Gold has officially broken through its previous all-time high of $3,500/oz yesterday morning and is now trading around a new peak of $3,54x/oz.

U.S. manufacturing PMI data released last night continued to show weakness. In addition, President Donald Trump’s imposition of broad tariffs, which shook global trade, together with expectations that the Federal Reserve will soon cut interest rates, has further reinforced gold’s position in the market.

Furthermore, Trump’s pressure on the Fed’s “independence” has driven investors to rush into gold as a safe haven, amid fears that a new playing field could emerge if Trump gains control over the central bank.

In a federal court, accusations that Trump’s tariffs on multiple countries were “beyond his authority” have been appealed by Trump, who seeks to bring the case to the Supreme Court. He confidently declared that he would win, stating that if he lost, the U.S. would become a global laughingstock for having to repeal the newly imposed tariffs.

On the geopolitical front, tensions are escalating. This morning, the U.S. military attacked a drug-trafficking vessel departing from Venezuela, reportedly linked to the Venezuelan government. At the same time, Trump announced a $50 million bounty on President Nicolás Maduro. With U.S. forces moving closer to Venezuela’s coastline, the potential for imminent conflict is increasingly likely. This has been a key driver behind gold’s sharp rise this morning, reaching a new high of $3,547/oz.

From this perspective, gold is currently the most sought-after commodity in the market, supported by mounting fears of a major economic recession and surging geopolitical risks. Analysts now expect gold to rally strongly toward the $3,700 – $4,000/oz range by the end of 2025.

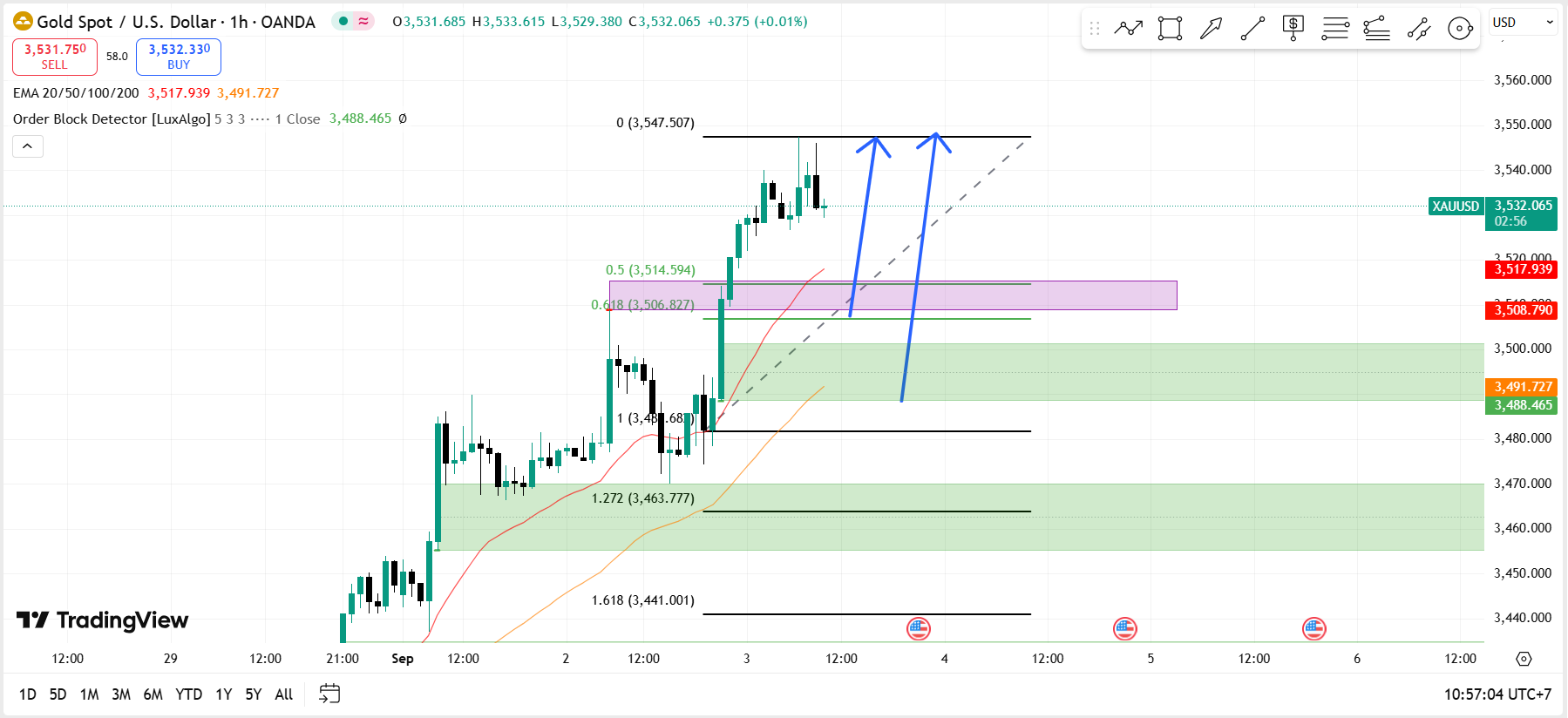

Technical Analysis:

Gold has been on a sustained rally in recent weeks, fueled by a stream of negative signals from the global economy.

-

In the short term, gold may experience a slight correction toward the Fibo 0.618 level at $3,506, or deeper into the bullish order block at $3,488–3,500, to establish a firm support zone.

-

After consolidating, gold is likely to rebound toward the $3.54x area, with the potential to break out and set fresh record highs.

Leave a Reply