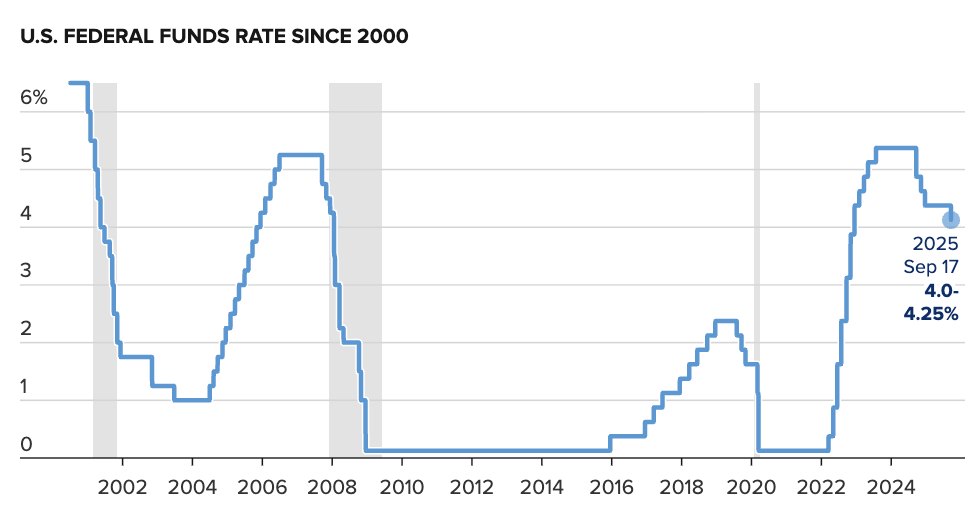

As expected, the US Federal Reserve (Fed) decided to cut interest rates by 25 basis points and signaled two more rate cuts this year amid growing concerns about the labor market.

The Federal Open Market Committee (FOMC) decided to lower the interest rate by 25 basis points to a range of 4% to 4.25%. The decision was passed by a vote of 11-1, showing less indecision than Wall Street had expected.

Fed cuts interest rates for the first time in 2025

Newly appointed Governor Stephen Miran was the only one to vote against, instead favoring a more aggressive cut of 50 basis points.

Governors Michelle Bowman and Christopher Waller, who are expected to oppose the decision, all voted in favor of the 25-basis-point cut. Mr. Miran, Mr. Waller and Ms. Bowman were all appointed by President Donald Trump, who has repeatedly urged the Fed to cut rates quickly and aggressively.

In its post-meeting statement, the committee again described economic activity as “moderate,” but added that “job growth has slowed” and noted that inflation “has risen and remains quite high.” This puts the Fed in a difficult position: on one side is the mandate to control inflation (which requires high interest rates), on the other side is the goal of maximum employment (which requires low interest rates to stimulate job creation).

“Uncertainty about the economic outlook remains high,” the FOMC statement said. “The committee is mindful of risks to both sides of its dual mandate and judges that downside risks to employment have increased.”

Will there be two more rate cuts?

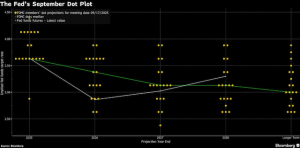

Along with the rate cut, the Fed also released a “dot plot” chart, an important tool that shows each member’s forecast for future interest rates. This chart shows that a majority of members (10 out of 19) expect two more rate cuts in 2025, most likely in October and December.

Biểu đồ dot-plot tháng 9/2025

However, there is a clear division within the Fed: 9 members want only one more cut this year, one member does not want to cut interest rates at all (including the recent cut), and especially one member – said to be the new Governor Miran appointed by Mr. Trump – proposed a sharp cut of up to 1.25% this year.

Although the chart does not label members by name (each member is represented by a dot), Mr. Miran has long been known as a strong advocate of aggressive rate cuts.

“A majority of FOMC members are now targeting two more cuts this year, suggesting that the committee’s dovish faction is in control,” said Simon Dangoor, head of fixed income macro strategy at Goldman Sachs Asset Management. “We believe it would take a significant surprise on the back of higher inflation or a recovery in the labor market to cause the Fed to leave its current easing trajectory.”

The Fed’s dot plot also shows that members forecast just one rate cut in 2026, less than the market’s expectation of three cuts.

Officials also forecast another cut in 2027, when rates gradually approach 3%, considered the long-term neutral level that neither stimulates nor slows the economy. Notably, about half of officials said long-term rates should be lower than this average.

Fed Chairman Jerome Powell

Raise economic growth forecast, keep inflation forecast unchanged

On the economic outlook, Fed members forecast slightly faster economic growth than they forecast in June, while keeping their forecasts for unemployment and inflation unchanged.

This Fed meeting takes place in an unusually tense political context, especially for an organization that usually operates discreetly and rarely has public disagreements.

Just a year ago, faced with similar signs of rising unemployment that could signal a recession, the FOMC made a massive 50 basis point cut. President Trump later accused the move of being politically motivated to influence the presidential election in favor of Democratic opponent Kamala Harris.

Mr Trump’s continued pressure on the Fed, along with the appointment of Governor Miran, has raised concerns about the central bank’s independence – a principle that has been closely guarded throughout history. Mr Miran is not only known for his public criticism of Chairman Powell and his colleagues, but is also considered “Mr Trump’s man” within the Fed, strongly supporting the aggressive rate-cutting policy that the President wants.

Trump is also trying to fire Federal Reserve Governor Lisa Cook on mortgage fraud grounds, but an appeals court has temporarily blocked that effort.

Regarding the recent US economic situation, indicators show that economic growth remains strong and consumer spending exceeds forecasts, but the labor market shows worrying signs.

The unemployment rate rose to 4.3% in August, its highest level since October 2021, though still low by historical standards. Job growth has slowed significantly, and a recent revision from the US Bureau of Labor Statistics showed that in the 12 months ending in March 2025, the number of jobs was revised down by nearly 1 million compared to the original figure.

Governor Waller, who was also appointed by Trump and is being mentioned as a potential candidate to replace Chairman Powell when his term expires in May 2026, has expressed the view that the Fed should act soon to ease monetary policy to prevent the risk of future labor market deterioration.

Trả lời