The S&P 500 and NASDAQ stalled as positive sentiment from Google’s ruling cooled down, while the Dow Jones suffered losses as the energy market entered a downturn.

Last night, the JOLTS job openings data showed a sharp decline, sending a negative signal for the U.S. labor market — while also reinforcing expectations that the Fed will cut interest rates as soon as September during the upcoming meeting on September 17–18.

In addition, investors have started to turn cautious with AI Tech stocks after Google’s ruling. Although the market initially reacted positively, some experts warned that the Tech bubble may be “overheated” and could burst at any moment — potentially dragging down the entire market.

Currently, the market’s focus has shifted toward labor data and Fed’s interest rate signals to seek further clues ahead of the official rate decision week.

According to the CME FedWatch Tool, markets are pricing in a 96% probability that the Fed will cut interest rates by 25 basis points at the September 17–18 meeting.

Technical Analysis

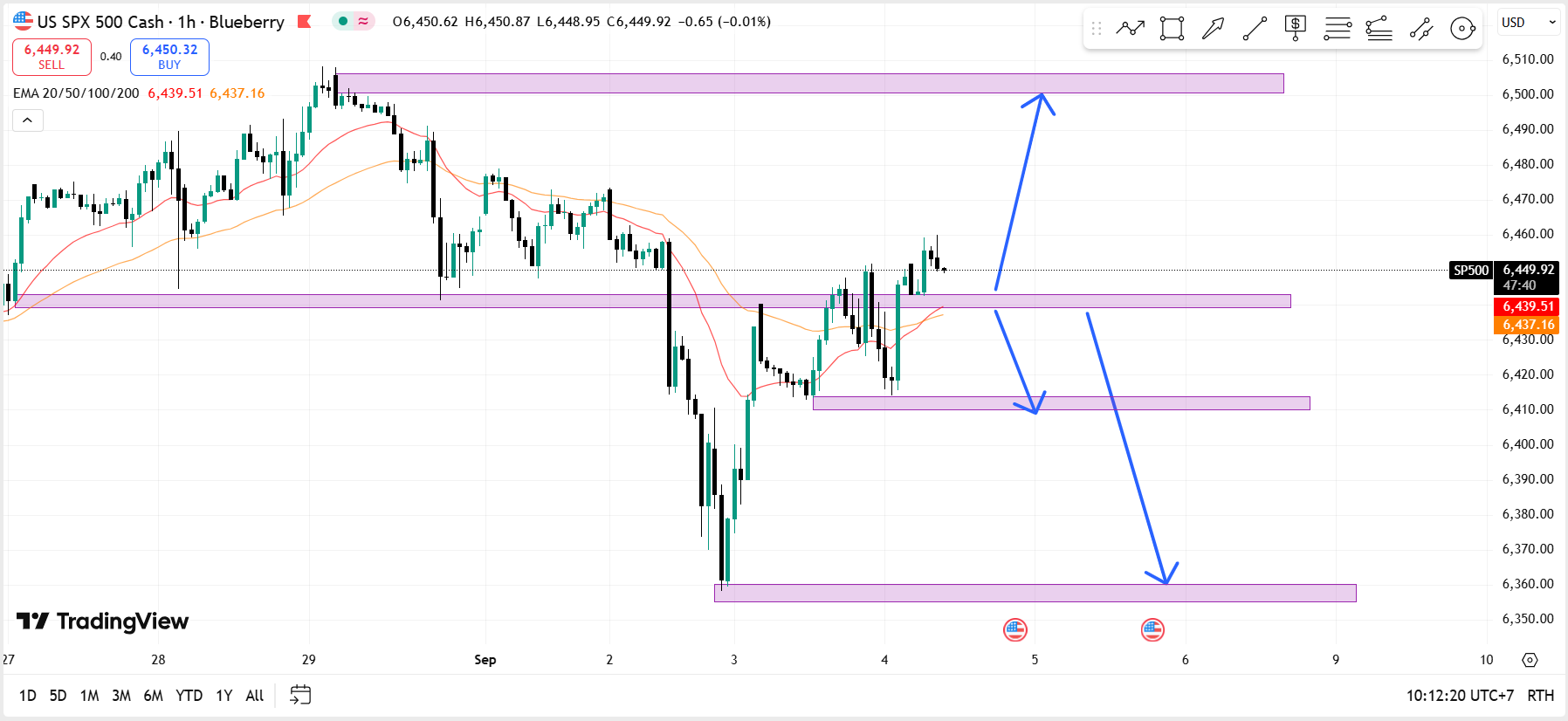

At present, the S&P 500 is showing an upward trend, and the EMA20 has crossed above EMA50, suggesting a potential buy opportunity toward the 6500 zone.

If the S&P 500 reverses and breaks below the 6437 level, traders may consider selling down to 6414 or even further toward 6357.

Leave a Reply