Seychelles FSA - Seychelles Financial Services Authority

- Website: http://www.fsaseychelles.sc/

- Founded: 2012

- Operated by: Government

- License Type: B

- Country: Seychelles

- Hotline: +(248) 438 0800

- Email: enquiries@fsaseychelles.sc

What is Seychelles FSA?

As Seychelles becomes an increasingly popular destination for financial companies and foreign capital, the Financial Services Authority of Seychelles (Seychelles FSA) has taken on a more prominent role in the non-bank financial services sector.

The Seychelles FSA was established under the Financial Services Authority Act of 2013. It is responsible for licensing, implementing regulations, and supervising business activities in the non-bank financial services sector in Seychelles. Activities regulated by the Seychelles FSA include trust services, capital markets and collective investment schemes, insurance, and gambling. In addition, the Seychelles FSA also licenses and registers international business companies, funds, limited partnerships, and international trust companies in Seychelles.

How does Seychelles FSA regulate forex brokers?

1. Ensuring client fund safety:

According to the Authority’s guidelines, Seychelles FSA enforces regulations on the segregation and safekeeping of clients’ money or securities held by licensees on behalf of their clients.

2. Reporting requirements for forex brokers:

- Transaction Reports.

- Audit Reports.

- Client Fund Reports.

- Anti-Money Laundering (AML) Reports.

How to verify if a broker is licensed by Seychelles FSA

Generally, broker records regulated by Seychelles FSA can be found at:

https://fsaseychelles.sc/regulated-entities/capital-markets

Steps:

1. Find the official legal name of the broker from its website.

2. Select “Securities Dealer” and search for the broker’s name in the list.

3. If the broker’s name does not appear in the list, it may be a fraudulent broker — exercise caution. If it appears, click the name to view more information. Securities Dealers are authorized to provide forex trading services. Always cross-check that the details registered with Seychelles FSA (website, email address, etc.) match the information published on the broker’s website. If not, avoid the broker as it may be a scam, putting your funds at serious risk.

How to resolve disputes with an FSA-regulated broker

If you encounter a dispute with a Seychelles FSA-regulated broker, you can protect your rights through the following ways:

1. Contact the broker directly to seek a resolution.

2. File a complaint with Seychelles FSA if the broker’s solution is unsatisfactory. Complaints can be submitted in two ways:

- By email: complaints@fsaseychelles.sc

- By post: The Chief Executive Officer, Policy (Information & Communication Unit), Financial Services Authority, Bois De Rose Avenue, P.O Box 991, Victoria, Mahé, Seychelles

- Download the Complaint Form here: https://fsaseychelles.sc/complaint-handling

3. Take the case to court in Seychelles if the above two methods do not resolve the dispute.

Thành viên tổ chức

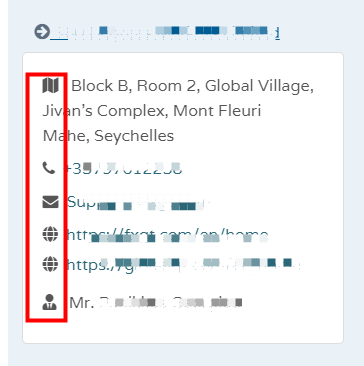

ThinkMarkets

Regulatory Body: CySEC FCA ASIC Seychelles FSA FSCA

easyMarkets

Regulatory Body: ASIC CySEC FSCA BVI FSC Seychelles FSA