In contrast to the gold price, the silver price continued to increase slightly on the morning of October 30. The world silver price increased by about 0.3 USD/ounce compared to the same time of the previous session, trading around 47.8 USD/ounce. Domestically, the price of Phu Quy silver bars increased by 0.3% compared to the end of yesterday, trading at 1,885,000 VND/tael and 50,266,541 VND/kg.

(Illustration)

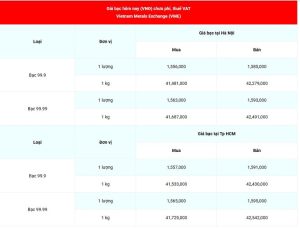

Specifically, at 11:40 a.m. on October 30, according to Vietnam Metals Exchange (VME), the price of 99.99 silver (excluding fees and VAT) in Hanoi was listed at VND 1,563,000/tael (buy) and VND 1,593,000/tael (sell).

The price in Ho Chi Minh City is 1,565,000 VND/tael (buy) and 1,595,000 VND/tael (sell).

Price of 99.99 silver (excluding fees and VAT) in Hanoi and Ho Chi Minh City late morning October 30. (Source: giabac.net)

Phu Quy Gold and Gemstone Group listed the buying and selling prices of 999 silver bars and ingots at 11:34 a.m. on October 30 at VND 1,828,000/tael (buy) and VND 1,885,000/tael (sell), respectively increasing by VND 9,000/tael (buy) and VND 10,000/tael (sell) compared to late yesterday morning.

Phu Quy silver price at 11:34 on October 30.

The price of Phu Quy 999 silver bar 1kg is traded at 48,746,545 VND/kg (buy) and sold at 50,266,541 VND/kg. The buy-sell difference is 1,519,996 VND.

Phu Quy silver price increased 0.3% from the end of yesterday.

At other brands, Ancarat listed the buying and selling price of silver at 1,828,000-1,883,000 VND/tael, Sacombank-SBJ Company at 1,827,000-1,875,000 VND/tael.

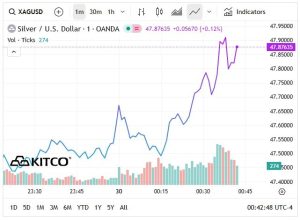

In the world market, according to kitco.com, as of 11:40 a.m. on October 30 (Vietnam time), the silver price increased slightly by 0.3 USD/ounce compared to the previous session, trading around 47.8 USD/ounce. Last night, there were times when the silver price reached 48.3 USD/ounce.

World silver price chart. (Source: kitco.com)

Silver fell more than 6% last week on profit-taking after a record rally, helping set up the current technical recovery.

The gold market is struggling to find direction as Federal Reserve Chairman Jerome Powell dampened expectations of a December interest rate cut, according to market analyst Gary S. Wagner.

After the Fed cut interest rates by another 25 basis points in a move that investors had anticipated, Mr. Jerome Powell said at a press conference: “At this meeting, members had very different views on the next step. Continuing to cut interest rates in December is not certain.”

Mr. Powell’s comments sent a cautious tone through the commodity markets.

Gold experienced a volatile day, initially rising $61 an ounce in the first four hours of trading on Wednesday (October 29). However, the last four hours of trading saw a sharp reversal, with the precious metal falling $67 an ounce to end the trading day down $26.40 an ounce, or 0.67%.

However, the silver market bucked the trend of gold, showing relative strength with a gain of $0.50/ounce – equivalent to about one percentage point – to close on October 29 at $47.54/ounce on the spot market.

This recovery in silver prices on the strength of the dollar may signal some fundamental momentum. Market participants appear to be waiting for positive signals from the US-China trade talks. Furthermore, investors are expecting silver prices to rise as they benefit from constructive diplomatic outcomes that could support industrial demand.

Additionally, silver’s outperformance against gold suggests a potential re-pricing may be underway. The white metal’s current price may reflect a market correction toward a more historical gold-silver ratio, a technical relationship that could serve as a key catalyst for silver’s price appreciation through year-end and into 2026.

Leave a Reply