Gold prices have surged to a 5-week high, reaching the $3,423/oz level despite positive economic data, as investors remain concerned about the weakening US dollar.

In addition, the market is also worried about the potential loss of the Federal Reserve’s independence within the US economic system, as it faces mounting pressure from Donald Trump. He is seeking to bring the Fed under his influence in order to steer monetary policy according to his own agenda.

This has supported gold prices in recent weeks, despite signs that the US economy is recovering strongly. Confidence in the world’s largest economy has been shaken, however, as the dollar weakens under Trump’s policies.

According to the CME FedWatch Tool, 87% of investors now expect the Fed to cut interest rates in September. If such a cut happens, gold will likely continue to gain momentum into Q4 2025 and could soon reach a new all-time high (ATH).

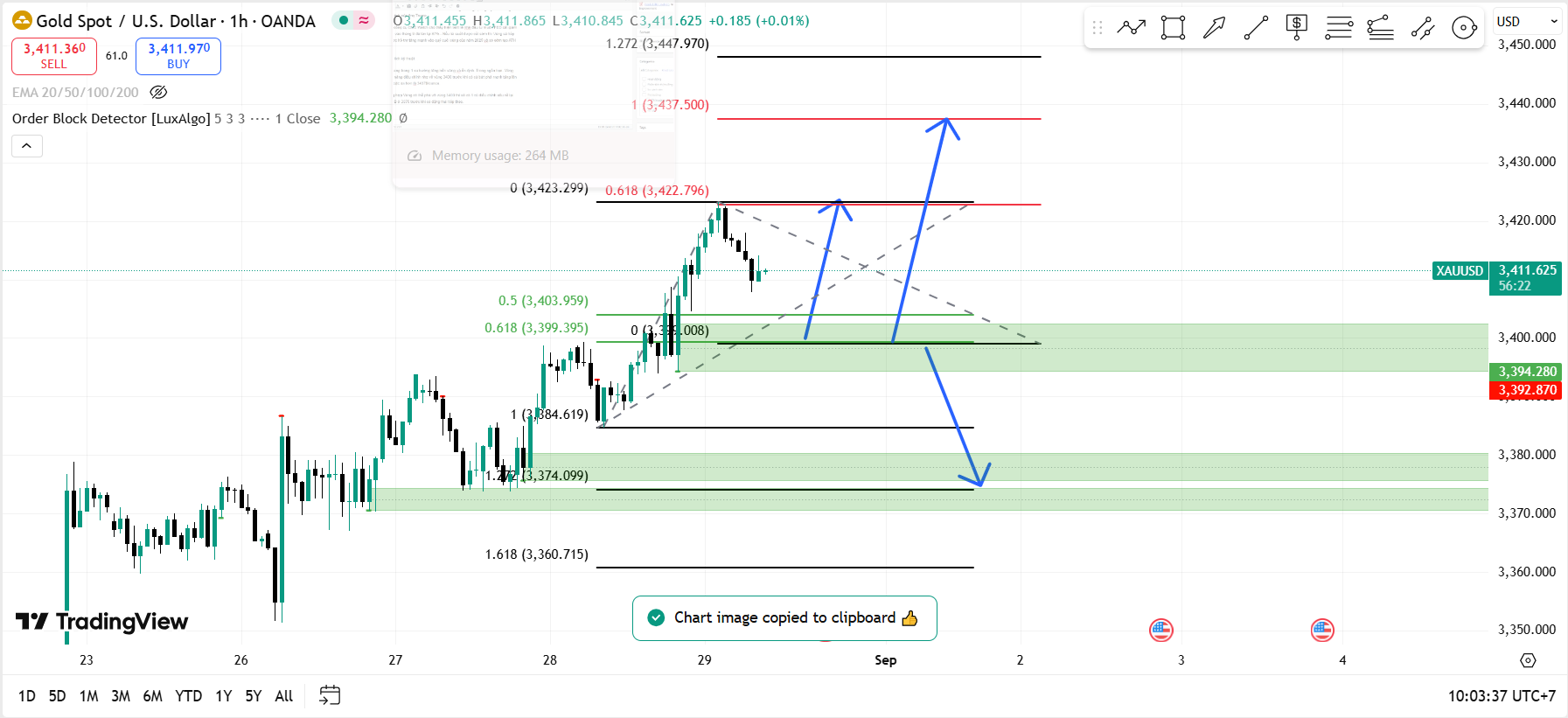

Technical Analysis:

Gold is currently in a strong and sustainable uptrend. In the short term, a slight correction back to the $3,400 zone is possible before a strong breakout toward $3,423 or even $3,437/oz.

If gold fails to hold the $3,400 support, a deeper pullback to the order block (OB) zone at $3,375 could occur before the next move.

Leave a Reply