The two largest gold tokens are both up more than 40% over the past 12 months.

The gold-backed Token market is moving positively following the rising gold price in the world. The total capitalization of the Tokenized gold market has exceeded 2.07 billion USD.

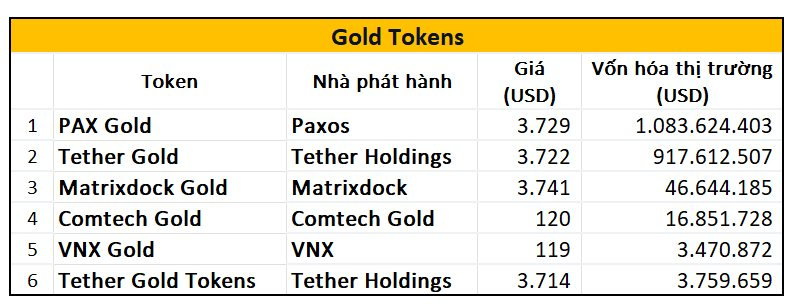

Among them, the total capitalization of gold-backed tokens of Tether Gold and Paxos Gold is dominating. Data shows that Paxos Gold (PAXG) reached a historical peak of 3,729 USD, bringing the capitalization of Paxos Gold to more than 1.08 billion USD. Tether Gold (XAUT) also reached 3,722 USD, capitalization of over 917 million USD. Both tokens have increased by more than 40% in the past 12 months. Besides, Tether Gold Tokens (XAUT0) has a capitalization value of more than 3.7 million USD.

Source: Coinmarketcap

Tokenized Gold is a digital asset that represents a physical amount of gold, allowing access to gold via blockchain without having to hold physical gold directly. In the international market, the price of gold has risen to a record high above 3,700 USD/ounce.

Currently, the gold token market still accounts for a small portion of the total global gold market (estimated at $25 trillion), but is growing rapidly in the field of cryptocurrencies and tokenized assets. A report from Tether indicates that the surge in demand for tokenized gold is mainly due to macroeconomic factors such as increased global instability, escalating geopolitical conflicts and a growing need for anti-inflation assets.

With Tether Gold and Paxos Gold, each token of these two projects corresponds to one ounce of physical gold. Tether says it stores its gold in Switzerland, while Paxos stores its gold in London. In 2025, gold tokens have become one of the most prominent use cases in the cryptocurrency market, with trading volumes exploding.

In addition to gold-backed tokens, the stablecoin market in general also includes many tokens whose prices are pegged to fiat currencies and other commodities. The most prominent is Tether’s market-leading coin USDT, launched in 2014.

In Vietnam, the Government has issued Resolution 05, officially launching a 5-year pilot phase for the crypto-asset market. In a newly published report, Mr. Michael Kokalari, CFA, Director of Macroeconomic Analysis and Market Research, VinaCapital, said that this move shows the Government’s acceptance of crypto-assets.

VinaCapital’s observations from practice show that this time is different. Activity is showing clear signs of acceleration with frequent discussions between regulators, many industry events, and the launch of NDAChain. All reflect a shift towards recognizing digital assets as a legitimate part of the financial system.

VinaCapital emphasized that Vietnam is laying the foundation for a digital economy that goes beyond crypto-asset trading, aiming to integrate digital assets into the country’s markets and services. Beyond the financial sector, the country’s economy will also benefit from tokenization and blockchain applications. Industries such as supply chain management, renewable energy, and real estate can access new funding models through tokenized assets, while carbon credits, trade invoices, and other instruments will have higher liquidity.

Leave a Reply