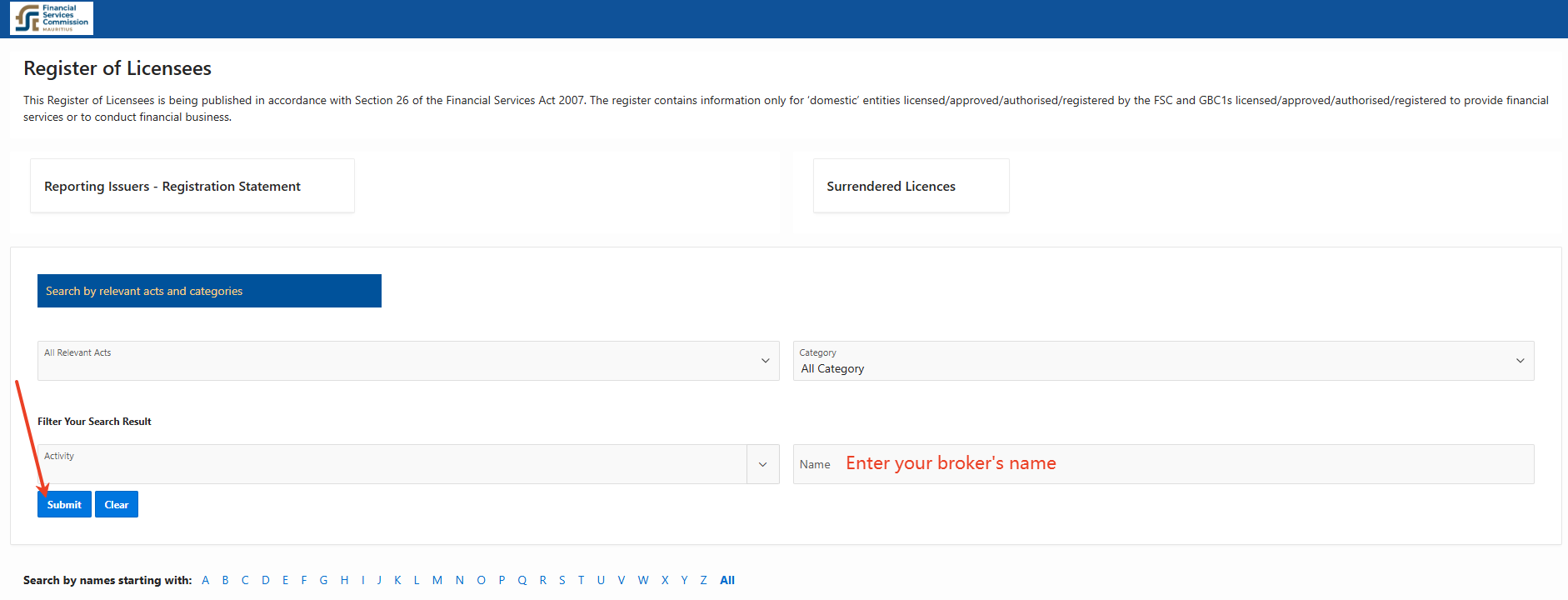

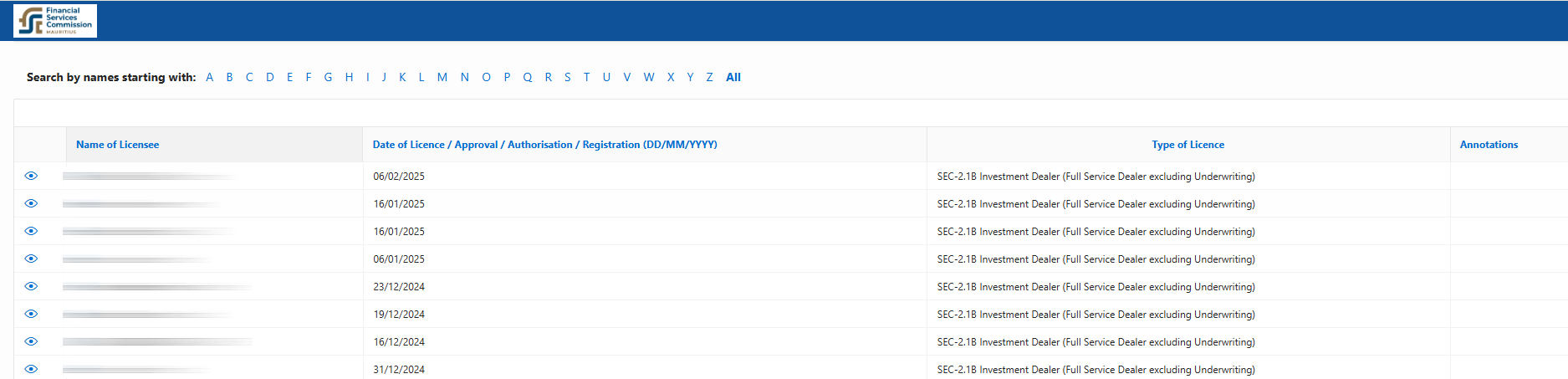

How to check if a broker is licensed by FSC

1. Take the broker’s name from its official website.

2. Visit the FSC Online Public Register.

3. Enter the broker’s name in the search bar.

4. Verify whether the displayed information matches the broker’s official website. If the details do not match, the broker is likely unauthorized, and your funds may be at risk.

Handling disputes with FSC-regulated brokers

If a dispute arises, investors can:

1. Contact the broker directly to negotiate a solution.

2. File a complaint with the Ombudsperson for Financial Services:

- Email: ombudspersonfs@myt.mu

- Post: Office of Ombudsperson for Financial Services, 8th Floor, SICOM Tower, Wall Street, Ebene

- Fax: 468-6473

3. Submit an online complaint to FSC if the broker is outside the Ombudsperson’s jurisdiction: FSC Complaint Form.

4. Take legal action in Mauritius courts if the above methods fail.

Thành viên tổ chức

PrimeXBT

Regulatory Body: Mauritius FSC Seychelles FSA FSCA

PU Prime

Regulatory Body: Mauritius FSC FSCA Seychelles FSA ASIC