Digital asset market today September 26: Although the recently released US economic data shows positive signs, investors do not think so. The cryptocurrency market is quite bad, with most of the top tokens falling.

Digital asset market today September 26: Cryptocurrencies Bitcoin, ETH, SOL “shocking” decrease

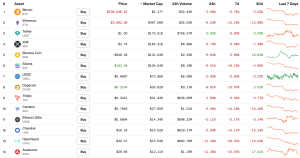

Updated at 7:00 a.m., September 26 (Vietnam time), according to Coindesk, the cryptocurrency market was covered in red, witnessing a huge crash.

Bitcoin price dropped by 3.59%, trading at $109,036, market capitalization at $2,170 billion. The world’s second largest cryptocurrency Ethereum (ETH) also “flew” by 6% in the past 24 hours, and decreased by 13.89% in the past 7 days. XRP decreased by 5.73%, Binance Coin (BNB) lost 6.93%, while Solana (SOL) dropped by more than 8.51%…

The latest report from the US Department of Labor showed that the number of unemployment claims decreased last week. Notably, the Bureau of Economic Analysis (BEA) announced that GDP in the second quarter of 2025 increased by 3.8%, completely reversing the decline in the first quarter.

While this was a positive sign in theory, the market reaction was quite negative. The Nasdaq and S&P 500 both fell slightly, while the crypto market saw a sharper decline.

Some economists at Harvard and Bloomberg believe that this growth data is unreliable and may even be “manipulated”, especially when the Trump administration recently fired the head of the agency that published the negative data. The shaken confidence has made both traditional and crypto investors cautious, despite the view that crypto is a “safe haven” when recession occurs.

“Huge capital barrier” when setting up a crypto asset exchange

Resolution 05 marks a turning point when crypto assets are included in the official management framework for the first time, however, many points remain controversial.

Mr. Jack Nguyen, Director of BlockBase Fund, pointed out that the regulation requires Vietnamese investors to transfer their assets to domestic exchanges, but the benefits and trading products have not been clarified. In particular, the minimum charter capital of VND 10,000 billion for each exchange is considered a big barrier, far exceeding international practice, turning the market into a “game of the big guys” and eliminating opportunities for startups. According to him, this huge cost will make it difficult for most exchanges to make a profit during the 5-year pilot period.

In addition to capital, the resolution also tightens the requirement of a 51% domestic ratio and requires banks, securities companies, and investment funds to hold at least 35% of capital at the exchanges. This approach clearly shows the message: The State wants to maintain the “homeowner” rights and prioritize organizations with risk management capacity.

Tighter controls have two effects. On the one hand, they can boost confidence and attract capital flows from traditional investors. On the other hand, trading volumes, especially derivatives, are at risk of falling sharply, as in the experience of Japan and South Korea, which have lost 50–70% of their liquidity.

In that context, opportunities are opening up for ancillary services: education, platform technology, risk management, marketing, etc. “The game in the next 5 years is not about transactions, but about who can build a sustainable ecosystem and stable technology,” Mr. Jack Nguyen emphasized.

Cryptocurrency super scam “sweeps” through 23 countries, blowing away 118 million USD

European authorities have dismantled a massive cryptocurrency fraud ring that cost more than 100 victims in 23 countries more than $118 million. The operation, led by Eurojust, saw five suspects arrested, raids in Spain, Portugal, Italy, Romania and Bulgaria, and several bank accounts frozen.

The group allegedly operated an online investment platform, promising “huge returns” and then transferring money to Lithuania for laundering. When victims withdrew their funds, they demanded “additional fees” before shutting down the platform, leaving investors with nothing.

Đường dây lừa đảo crypto 118 triệu USD chấn động châu Âu. Ảnh chụp màn hình mạng X của Eurojust

Not only Europe, the US also recorded a similar situation. Figures from the Federal Trade Commission (FTC) show that Americans lost a record $12.5 billion in 2024 due to fraud, of which investment fraud accounted for $5.7 billion. 79% of victims reported losing money, with an average loss of more than $9,000 per person.

Meanwhile, Venus Protocol in the DeFi system promptly prevented a hack on September 2, causing hackers to lose up to 3 million USD. In South Korea, Seoul police also just broke up a cybercrime group that stole 30 million USD from 258 victims, most of whom were business leaders.

The cases show that high-tech crimes are increasingly cross-border, sophisticated and unpredictable. Officials warn: “Don’t believe the promise of sky-high profits, because the ‘pay and lose’ scheme is spreading globally.”

Leave a Reply