MFSA - Malta Financial Services Authority

- Website: http://www.mfsa.com.mt/

- Founded: 2001

- Operated by: Government

- License Type: AA

- Country: Malta

- Hotline: +356 79219961

Who is the MFSA?

Malta has long been considered an attractive destination for financial businesses seeking to expand in Europe. The Malta Financial Services Authority (MFSA) – operating independently since 2002 – is the regulator overseeing all financial activities in Malta, including banking, insurance, pension funds, securities, and financial advisory services.

MFSA is well-regarded for its strong legal framework and professional financial market. Its main priority is investor protection, while also helping consumers detect and report violations or fraudulent brokers.

How does the MFSA regulate a forex broker?

Key reporting requirements:

- Transaction reports

- Audit reports

- Client asset reports

Anti-money laundering (AML) reports

How to check a broker is MFSA-regulated or not?

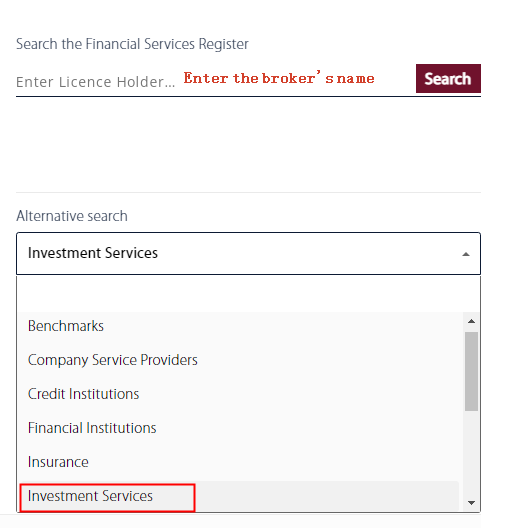

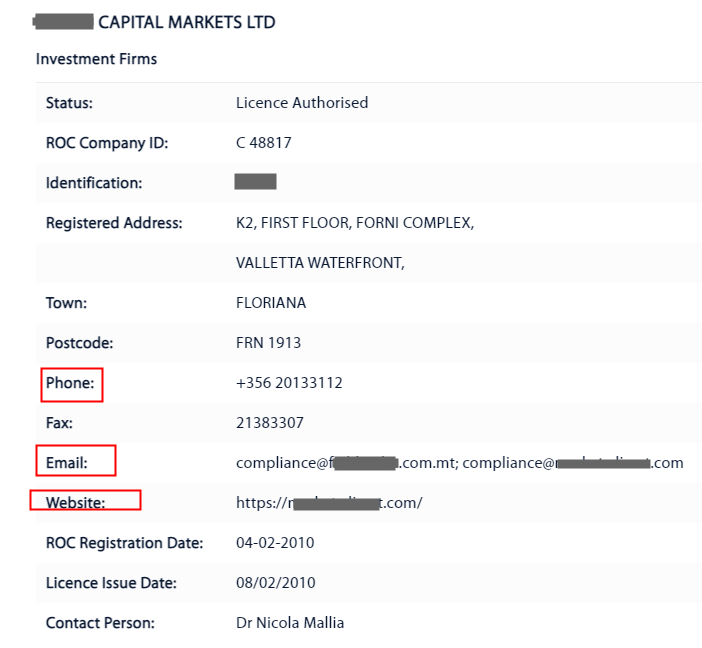

Generally speaking, MFSA-regulated broker profile will be found at the Financial Services Register page on MFSA website. Try to find it and check if it will match the info from the broker website.

The detailed steps are as follow:

1. Find the name of the forex broker, which you can get from the broker’s website;

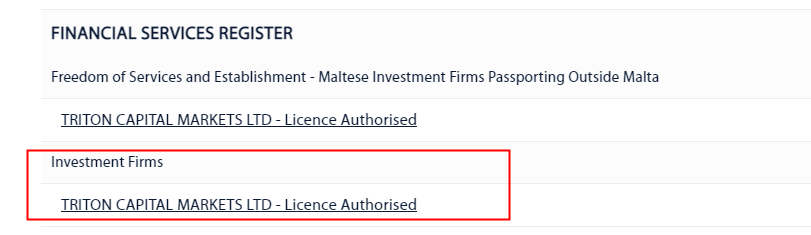

2. Enter the name into the search bar on https://www.mfsa.mt/financial-services-register/, and choose the firm under “Investment Services”;

