The pillars still anchored the stable score but the cash flow this afternoon has seriously weakened as investors chose to stay out. Although this did not make the market worse, the liquidity of the two floors in the afternoon session decreased by 15% compared to the morning session and the whole day decreased by 33% compared to yesterday. Only foreign investors had a “stable” net withdrawal.

VN-Index moved sideways for the 5th consecutive session with shockingly reduced liquidity.

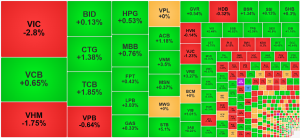

Both VHM and VIC weakened further in the afternoon session, VIC fell about 0.64% compared to the morning closing price and closed down 2.8% compared to the reference price. VHM fell another 0.74%, closing down 1.75%. Many other large-cap stocks also weakened compared to the morning session such as VPB, MBB, HPG, GAS, BID… although not all codes closed in the red. Statistics of the VN30 basket showed that 16 codes decreased in price compared to the morning session and 9 codes improved.

STB and VNM were the two best stocks in the afternoon session. VNM closed the morning session up 1.67% and accelerated in the afternoon right after reopening. This stock increased continuously, closing 3.5% above the reference price. STB started later, closing the morning session up 2.64% and for more than 2/3 of the afternoon session, it was still moving sideways with nothing special. Suddenly, from 2:10 onwards, the cash flow poured in fiercely, causing the price to skyrocket. STB closed 5.1% above the reference price, equivalent to an increase of 2.4% this afternoon alone with a liquidity of 474.6 billion VND, the highest in the VN30 basket. Overall, STB was also one of the only two stocks to reach the trillion-VND liquidity threshold.

This development put STB and VNM in the top 5 stocks pulling points of VN-Index. The remaining codes are LPB up 3.03%, TCB up 1.85%, ACB up 1.18%. These stocks increased insignificantly this afternoon and liquidity was also quite weak.

The ability to balance the pillars helped the VN-Index fluctuate very little, closing up slightly by 3.35 points, equivalent to 0.2% compared to the reference. The breadth was quite good with 175 stocks increasing/139 stocks decreasing, very little change compared to the morning session. The group that expanded the amplitude was not much different from the morning session, the entire HoSE floor had 66 stocks closing up over 1% (52 stocks in the morning session). VIX and STB attracted the best cash flow in this group, liquidity both exceeded the thousand billion VND mark. In addition, TCH increased by 3.39%, EVF hit the ceiling, CII increased by 1.37%, HAG increased by 3.68%, HHS increased by 4.76%, all with a trading scale of over 300 billion VND.

On the downside, there were no more stocks being squeezed more widely. The entire floor recorded 60 stocks down more than 1% (57 stocks in the morning session). The stocks that were dumped more prominently than the rest were VCI down 1.38% with 225.8 billion VND; VJC down 1.23% with 216 billion VND; VCG down 1.08% with 192.2 billion VND; GMD down 2.06% with 133.1 billion VND; DCM down 1.48% with 106.3 billion VND.

The narrow market fluctuations and the stock divergence are not a bad sign at the moment. The total value of HoSE orders today decreased by 32% compared to yesterday, down to the lowest level in 6 sessions. However, the stock price did not decrease much, reflecting that the pressure from the selling side was quite mild. This is the period when the market is waiting for news, so the decrease in trading intensity is not unusual.

Only foreign investors maintained strong capital withdrawal pressure. On all 3 floors today, this group net sold up to 1,800 billion VND, of which HoSE alone was 1,651 billion VND. The total selling value of stocks on this floor reached 3,509 billion VND, accounting for 16.3% of total floor transactions. The codes with the largest sales were VHM -186.6 billion, FPT -163.8 billion, MWG -154.7 billion, STB -142.1 billion, VRE -113.7 billion, HPG -106.8 billion. On the net buying side, there were VIX +84 billion, LPB +65 billion, TCH +53.6 billion, ANV +50.3 billion, TCB +35.8 billion.

Leave a Reply