Pump.fun (PUMP), Zcash (ZEC), and Aptos (APT) have extended their recovery momentum over the past 24 hours, emerging as the most prominent names in the cryptocurrency market. Aptos has bounced strongly from a key support zone, opening up room for growth before facing a key resistance level, while Pump.fun and Zcash are at a decisive turning point for the next trend.

PUMP: Recovery momentum thanks to token buyback program

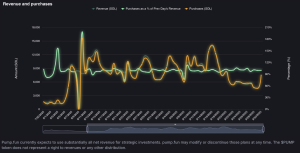

Pump.fun just spent 7,496 SOL to buy back PUMP tokens, bringing the total purchase value to 617,749 SOL, amid Tuesday’s surge in sales to 7,498 SOL. Buybacks typically put downward pressure on supply, driving up prices and demonstrating the team’s strong belief in the project.

Revenue and Buybacks | Source: Pump.fun

By Wednesday afternoon, PUMP had surged nearly 7%, breaking above a key resistance level of $0.006162 – a high set last Thursday. If the price can close above this level in the 4-hour timeframe, Pump.fun’s uptrend will likely be consolidated and extended.

The next resistance levels are located at $0.006788 and $0.007655, corresponding to the old bottoms on September 20 and September 17, respectively.

The RSI is currently at 63, above the neutral level and has room to rise before entering the overbought zone, indicating that buying pressure is increasing. In parallel, the MACD line continues to rise along with the signal line, remaining above the zero mark with a series of consecutive green histograms – a clear sign of bullish momentum.

PUMP/USDT 4-hour chart | Source: TradingView

However, if PUMP fails to hold above $0.006162, a correction back to test the 200-period EMA at $0.005530 is entirely possible.

Zcash: Bullish Momentum Holds, Heading for New Highs

ThorSwap has just expanded support for Zcash (ZEC), allowing users to swap ZEC directly to Bitcoin or other top altcoins. However, the privacy coin’s signature feature – stealth addresses – is still under review and will likely be added at a later stage.

ZEC traded around $76 on Wednesday, posting a four-day winning streak. The coin had come close but failed to close above its 52-week high of $74.59 on Tuesday.

The current rally is targeting the 52-week high of $79.33. A successful breakout and a positive close would see ZEC set a one-year high. Based on the Fibonacci extension from $74.59 (December 2) to $29.17 (March 10), the next key resistance zone is located at $96.29, which coincides with the 1.272 Fibonacci extension.

ZEC/USDT daily chart | Source: TradingView

On the daily chart, the RSI has reached 79, falling deep into overbought territory, raising concerns of a reversal if profit-taking pressure appears. However, the MACD line line and the signal line remain expanded with a green histogram, indicating that the bullish momentum is still strong.

Conversely, if ZEC fails to hold the $74.59 mark, a correction to the $61.01 area – corresponding to the 78.6% Fibonacci retracement level – could occur.

Aptos: Recovery Aims at 200-Day EMA

Aptos has just announced the integration of PayPal’s stablecoin PYUSD via LayerZero and Stargate Finance, expanding its payment options within the ecosystem. In parallel, the project also announced a strategic partnership with Republic – a global investment firm – to fully exploit the potential of its blockchain.

In the market, APT continued to record an increase of more than 1%, marking a streak of 6 consecutive sessions of increase. The recovery started with a bounce at the support zone of $3,893 on Friday, then broke above the 50-day EMA at $4,438.

If the bullish momentum is sustained and breaks above the 100-day EMA at $4,607, Aptos has a chance to test the long-term resistance line, which is formed by the February 20 and July 23 highs. Notably, the 200-day EMA at $5,153 is currently moving parallel to this resistance zone, which could become the next strong resistance.

APT/USDT Daily Chart | Source: TradingView

On the technical front, the daily RSI has shown a clear V-shaped reversal from the oversold zone, now crossing the neutral level to 53, reflecting increasing buying pressure. In addition, the MACD is also approaching the crossover point with the signal line, further strengthening the bullish momentum.

However, the risk remains: if APT fails to hold above the 50-day EMA ($4,438), the price could reverse and fall back to the $3,893 support zone.

Leave a Reply