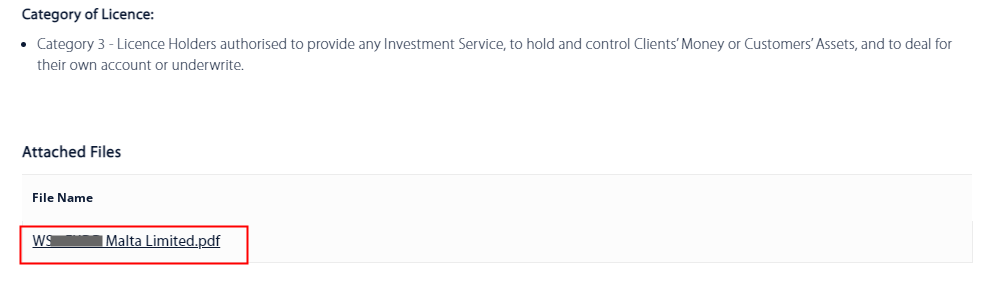

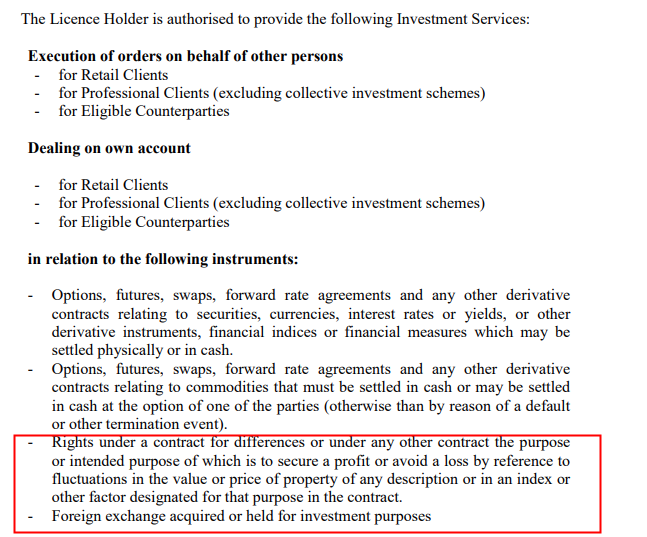

3. And you’ll get the broker’s contents on MFSA website. At this time you will check the ‘Category of Licence’ and download attached file for check if the broker has the authorization to provide ‘Rights under a contract for differences or purpose or intended purpose of which is to by reference to fluctuations in the value under any other contract the secure a profit or avoid a loss or price for property of any description or in an index or other factor designated for that purpose in the contract‘ or ‘Foreign exchange acquired or held for investment purposes‘.

4. If all the above steps have been done, don’t forget to check the most important information: check if the firm details published on MFSA website matches the ones you’ll go to trade with, especially the website and email etc.

If no, please keep away the broker because it’s probably an unauthorized firm and your money will fall in danger.

How to solve disputes with a MFSA-regulated broker?

When you have disputes with a MFSA-regulated broker, you can proceed the following ways:

1st way: The recommended way is to contact the broker directly and discuss with them to find a solution.

2nd way: If you are dissatisfied with the broker’s reply or if it doesn`t reply at all, you can refer the complaint to the Office of the Arbiter for Financial Services (OAFS) in Malta. It has the power to mediate, investigate and adjudicate complaints filed by customers against financial services providers. When your complaint is accepted, a complaint fee of €25 is payable to the OAFS.

You can either submit an online complaint form after completing your registration or send the complaint by post: Office of the Arbiter for Financial Services, First Floor, St Calcedonius Square, Floriana FRN1530, Malta.

Online Complaint Form: https://financialarbiter.org.mt/content/step-3-complain-us

Mailed Complaint Form: https://financialarbiter.org.mt/sites/default/files/OAFS-EN_Complaint_Form_2019-fillable_sp%20%282%29.pdf

3rd way: If the 2 ways above can’t solve the dispute, the last way is to issue a case to the court in Malta.