NFA - National Futures Association

- Website: https://www.nfa.futures.org/

- Founded: 1980

- Operated by: Self-Regulatory Organization – SRO

- License Type: AAA

- Country: United States of America (USA)

- Hotline: 312-781-1410

- Email: information@nfa.futures.org

What is NFA?

The legal framework in the United States is considered one of the most stringent in the world. Under U.S. regulations, citizens and residents are only permitted to trade through forex brokers that are supervised by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). Entities or individuals lacking authorization from these regulators are prohibited from offering services or soliciting U.S. clients. For this reason, many financial websites (including this one) display disclaimers informing U.S. visitors that their content is not intended for them.

The NFA serves as the self-regulatory organization for the U.S. derivatives industry, establishing and enforcing effective compliance standards. It also works in coordination with the CFTC to uphold the integrity of the derivatives market, safeguard investors, and ensure that its members meet their regulatory obligations.

How does NFA regulate forex brokers?

1. Customer Fund Safety: Segregation of Customer Funds

(1) All customer funds used to trade on designated contract markets (exchanges) must be segregated from the proprietary funds of the Futures Commission Merchant (FCM)—including cash deposits and any securities or other assets deposited or pledged by that customer to margin or guarantee futures trading.

(2) Segregated accounts must be titled for the benefit of the FCM’s customers.

(3) Confirmations must be provided to prevent banks or clearinghouses from recognizing any right of setoff against the account for FCM’s debts.

(4) Customer funds held in segregation have bankruptcy priority in case the FCM becomes insolvent.

2. Reporting Requirements for Forex Brokers:

Daily Forex Reports; Monthly Forex Reports; Quarterly Forex Reports; Daily Trade Data Reports; Financial Reports (unaudited); Certified Financial Reports (audited); Anti-Money Laundering Reports; Net Capital Reports; Chief Compliance Officer Reports.

How to verify whether a broker is licensed by NFA?

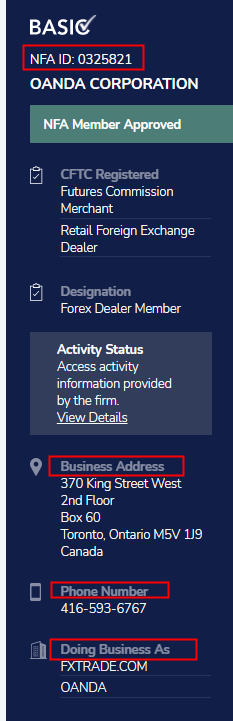

In general, broker records regulated by NFA can be found on the NFA’s BASIC website. You should try to locate the record and verify whether the broker information published on the NFA website matches the information from the broker’s own website.

Detailed steps are as follows:

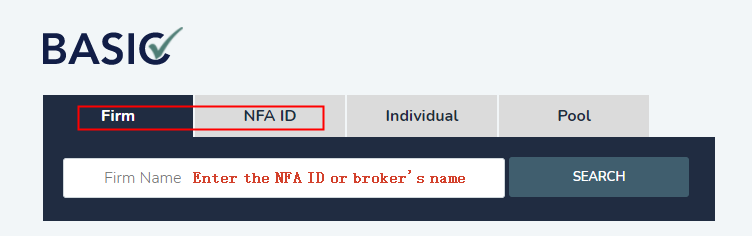

1. Find the NFA ID (preferred) or the name of the forex broker, which you can obtain from the broker’s website.

2. Enter the NFA ID or the broker’s name into the search bar on https://www.nfa.futures.org/basicnet/.

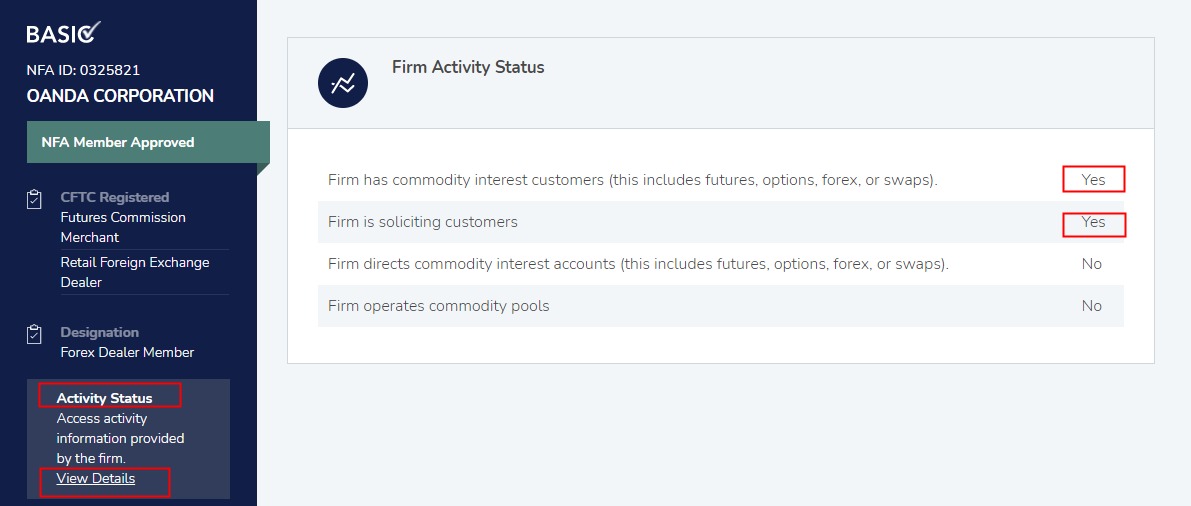

3. You will then obtain the broker’s record on the NFA website. At this point, click on “Status” and check whether the broker is marked “Yes” for “Firm with customer interest in commodities (including futures, options, forex, or swaps)” and “Yes” for “Firm soliciting customers.”

4. After completing all the above steps, do not forget to check the most important detail: whether the company details published on the NFA website match the information of the broker you intend to trade with, especially the website and email.

If not, please stay away from the broker, as it may be an unauthorized company and your funds could be at risk.

How to resolve disputes with an NFA-regulated broker?

When you have a dispute with a broker regulated by the NFA, you can proceed in the following ways:

First method: The recommended way is to contact the broker directly and discuss with them to find a solution.

Second method: If you are not satisfied with the broker’s solution, you can file an online complaint with the NFA: https://www.nfa.futures.org/complaintnet/complaint.aspx.

Third method: If the above two methods do not resolve the dispute, the final option is to request arbitration services: https://www.nfa.futures.org/arbitration/index.html.