VFSC - Vanuatu Financial Services Commission

- Website: https://www.vfsc.vu/

- Founded: 1992

- Operated by: Government

- License Type: B

- Country: Republic of Vanuatu

- Hotline: +678 22247

Who is VFSC?

The Vanuatu Financial Services Commission (VFSC), officially established in 1993, is the primary financial regulatory authority of Vanuatu. Prior to that, it operated as the Financial and Economic Management Authority under British administration from 1971 until the country gained independence in 1980.

The VFSC is structured into four main divisions: Corporate Services, Enforcement & Insolvency, Supervision & Regulation, and Registry. Its responsibilities include licensing securities brokers, enforcing anti-money laundering and counter-terrorism regulations, overseeing company registration, regulating electronic transactions, managing cross-border partnerships, and supervising personal property securities. In addition, the VFSC monitors the non-deposit-taking financial sector in Vanuatu.

Due to its relatively low capital requirements and fast licensing process (usually within 2–3 months), VFSC has become a popular offshore regulator among forex brokers. A VFSC license also enables online operations. Furthermore, Vanuatu offers a favorable tax environment, as it imposes no personal income tax, no capital gains tax, and no inheritance tax.

How does VFSC regulate forex brokers?

1. Ensuring client fund safety:

Under Vanuatu’s Financial Act and Regulations, when a broker controls or manages client funds, these must be properly safeguarded through segregation and identification.

2. Initial capital requirements for forex brokers:

All Financial Dealers are required to maintain a deposit of 5 million Vanuatu Vatu (VT) with VFSC. This deposit can be counted as part of their capital.

3. Reporting requirements for forex brokers:

VFSC-regulated forex brokers must submit client fund reports, complaint reports, and anti-money laundering reports to VFSC.

How to check if a broker is licensed by VFSC?

Generally, the records of VFSC-regulated brokers can be found at:

https://www.vfsc.vu/70-prevention-of-fraud-investments-act/.

Verify whether the information matches the broker’s own website.

Detailed steps:

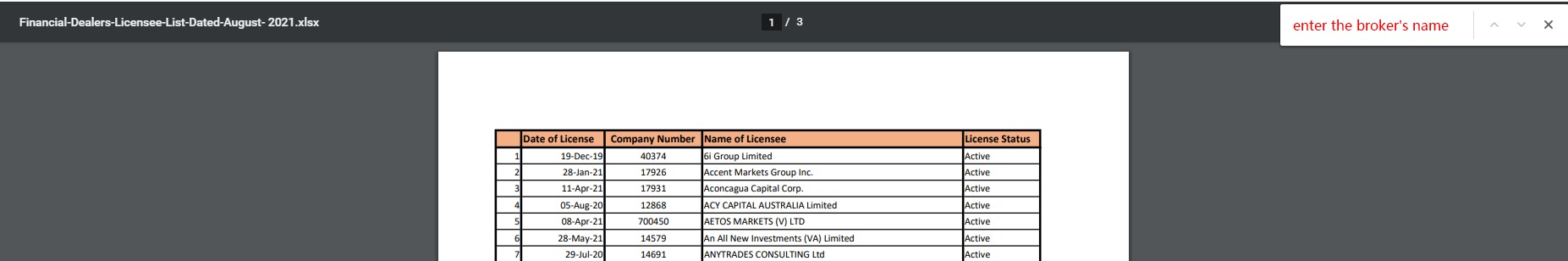

1. Find the broker’s VFSC license number (recommended) or the broker’s name from its official website.

2. Click the link under “List of Licensees” at:

https://www.vfsc.vu/70-prevention-of-fraud-investments-act/

and search for the number or name of the broker in the list using the shortcut Ctrl + F.

Note: If you cannot find the broker’s record in the list, it may be a fraudulent broker. Please stay away from it.

How to resolve disputes with a VFSC-regulated broker?

When you have a dispute with a VFSC-regulated broker, you can protect your rights through the following methods:

• Method 1: Contact the broker directly and discuss with them to find a solution.

• Method 2: If you are not satisfied with the broker’s solution, you may escalate the issue by contacting VFSC in Vanuatu, which helps resolve disputes between forex brokers and investors. You can send a complaint via email: info@vfsc.vu or call +678 22247.

• Method 3: If the above two methods fail to resolve the dispute, the final option is to take the case to court in Vanuatu.